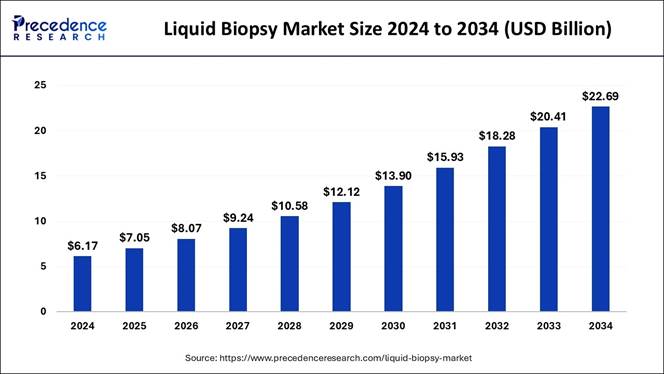

The global liquid biopsy market size was estimated at USD 6.17 billion in 2024 and is predicted to rise from USD 7.05 billion in 2025 to USD 22.69 billion by 2034. According to Precedence Research the market is poised to grow at a double-digit CAGR of 13.91% from 2025 to 2034. The North America liquid biopsy market size reached USD 2.81 billion in 2024 and is growing at a solid CAGR of 13.95%.

The global liquid biopsy market has been calculated at SD 7.05 billion in 2025 and is primarily driven by the rising prevalence of cancer among the global population and rising awareness regarding the availability of different non-invasive treatments.

“Liquid biopsy is rapidly shifting the paradigm of cancer diagnostics from reactive to proactive,” said Deepa Pandey, Principal Consultant Precedence Research. “As innovation in ctDNA and NGS technology accelerates, so does the potential for early detection and personalized care.”

Note: This report is

readily available for immediate delivery. We can review it with you in a

meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages

for Informed Decision-Making 👇 https://www.precedenceresearch.com/sample/1398

Liquid Biopsy Market Highlights:

🔹 In terms of revenue, the global liquid biopsy market was valued at USD 6.17 billion in 2024.

🔹 It is projected to reach USD 22.69 billion by 2034.

🔹 The market is expected to grow at a CAGR of 13.91% from 2025 to 2034.

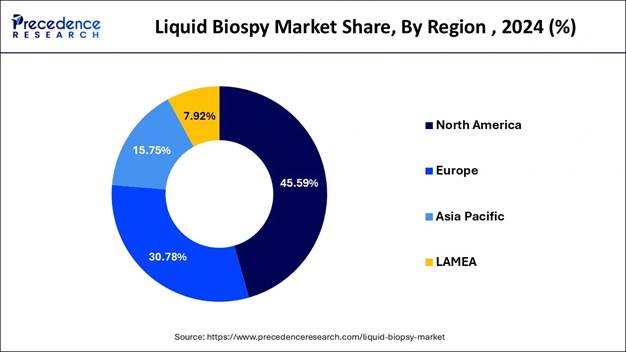

🔹 North America accounted for the largest market share of 45.59% in 2024.

🔹By technology, the NGS segment held the major market share of 65.20% in 2024.

🔹By sample type, blood sample-based tests contributed the highest market share of 67.59% in 2024.

🔹By usage, the clinical segment generated the biggest market share of 72.17% in 2024.

🔹By biomaker, the cell-free DNA segment captured the largest market share of 47.87% in 2024.

🔹By product, kits and consumables held the largest market share of 53.12% in 2024.

🔹By indication, lung cancer segment contributed the biggest market share of 32.10% in 2024.

🔹By application, the screening segment recorded the highest market share of 39.27% in 2024.

Strategic Outlook: What This Means for Investors:

With the global liquid biopsy market poised to reach USD 22.69 billion by 2034, investors have a unique opportunity to back companies delivering non-invasive, cost-effective diagnostics. Increasing cancer prevalence, coupled with strong adoption of genomic tools like NGS, is driving consistent demand across developed and emerging economies.

Liquid Biopsy Market Overview and Industry Potential

Liquid Biopsy: Transforming Cancer Detection and Early Diagnostics for the Future

The liquid biopsy market is expected to experience significant growth owing to the increased focus on cancer detection and early diagnostic needs rising in recent years. Moreover, several healthcare professionals have been actively replacing traditional tissue biopsies with liquid biopsies in recent years. Furthermore, the sudden advancements in technologies such as next-generation sequencing have actively provided sophisticated consumer growth to the industry in the past few years.

“As per the data provided by the International Agency for Research on Cancer in the GLOBOCAN 2020 estimates, around 19.3 million new cases of cancer and around 10 million deaths were reported due to cancer in 2020. The rising prevalence of breast cancer among the female population has made it the most common type of cancer diagnosed across the globe. In 2020, around 2.3 million new breast cancer cases were recorded, closely followed by the lung cancer, colorectal cancer, and prostate cancer.”

Also Read 👉 How Liquid Biopsies Are Revolutionizing Breast Cancer Detection and Treatment

What are the Latest Trends in Liquid Biopsy Market?

🔹 Companies and institutions are working on blood tests that can detect multiple cancer types from a single sample, using combinations of cfDNA, methylation, and protein markers.

🔹 Liquid biopsy is being used post-surgery or post-treatment to detect residual disease or early relapse, especially in colon, lung, and breast cancers.

🔹 Methylation-based tests are showing better performance for certain cancers (e.g., brain, pancreas) where ctDNA is scarce.

🔹 Potential to support cancer care in low-resource or remote settings, including in developing countries.

Scope of Liquid Biopsy Market

|

Report Attributes |

Statistics |

|

CAGR (2025-2034) |

13.91% |

|

Market Size in 2025 |

USD 7.05 Billion |

|

Market Size in 2030 |

USD 13.90 Billion |

|

Market Size in 2032 |

USD 18.28 Billion |

|

Market Size by 2034 |

USD 22.69 Billion |

|

Base Year |

2024 |

|

Historic Years |

2020 to 2023 |

|

Forecast Years |

2025 to 2034 |

|

Leading Region in 2024 |

North America (Contributed 45.59% Market Shares) |

|

Fastest Growing Region |

Asia Pacific (2025-2034) |

|

Segments Covered |

Technology, Usage, Types of Sample, Circulating Biomarker, Products, Indication Type, Clinical Application and Regions |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

📞 Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Liquid Biopsy Market Opportunity:

Low-Cost Liquid Biopsy Kits Set to Transform Cancer Diagnosis in Developing Regions

The development of affordable liquid biopsy tests is anticipated to create lucrative opportunities for the manufacturer in the coming years. Moreover, the manufacturer can gain a major industry share by launching their affordable treatments in the developing region, as the cancer cases are rising worldwide. Furthermore, by introducing easy-to-use kits and low-cost kits, the manufacturer is projected to create a beneficial environment for the industry during the forecast period.

Liquid Biopsy Market Challenges:

Inaccurate Results May Hold Back Liquid Biopsy Adoption, Yet Technological Progress Promises Better Accuracy

The accuracy concerns are expected to hinder the industry’s growth in recent years. Several liquid biopsy tests sometimes create hurdles by relaying inaccurate data, which likely affects overall patient health. However, technological advancements are likely to help manufacturers in this matter by providing advanced systems with more accurate results in the upcoming years.

Despite these limitations, liquid biopsies are still more patient-friendly and faster than traditional biopsies, often delivering results in under 7 days versus weeks. Advancements in AI-based mutation detection are also expected to reduce false positives significantly.

Liquid Biopsy Market Segmentation Overview and Analysis:

|

Segments |

Sub-Segments |

|

By Technology |

NGS, PCR, FISH, and Other |

|

By Usage |

RUO, and Clinical |

|

By Types of Sample |

Blood, Urine, Saliva, and Cerebrospinal Fluid |

|

By Circulating Biomarker |

Circulating Tumor Cells, Cell-free DNA, Circulating Cell-Free RNA, Exosomes and Extracellular Vesicles, Others |

|

By Products |

Test/Services, Kits and Consumable, and Instruments |

|

By Indication Type |

Lung Cancer, Breast Cancer, Prostate Cancer, Colorectal Cancer, Melanoma, Non-Oncology Disorders and Other Cancers |

|

By Clinical Application |

Treatment Monitoring, Prognosis and Recurrence Monitoring, Treatment Selection, Diagnosis and Screening |

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

💡 Technology Analysis:

Why Did the NGS Segment Dominate the Market in 2024?

The NGS segment held the largest share of the liquid biopsy market in 2024, owing to its benefits, such as allowing detailed observation of multiple genetic mutations for a single test. Moreover, the affordability and easy working scenario have actively driven the growth of the segment in recent years, as per industry observation. Also, by detecting rare functions with high accuracy, the NGS segment has gained immense market share in recent years.

Compared to PCR and FISH, NGS provides higher sensitivity and can detect multiple mutations simultaneously. While PCR is often limited to known targets, NGS can uncover emerging biomarkers, making it ideal for comprehensive cancer profiling.

💡 Usage Analysis:

Why Did the Clinical Segment Dominate the Market in 2024?

The clinical segment dominated the market with the largest share in 2024 because liquid biopsy is increasingly used by doctors for real-time cancer diagnosis, treatment decisions, and monitoring. Patients benefit from faster, less painful tests compared to traditional biopsies. Hospitals and clinics prefer liquid biopsy to track cancer changes over time without needing repeat tissue samples.

Also Read 👉 How Tissue Engineering is Shaping the Future of Regenerative Healthcare

💡 Types of Sample Analysis:

How Blood Sample-based Test Segment Maintains Its Dominance in the Current Industry?

The blood sample-based test segment held the largest share of the market in 2024, owing to factors such as its non-invasive, easy, and quick results. Also, several professionals are actively using these types of tests for the biopsy. Moreover, by helping in the detection of cancer effectively, the blood sample-based test has gained immense attention in recent years. Moreover, they can allow the detection of cancer treatment and repeat treatment options.

Also Read 👉 Exploring Advances in Stomach Cancer Treatment and Diagnostic Innovations

💡 Circulating Biomarker Analysis:

The circulating tumour cells segment held the largest share of the liquid biopsy market in 2024, because it offers detailed genetic information about the tumor directly from a blood sample. ctDNA can show if a patient has cancer, how advanced it is, and how it's responding to treatment. It helps identify genetic mutations and drug resistance, making it essential for targeted therapies. Since ctDNA is present even in early-stage cancers, it enables earlier and more precise detection.

Also Read 👉 Targeted Therapeutics: Transforming Personalized Cancer Treatment Globally

💡 Products Analysis:

The kits and consumables segment held the largest share of the market in 2024, because they are essential for running liquid biopsy tests regularly. These include test kits, reagents, tubes, and cartridges used in collecting and processing samples. Since each test requires new consumables, demand remains high from hospitals, labs, and research centers. They ensure accuracy, speed, and ease of use, especially in high-throughput testing.

💡 Indication Type Analysis:

The cancer segment held the largest share of the market in 2024 because liquid biopsy was primarily developed to detect and monitor various types of cancer. It offers a faster and less painful alternative to traditional tissue biopsies, especially for cancers like lung, breast, and prostate. Liquid biopsy can detect cancer mutations, track tumor progression, and guide personalized treatments.

💡 Clinical Application Analysis:

The treatment monitoring segment held the largest share of the liquid biopsy market in 2024, because liquid biopsy is ideal for checking how well a cancer treatment is working. It allows doctors to track changes in the tumor through blood samples without invasive procedures. If the cancer starts resisting a drug, a liquid biopsy can detect genetic changes early, helping to adjust the therapy.

Liquid Biopsy Market Key Regional Coverage and Analysis:

|

Region |

Countries Included |

|

North America |

U.S., Canada, and Mexico |

|

Europe |

Germany, UK, France, Italy, Spain, and Rest of Europe |

|

Asia Pacific |

China, Japan, South Korea, India, Australia, Southeast Asia, and Rest of Asia Pacific |

|

Latin America |

Brazil, Argentina, and Rest of Latin America |

|

Middle East & Africa |

GCC, South Africa, North Africa, and Rest of MEA |

How did North America Dominate the Liquid Biopsy Market in 2024?

North America held the dominant share of the liquid biopsy market in 2024, owing to the presence of advanced diagnostic labs and the adoption of innovative technologies. The region is observed as actively investing in advanced technology for the healthcare sector, which can create lucrative opportunities for the industry in the coming years. Furthermore, the leading biotech companies have been creating partnerships with research centres in recent years.

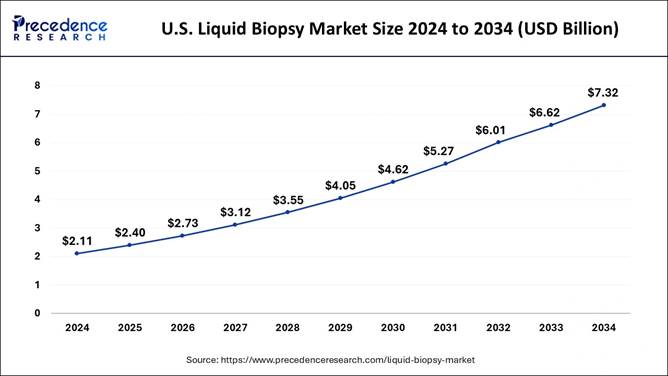

How big the U.S. Liquid Biopsy Market Size 2025 to 2034?

The U.S. liquid biopsy market is expected to experience strong growth from 2025 through 2034. The market is projected to grow at a 13.91% CAGR over 2025‑2034, reaching approximately USD 7.32 billion by 2034, up from USD 2.40 billion in 2025.

U.S. Liquid

Biopsy Market Top Companies

🔹ANGLE plc, Biocept Inc.

🔹Bio-Rad Laboratories Inc.

🔹Epigenomics AG

🔹Exact Sciences Corporation

🔹F. Hoffmann-La Roche AG

🔹Guardant Health Inc.

🔹Illumina Inc.

🔹MDxHealth SA

🔹Menarini Silicon Biosystems

🔹QIAGEN N.V.

🔹Thermo Fisher Scientific Inc.

Note: This report is

readily available for immediate delivery. We can review it with you in a

meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report 👉 https://www.precedenceresearch.com/sample/2474

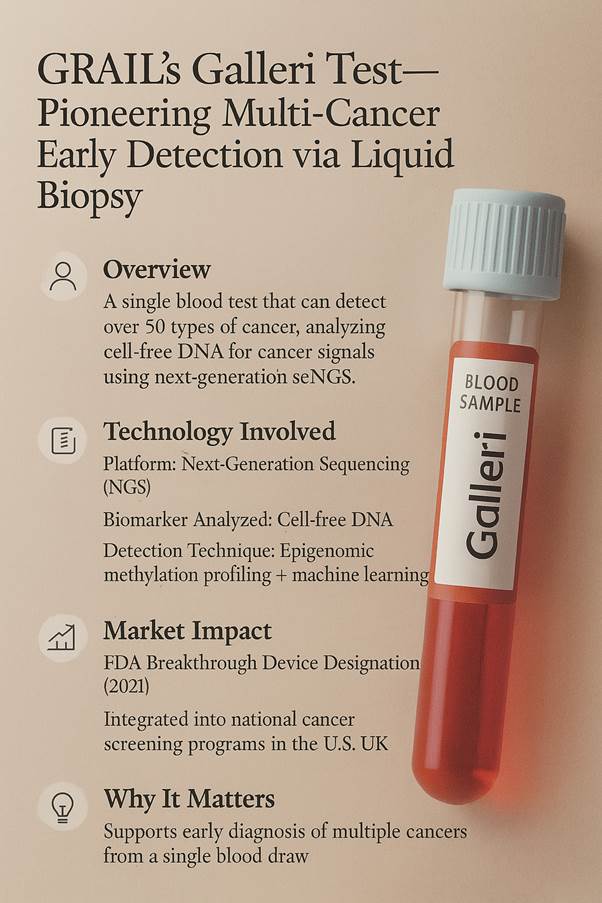

In 2025, GRAIL's Galleri test gained significant traction in the U.S., screening for over 50 types of cancer with a single blood sample. This groundbreaking test has already been adopted by major healthcare providers and is influencing national early detection strategies.

Case Study: GRAIL’s Galleri® Test — Pioneering Multi-Cancer Early Detection via Liquid Biopsy

Overview:

GRAIL, a healthcare company backed by Illumina and other major investors, developed Galleri®, a breakthrough blood test that can detect over 50 types of cancer through a single liquid biopsy. The test analyzes cell-free DNA (cfDNA) for cancer signals using advanced methylation patterns and next-generation sequencing (NGS)—the very technology identified as dominating the liquid biopsy market in your press release.

Technology

Involved:

🔸Platform: Next-Generation Sequencing (NGS)

🔸Biomarker Analyzed: Cell-free DNA (cfDNA)

🔸Detection Technique: Epigenomic methylation profiling + machine learning

🔸Sample Type: Blood

Market Impact:

🔸In 2021, Galleri received Breakthrough Device Designation from the FDA.

🔸As of 2023–2024, Galleri has been integrated into national cancer screening pilot programs in the U.S. and UK, including partnerships with the NHS in England.

🔸GRAIL’s clinical studies, such as PATHFINDER, demonstrated that Galleri could detect cancers not routinely screened for, including pancreatic, ovarian, and esophageal cancers, before symptoms appeared.

Why It Matters:

🔸Supports the trend noted in your report: early diagnosis through multi-cancer detection from a single blood draw.

🔸Embodies the non-invasive, rapid, and scalable nature of liquid biopsy solutions.

🔸Proves market readiness and clinical acceptance of advanced liquid biopsy tools.

🔸Aligns with

projected global demand in North America and Asia Pacific, as Galleri

expands into India, Japan, and other countries via licensing and partnerships.

Strategic

Lessons for Stakeholders:

🔸Investors: Galleri illustrates the kind of platform that attracts big funding rounds and strong M&A interest (e.g., Illumina’s $8B acquisition attempt).

🔸Healthcare Providers: Adoption of Galleri-type tools enables scalable cancer screening in clinics and even primary care.

🔸Diagnostic Companies: Opportunities lie in methylation-based testing, high-sensitivity cfDNA analysis, and MRD (minimal residual disease) monitoring, high-growth niches within liquid biopsy.

⏳ Don’t Miss Out! | ⚡ Instant Access to U.S. Liquid Biopsy Market Report 👉 https://www.precedenceresearch.com/checkout/2474

What to Expect

from Liquid Biopsy Market in U.S. & Canada?

The United States is at the forefront of liquid biopsy innovation, fueled by its robust biotech ecosystem, leading academic institutions, and a mature regulatory framework. American companies and research labs are responsible for many of the key breakthroughs in circulating tumor DNA (ctDNA) analysis, methylation-based detection, and minimal residual disease (MRD) monitoring.

Tests like the Galleri multi-cancer early detection (MCED) test by GRAIL and FoundationOne Liquid by Foundation Medicine are among the most clinically advanced offerings.

Asia Pacific’s Healthcare Boom: Embracing Early Diagnosis and Affordable Treatment

Asia Pacific is expected to expand notably during the forecast period, owing to increased awareness of early diagnosis and the enlarged healthcare access in recent years. The regional countries such as India, China, and Japan have put heavy emphasis on early disease diagnostic centres in recent years. Also, the enlarged population and its growth have actively immense industry attention to the market in the past few years. Also, the initiatives such as the non-invasive surgeries and the affordable cancer treatment can create immense opportunities for the region during the projected time frame.

Asia Pacific is witnessing a surge in demand for non-invasive diagnostic solutions due to increasing cancer cases and improved healthcare access. According to the WHO, nearly 60% of global cancer cases are now reported in Asia, emphasizing the region's urgent diagnostic needs.

Related Topics You May Find Useful:

➢ Cancer Biopsy Market 2025 to 2034: The global cancer biopsy market size accounted for USD 30.77 billion in 2024 and is predicted to increase from USD 36.55 billion in 2025 to approximately USD 172.29 billion by 2034, expanding at a CAGR of 18.80% from 2025 to 2034.

➢ Biopsy Devices Market 2025 to 2034: The global biopsy devices market size accounted for USD 2.45 billion in 2024 and is predicted to reach around USD 4.89 billion by 2034, growing at a CAGR of 7.16% from 2025 to 2034.

➢ Fusion Biopsy Market 2025 to 2034: The global fusion biopsy market size was calculated at USD 738.94 million in 2024 and is anticipated to reach around USD 1,690.87 million by 2034, expanding at a CAGR of 8.63% from 2025 to 2034.

➢ Breast Biopsy Devices Market 2025 to 2034: The global breast biopsy devices market size was estimated at USD 1.09 billion in 2024 and is expected to reach around USD 1.64 billion by 2034, growing at a CAGR of 4.17% from 2025 to 2034.

➢ Biopsy Needle Market 2025 to 2034: The global biopsy needle market size accounted at USD 1.39 billion in 2024, and is expected to reach around USD 2.82 billion by 2034, expanding at a CAGR of 7.33% from 2025 to 2034.

➢ Predictive Biomarkers Market 2025 to 2034: The global predictive biomarkers market size was estimated at USD 24.31 billion in 2024 and is predicted to increase from USD 28.88 billion in 2025 to approximately USD 136.24 billion by 2034, expanding at a CAGR of 18.81% from 2025 to 2034.

➢ Endomyocardial Biopsy Market 2024 to 2034: The global endomyocardial biopsy market size accounted for USD 374.41 million in 2024 and is anticipated to reach around USD 771.67 million by 2034, growing at a CAGR of 7.50% between 2024 and 2034.

➢ U.S. Oncology Molecular Diagnostics Market 2025 to 2034: The U.S. oncology molecular diagnostics market size was estimated at USD 790 million in 2024 and is predicted to increase from USD 880 million in 2025 to approximately USD 2,500 million by 2034, expanding at a CAGR of 12.21% from 2025 to 2034.

💡 Liquid Biopsy Market Top Companies

🔹 Bio-Rad Laboratories

🔹 Biocept Inc.

🔹 Guardant Health

🔹 Illumina, Inc.

🔹 F. Hoffmann-La Roche Ltd.

🔹 Johnson & Johnson

🔹 Laboratory Corporation of America Holdings

🔹 MDxHealth SA

🔹 QIAGEN N.V

🔹 Thermo Fisher Scientific Inc.

What is Going Around the Globe?

→ In 2025, the Florida Cancer Specialist & Research Institute introduced their latest liquid biopsy test. These tests can detect signs of cancerous tumors and cells in the bloodstream, as per the report published by the institute recently. (Source - https://flcancer.com)

→ In 2025The, LabCorp unveiled the molecular residual disease and their liquid biopsy solutions recently. (Source - https://ir.labcorp.com)

🧬 Recent Developments in the Market:

🔹 In early 2025, LabCorp launched its liquid biopsy-based MRD monitoring platform across the U.S.

🔹 The Florida Cancer Specialist Institute introduced a liquid biopsy test to detect circulating tumor cells in early-stage patients.

🔹 Foundation Medicine’s NGS-based blood test received expanded FDA approval for broader cancer indications.

Liquid Biopsy Market Segmentation:

By Technology

• NGS

• PCR

• FISH

• Other

By Usage

• RUO

• Clinical

By Types of Sample

• Blood

• Urine

• Saliva

• CerebroSpinal Fluid

By Circulating Biomarker

• Circulating Tumor Cells

• Cell-free DNA

• Circulating Cell-Free RNA

• Exosomes and Extracellular Vesicles

• Others

By Products

• Test/Services

• Kits and Consumables

• Instruments

By Indication Type

• Lung Cancer

• Breast Cancer

• Prostate Cancer

• Colorectal Cancer

• Melanoma

• Other cancers

Non-Oncology Disorders

By Clinical Application

• Treatment Monitoring

• Prognosis and Recurrence Monitoring

• Treatment Selection

• Diagnosis and Screening

By Geography

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

📥 Download the full report or book a custom analyst briefing today 👉 https://www.precedenceresearch.com/checkout/1398

📞 Speak to a Specialist: sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans 👉 https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Statifacts | Nova One Advisor

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: