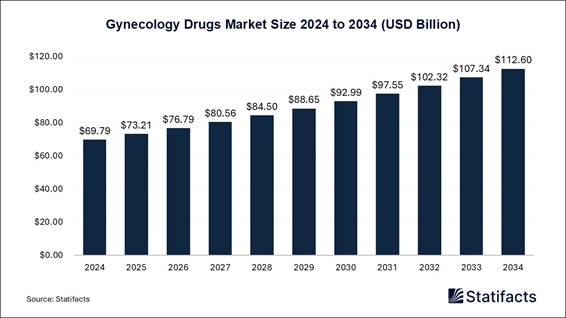

The global gynecology drugs market size is forecasted to reach around USD 112.6 billion by 2034, increasing from USD 69.79 billion in 2024 and representing a remarkable CAGR of 4.9% from 2025 to 2034.

According to Statifacts, the worldwide gynecology drugs market size was valued at approximately USD 69.79 billion in 2024 and is estimated to hit around USD 97.55 billion by 2031. The gynecology drugs market is driven by the increasing consumer preference towards treatments that enhance immunity systems and overall health and wellness.

This report is readily available for

immediate delivery. We can review it with you in a meeting to ensure data

reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8061

Gynecology Drugs Market Highlights

• North America led the global gynecology drugs market in 2024. Meanwhile, the Asia Pacific region is expected to experience the highest growth rate throughout the forecast period.

• Europe witnessed significant growth in the gynecology drugs market in 2024, contributing to the global market expansion.

• By therapeutic insights, the non-hormonal therapy segment dominated the market in 2024. However, the hormonal therapy segment is forecasted to grow at the fastest pace between 2025 and 2034.

• By indication trends, the contraception (birth control) was the leading indication in 2024. The menopausal disorder segment is anticipated to register the highest growth rate during the period from 2025 to 2034.

• By distribution channels, the hospital pharmacies held the largest market share in 2024. However, the retail pharmacies segment is predicted to see the highest compound annual growth rate (CAGR) during the study period.

Market Outlook and Industry Potential

The gynecology drugs market is attributed to the rising adoption of medicine for diseases including chronic disorders and cancer, increasing demand for advanced treatments such as gynecology checkpoint inhibitors and CAR T-cell therapies, increasing patient consciousness of biosimilars and monoclonal antibodies, growing geriatric population and rising technological advancements in research and development activities.

In addition, the significant opportunities in the global market are rising diversification and product development and rising technological advancements. By enabling more convenient, effective and efficient treatments and services, the rise of innovation can increase demand for gynecology drugs. The gynecology drug therapy of product development launching new ones and improving existing products to increase consumer demands, which further transform the growth of the gynecology drugs market in the coming years.

Latest Trends in Gynecology Drugs Market:

|

Category |

Details |

|

Global Market Trends |

- Shift toward non-hormonal therapies for menopause and endometriosis. - Rising demand for long-acting reversible contraceptives (LARCs). - Growth in combination therapies targeting multiple gynecological conditions. - Digital health integration (telemedicine + prescription platforms) expanding access to gynecology drugs. |

|

Therapeutic Focus Areas |

- Endometriosis & Fibroids: Increased development of GnRH antagonists (e.g., elagolix, relugolix). - PCOS: Research into metabolic and anti-inflammatory therapies. - Menopause: Development of safer hormone therapies and SERMs (Selective Estrogen Receptor Modulators). - Infertility & IVF Adjuncts: Rising support drug demand with IVF cycle growth. |

|

Growth Drivers |

- Growing prevalence of reproductive health disorders. - Higher awareness and early diagnosis of gynecological conditions. - Increase in delayed pregnancies, boosting demand for fertility treatments. - Rising government women’s health initiatives in emerging markets. |

|

Innovation & R&D |

- Focus on targeted therapies and personalized medicine for gynecology. - Biologics and monoclonal antibodies under development for gynecologic cancers. - Use of AI in drug discovery and patient-specific treatment matching. |

|

Emerging Country Highlight |

India is a key emerging player: - Rapid urbanization, rising awareness, and expanding health insurance are increasing access to gynecology care. - Government programs like Mission Shakti and Ayushman Bharat support women's health. - Domestic pharma companies are expanding generic and branded gynecology drug portfolios. |

|

Market Access Challenges |

- Pricing pressures in public health systems (especially in Asia, Africa). - Cultural taboos and stigma still limit access in some regions. - Regulatory disparities between countries slowing cross-border drug approval. |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

AI Impact on Gynecology Drugs Market

AI is revolutionizing the global market revenue by adopting several technological advancements. By detecting huge clinical datasets, AI is revolutionizing the gynecology industry. It is also revolutionizing personalized treatment strategies, development of gynecology drugs and drug discovery across several diseases. AI can also improve therapeutic approaches and detect outcomes significantly and continuously by identifying intricate patterns.

In addition, AI is having major impact on the gynecology drugs industry, enhancing the personalization, convenience and speed of treatment. Leading to more targeted and efficient medical therapies, researchers can better understand the complicated connections between the cancer and immune system, by leveraging AI for drug data analysis, which further expected to transform the growth of the gynecology drugs market in the coming years.

Case Study: AI-Driven Drug Discovery Accelerating Innovation in Women’s Health

Background:

In recent years, artificial intelligence (AI) has become a cornerstone of pharmaceutical innovation, particularly in women’s health. The global gynecology drugs market, projected to reach USD 112.6 billion by 2034, is increasingly influenced by AI’s transformative potential in accelerating drug discovery and personalized therapies. With rising incidences of disorders like PCOS, endometriosis, and menopause-related conditions, pharmaceutical companies are seeking faster, cost-effective, and precision-based solutions to develop next-generation gynecological drugs.

A notable development in this space occurred in October 2025, when Takeda Pharmaceutical and Nabla Bio announced an expansion of their AI-powered biologics design collaboration using Nabla’s proprietary Joint Atomic Model (JAM) platform. This model leverages generative AI to identify, design, and optimize therapeutic proteins, dramatically reducing discovery time and cost. Although primarily focused on immunology and oncology, the framework demonstrates strong potential to revolutionize gynecology-focused drug discovery as well.

Challenge:

Traditional gynecology drug development faces several bottlenecks:

• High R&D costs and lengthy clinical trials, particularly for hormonal therapies.

• Complexity of female hormonal pathways that vary significantly across individuals.

• Limited focus on non-hormonal therapies, despite increasing patient demand for safer alternatives.

• Underrepresentation of women in clinical research, slowing innovation and evidence generation.

These limitations have resulted in slow market introduction for innovative therapies targeting menopause, infertility, and gynecological cancers creating a gap that AI and machine learning technologies are now beginning to fill.

Objective:

The primary objective was to evaluate how AI can:

• Reduce the time-to-market for new gynecology drugs.

• Enhance precision and personalization in drug targeting.

• Support data-driven R&D decisions through predictive modeling and biomarker identification.

Enable scalable innovation in emerging markets such as India and Southeast Asia, where women’s health needs are expanding rapidly.

Approach:

Takeda and Nabla Bio’s collaboration provided a real-world framework adaptable to gynecological drug discovery:

• AI-Based Molecular Design: Nabla’s JAM platform simulates protein ligand interactions with atomic precision, allowing researchers to identify potential compounds effective against estrogen receptors or inflammatory pathways implicated in endometriosis and PCOS.

• Generative Drug Modeling: Using generative algorithms, the platform produces thousands of potential drug candidates, rapidly filtering those with optimal safety and efficacy profiles.

• Predictive Analytics for Patient Outcomes: AI models can predict how different hormonal or non-hormonal compounds perform across varied patient demographics an essential step for precision medicine in women’s health.

• Clinical Trial Optimization: Machine learning aids in patient stratification, improving recruitment efficiency and trial success rates for gynecological drugs.

By integrating this AI-driven discovery approach into gynecology-focused pipelines, pharmaceutical firms could potentially shorten drug discovery timelines from 5–7 years to under 3 years, while significantly cutting early-stage costs.

Implementation:

The case study illustrates a scalable adaptation model:

• Phase 1 (Feasibility & Data Integration): Pharmaceutical R&D teams integrate gynecology-specific biological datasets — such as hormone receptor structures, patient genomics, and disease biomarkers — into the AI system.

• Phase 2 (Algorithm Training): The AI is trained to identify patterns linked to gynecological diseases, including molecular triggers in PCOS, endometriosis, or fibroids.

• Phase 3 (Candidate Generation): Using generative design, AI models create new compounds that mimic or block hormonal actions, focusing on safety, stability, and efficacy.

• Phase 4 (Validation & Clinical Simulation): The platform runs simulations to predict real-world therapeutic outcomes, helping prioritize the most promising candidates for preclinical trials.

Results:

While the Takeda–Nabla collaboration’s initial targets are beyond gynecology, the results validate AI’s transformative role in pharmaceutical development:

• Reduction in molecule screening time by 60–70%.

• Improved candidate success rates due to precise target prediction.

• Enhanced personalization potential, particularly valuable for conditions like menopause and PCOS, where treatment responses vary widely among women.

When applied to gynecology, similar outcomes could accelerate development of safer non-hormonal therapies and targeted biologics for chronic reproductive disorders.

These advancements align with market dynamics highlighted in Statifacts’ press release especially the shift toward non-hormonal therapies, growing AI integration, and expansion in emerging regions such as India and Asia-Pacific.

Impact:

The integration of AI into gynecology drug discovery presents a paradigm shift:

• Economic Impact: Potential reduction of R&D expenditure by 40–50%, enhancing affordability and scalability.

• Clinical Impact: Faster availability of personalized, side-effect-minimized drugs.

• Strategic Impact: Strengthened collaborations between global pharma companies, AI startups, and research institutions focused on women’s health equity.

For instance, India’s domestic firms like Emcure Pharmaceuticals, already expanding into the menopause and PCOS segment, could leverage AI models to advance their pipelines and compete globally

Shape the insights, trends and strategic planning your way 50% customization is on us!

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8061

Market Challenge

Strict Regulatory Approvals

One of the major challenging factors restraining the market growth is the commercializing and developing immunotherapy drug. Due to these exhaustive demands small-scale companies face major issues. In addition, increasing prevalence of drug resistance, high cost of gynecology drug clinical trials, and increase of complicated manufacturing of drugs are the major retraining factors which are expected to hinder the growth of the gynecology drugs market.

Global Government Initiatives Supporting the Gynecology Drugs Market

United States

• White

House Initiative on Women’s Health Research

A national program boosting funding and innovation in under-researched areas

like menopause, endometriosis, and PCOS.

United Kingdom

• Women’s

Health Strategy for England (2022–2030)

Focused on improving access to gynecology

services, menopause care, and closing gender health

gaps through NHS reforms.

Germany

• BMG

Women’s Health Research Fund

Germany’s

Federal Ministry of Health supports academic and clinical research into gynecological diseases and reproductive health.

France

• French

National Health Strategy – Focus on Women’s Rights

Government backing for affordable access to contraceptives, fertility

treatments, and women-centered drug development.

Canada

• Women’s

Health Initiative – Canadian Institutes of Health Research (CIHR)

Provides

funding for research on female-specific health issues, including

hormonal and gynecological disorders.

Japan

• Women’s

Health Promotion Act

National

strategy focusing on aging, reproductive health, and improved

access to hormonal therapies and gynecology drugs.

Gynecology Drugs Market Regional Insights:

What has Made North America the Leader in Industry in Recent Years?

North America dominated the gynecology drugs market revenue in 2024. The market growth in the region is driven by factors such as the increasing expansion of insurance coverage and healthcare services, rising investments in research and development activities, increasing presence of leading pharmaceutical companies, high health spendings and well-developed healthcare infrastructure. The U.S. and Canada are dominating countries driving the market growth.

United States: Growth Drivers in the Gynecology Drugs Market

• High Prevalence of

Gynecological Conditions

Conditions like endometriosis, uterine fibroids, menopause symptoms, and PCOS affect

millions of U.S. women, driving strong demand for targeted therapies.

• Advanced R&D and

Innovation Hub

The U.S. leads in the development of non-hormonal therapies,

long-acting contraceptives, and biologics for gynecologic disorders

and cancers.

• Strong Focus on Women’s

Health Equity

Federal initiatives and funding (e.g., White House Women’s Health

Research Agenda) are prioritizing underserved areas of gynecology drug

development.

• Expanding Menopause and

Midlife Health Market

Growing attention to menopausal care, including hormone replacement

therapy (HRT) and SERMs, is boosting innovation and market expansion.

• Integration of Digital

Health & Femtech

Widespread use of women’s health apps, wearables, and telehealth

platforms is streamlining access to gynecology consultations and

prescriptions.

Asia Pacific Gynecology Drugs Market Trends:

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is attributed to factors such as the increasing investments in women’s health initiatives, improving diagnosis rates and expanding healthcare access. China, India, Japan and South Korea are the fastest growing countries fueling the market growth.

India: Growth Drivers in the Gynecology Drugs Market

• Rising Prevalence of

Women's Health Disorders

Increasing cases of PCOS, endometriosis, uterine fibroids, and infertility

are boosting demand for both prescription and OTC gynecology drugs.

• Expanding Middle-Class

& Urban Population

Greater awareness and health-seeking behavior in urban women are driving demand

for contraceptives, hormonal therapies, and fertility medications.

• Government-Backed Women’s

Health Programs

Initiatives like Ayushman Bharat, Janani Suraksha Yojana, and Mission

Shakti are enhancing access to maternal and reproductive healthcare across

India.

• Growing IVF & Fertility

Services Sector

India's booming IVF and ART (Assisted Reproductive Technology) market is

leading to increased use of fertility support drugs.

Gynecology Drugs Market Scope

|

Report Attributes |

Statistics |

|

Market Size in 2024 |

USD 69.79 Billion |

|

Market Size in 2025 |

USD 73.21 Billion |

|

Market Size in 2030 |

USD 92.99 Billion |

|

Market Size in 2032 |

USD 102.32 Billion |

|

Market Size by 2034 |

USD 112.6 Billion |

|

CAGR 2025-2034 |

4.9% |

|

Leading Region in 2024 |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Years |

2025-2034 |

|

Segments Covered |

Therapeutics, Indication, Distribution Channel, and Region |

|

Region Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

|

Key Players |

Allergan plc, Amgen Inc., Bayer AG, Merck & Co., Inc., Pfizer Inc., Eli Lilly Company, F. Hoffmann-La Roche Ltd., AstraZeneca, and Others. |

Gynecology Drugs Market Segmentation

Analysis Therapeutics Type Analysis The non-hormonal therapy segment dominated

the gynecology drugs market revenue in 2024. The segment growth in the region

is driven by factors such as the increasing consumer preference towards

alternatives with less systemic side effects. These therapies are gaining

popularity in the mild gynecological infections and management of menopausal

symptoms among women. The hormonal therapy segment is expected to

grow fastest during the forecast period, due to its huge application in

treating diseases such as contraception, menopause-related diseases and PCOS.

Hormonal drugs are often expected first-line therapies due to their clinical familiarity,

fast symptom relief and proven efficacy. Indication Type Analysis Why Did the Contraception

Segment Dominates the Gynecology Drugs Market Revenue in 2024? The contraception segment dominated the

global market revenue in 2024. Contraception helps in improving women's health

and empowerment, preventing unintended pregnancies and addressing a fundamental

need for family planning by reducing menstrual health issues, maternal

mortality and unsafe abortions. The menopausal disorder segment is expected

to grow fastest during the forecast period. The segment growth in the region is

driven by the rising innovations in both non-hormonal and hormonal therapies,

increasing patient awareness and growing geriatric female population. Distribution Channel Analysis The Hospital Pharmacies

Segment Dominates the Gynecology Drugs Market Revenue in 2024. The hospital pharmacies play an important

role the global market, serving as major distribution channel, providing a crucial

supply point for high-complexity, complex and specialized drugs requiring in-hospital

use. They offer clinical expertise for specialized therapies, manage large and

specialized drug inventories and ensure drug safety. The retail pharmacies segment is expected to

grow fastest during the forecast period. Retail pharmacies offering

pharmacist counselling for patient adherence and support and providing broad

accessibility for common medications. Browse

More Research Reports: • The global gynecological devices

market size surpassed USD 10.52 billion in 2024 and is predicted to reach

around USD 23.22 billion by 2034, registering a CAGR of 8.23% from 2025 to

2034. • The U.S. gynecological devices

market size surpassed USD 3.85 billion in 2024 and is predicted to reach

around USD 8.53 billion by 2034, registering a CAGR of 8.28% from 2025 to 2034. • The laparoscopic gynecological

procedures market size is predicted to gain around USD 62.45

billion by 2034 from USD 30.3 billion in 2024 with a CAGR of 7.5%. Ready to Dive Deeper? Visit Here to Buy Databook and In-depth

Report Now! https://www.statifacts.com/order-databook/8061 Top Companies in the

Gynecology Drugs Market: • Allergan plc • Amgen. Inc. • Bayer AG • Pfizer Inc. • AstraZeneca • Merck & Co., Inc. • Eli Lilly Company • F. Hoffmann-La Roche Ltd.

Recent

Developments • In August 2025, GlaxoSmithKline Pharmaceuticals marked its re-entry

into the cancer drugs segment in the country and brought in Jemperli

(dostarlimab) and Zejula (niraparib) to India. The two oncology products

brought at a “tiered pricing” for India, executives with the multinational

company said. • In May 2025, Pune-headquartered Emcure Pharmaceuticals announced the expansion

of its gynaecology and dermatology product portfolio for the Indian market in

FY26 and launched a portfolio of products in the menopause and PCOS segment. Segments

Covered in the Report By Therapeutics • Hormonal Therapy o Estrogen Therapy o Progestin Therapy o Combination Therapy o Thyroid Replacement

Therapy o Parathyroid Hormone

Therapy o Others • Non-hormonal Therapy o Anti-Infective Agents o Anti-neoplastic Agents o Anti-inflammatory Agents o Others By Indication • Gynecological Cancers • Endometriosis • Female Infertility • Menopausal Disorder • Gynecology Infections • Polycystic Ovary Syndrome • Contraception (Birth Control) • Others By Distribution

Channel • Hospital Pharmacies • Retail Pharmacies • Online Pharmacies By Regions • North America o U.S. o Canada • Europe o Germany o UK o France o Italy o Spain o Sweden o Denmark o Norway • Asia Pacific o China o Japan o India o South Korea o Thailand • Latin America o Brazil o Mexico o Argentina • Middle East and Africa (MEA) o South Africa o UAE o Saudi Arabia o Kuwait Ready

to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/8061 𝐀𝐛𝐨𝐮𝐭 𝐔𝐬: Statifacts is a global

market intelligence and consulting leader, committed to delivering deep

strategic insights that fuel innovation and transformation. With a sharp focus

on the fast-evolving landscape of life sciences, we excel at navigating the

intricacies of cell and gene therapies, oncology, and drug

development. We empower our clients, ranging from biotech pioneers to

institutional investors with the intelligence needed to lead in high-impact

areas like regenerative medicine, cancer therapeutics, and precision health.

Our broad expertise across the pharma-biotech value chain is backed by robust,

statistically driven data for every market we cover, ensuring decisions are

informed, forward-looking, and built for impact. Statifacts offers subscription services for data and analytics

insights. This page provides options to explore and purchase a subscription

tailored to your needs, granting access to valuable statistical resources and

tools. Access here - https://www.statifacts.com/get-a-subscription Connect with Us Ballindamm 22, 20095 Hamburg, Germany Europe: +44 7383092044 Web: https://www.statifacts.com/ For Latest Update Follow Us: https://www.linkedin.com/company/statifacts Our Trusted Data Partners: