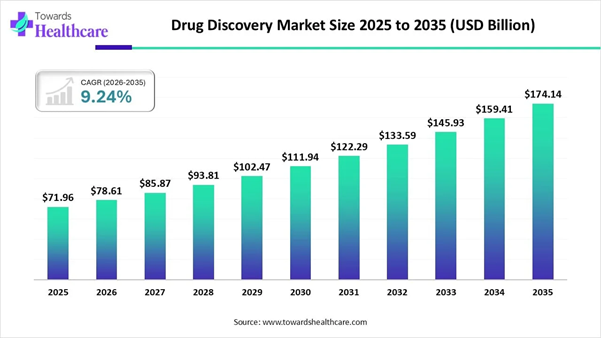

According to Towards Healthcare data, the global drug discovery market size is calculated at USD 71.96 billion in 2025, grows to USD 78.61 billion in 2026, and is projected to reach around USD 174.14 billion by 2035, growing at a 9.24% CAGR. The market is growing as AI accelerates biomarker identification, streamlines preclinical research, and enhances clinical trials' efficiency. It enables faster, more precise drug development and target validation.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6217

Key Takeaways

➤ Drug discovery industry poised to reach USD 78.61 billion by 2026.

➤ Forecasted to grow to USD 174.14 billion by 2035.

➤ Expected to maintain a CAGR of 9.24% from 2026 to 2035.

➤ North America held a major revenue share of the market in 2024.

➤ Asia-Pacific is expected to witness the fastest growth during the predicted timeframe.

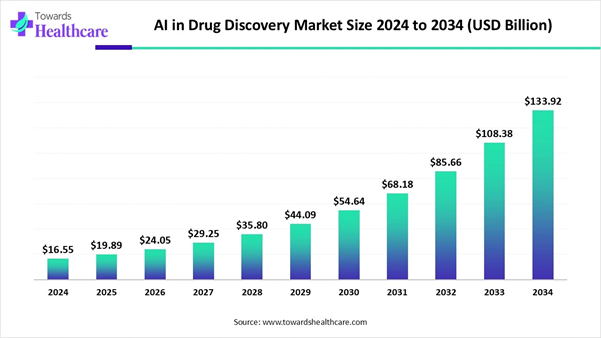

➤ The global AI in drug discovery market is set to grow from USD 19.89 billion in 2025 to about USD 133.92 billion by 2034 at a CAGR of 23.22%.

➤ By functional workflow/stage, the hit identification segment dominated the drug discovery market in 2024.

➤ By functional workflow/stage, the target discovery & validation segment is expected to show the fastest growth over the forecast period.

➤ By modality, the small molecules segment contributed the biggest revenue share of the market in 2024.

➤ By modality, the biologics segment is expected to witness the fastest growth in the market over the forecast period.

➤ By technology/platform, the high-throughput screening (HTS) & compound libraries segment registered its dominance over the global market in 2024.

➤ By technology/platform, the computational/in silico drug discovery segment is expected to grow at the fastest CAGR in the drug discovery market during the forecast period.

➤ By service model/provider type, the full service CROs/discovery CDMOs segment led the market in 2024.

➤ By service model/provider type, the SaaS/platform providers segment is expected to account for the highest growth in the forecast period.

➤ By end-user, the large pharmaceutical companies segment held a dominant revenue share of the market in 2024.

➤ By end-user, the small virtual biotech/startups segment is expected to grow with the highest CAGR in the market during the studied years.

➤ By therapeutic focus area, the oncology segment accounted for the highest revenue share of the market in 2024.

➤ By therapeutic focus area, the CNS/neurology segment is expected to expand rapidly in the market in the coming years.

What is Drug Discovery?

Drug discovery is the process of identifying and developing new medications by studying biological targets, screening compounds, and optimizing candidates for safety and efficacy before clinical use. The market is growing due to increasing demand for novel therapeutics, rising prevalence of chronic and complex diseases, and advancements in AI, genomics, and high-throughput screening technologies.

AI-powered pathology tools accelerate biomarker identification, streamline preclinical research, and improve predictive accuracy, reducing development timelines and costs. Growing investments by pharmaceutical companies, collaborations with research institutes, and the push for personalized medicine further drive market expansion, making drug discovery faster, more efficient, and highly targeted.

Quick Facts Table

|

Table |

Scope |

|

Market Size in 2026 |

USD 78.61 Billion |

|

Projected Market Size in 2035 |

USD 174.14 Billion |

|

CAGR (2026 - 2035) |

9.24% |

|

Leading Region |

North America |

|

Market Segmentation |

By Functional Workflow/Stage, By Modality, By Technology/Platform, By Service Model/Provider Type, By End-User, By Therapeutic Area Focus, By Region |

|

Top Key Players |

Atomwise, BenevolentAI, Charles River Laboratories, Certara, Evotec, Exscientia, Genedata, Insilico Medicine, IQVIA, Labcorp / Covance, Novartis (discovery & platform investments), Recursion Pharmaceuticals, Schrödinger, Thermo Fisher Scientific, WuXi AppTec |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Core Drivers shaping the Rapid Development of the Drug Discovery Market?

The rapid growth of the market is driven by rising chronic disease burdens, advancements in AI, genomics, and automation, and the demand for faster, more targeted therapies. Increased R&D investments, expanding biopharma collaborations, and the move towards personalized medicine further accelerate innovation, enabling quicker identification of drug candidates and improved development efficiency.

In 2024, Merck & Co. led drug discovery spending with major investments across roughly 27 R&D programs. Meanwhile, Roche outlined an ambition to introduce 20 breakthrough therapies by 2029, targeting high-impact disease areas to address critical medical needs.

What are the Key trends in the Drug Discovery Market in 2024?

➤ In September 2025, Infinimmune entered a partnership with Immunome, Inc. to advance the discovery and refinement of new antibodies. The collaboration allows Infinimmune to enhance and engineer promising leads into high-quality, development-ready therapies by leveraging Immunome’s GLIMPSE and Anthrobody platforms.

➤ In September 2025, GSK revealed plans to invest $30 billion in U.S. research, development, and supply chain expansion over the next five years. The funding aims to boost drug discovery, development, and clinical trial capacity, further reinforcing the country’s leadership in biopharmaceutical innovation.

How AI is Transforming the Drug Discovery Market?

AI plays a crucial role in drug discovery by expediting the entire process and leading to the development of more efficacious drugs. A recent research report found that AI-based drug discovery could save approximately 70% of costs to pharmaceutical and biotech companies. AI and machine learning (ML) can predict complex structures of proteins/targets, enabling researchers to design drugs based on their structure. AI-based drug discovery results in faster drug discovery, cost savings, reduced resource and manpower usage, and decreased attrition rates in clinical trials.

Global AI in Drug Discovery Market Growth

The global AI in drug discovery market is valued at USD 19.89 billion in 2025 and is projected to reach approximately USD 133.92 billion by 2034, growing at a CAGR of 23.22% between 2024 and 2034.

AI Integration in Drug Discovery: Who Leads and Who Lags in 2023?

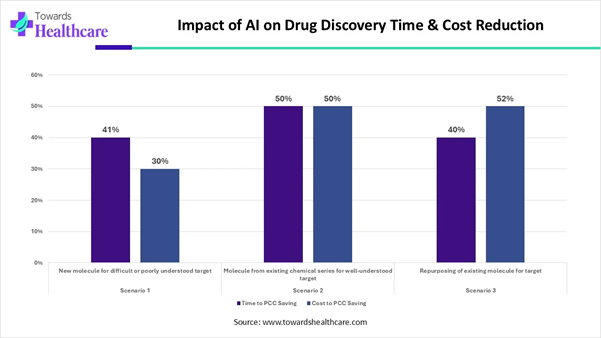

AI is helping the drug discovery process become faster and cheaper. The impact depends on the type of project:

1. When scientists develop a completely new

molecule for a difficult or poorly understood target, AI reduces the time by

41% and cuts the cost by 30%.

In this case, the work is complex, so the savings are helpful but not the

highest.

2. When researchers work with an existing

chemical series for a well-understood target, AI provides the biggest benefit.

It cuts both time and cost by 50% because the starting point is stronger, and

AI can optimize more efficiently.

3. When teams repurpose an already-known

molecule for a new target, AI again saves 40% of time and reduces costs by 52%.

This is because much of the basic research is already done, and AI speeds up

the matching process.

What is the Appearing Challenge in the Drug Discovery Market?

The market faces challenges such as high R&D costs, lengthy development timelines, and rising clinical trial complexities. Limited success rates, stringent regulatory requirements, and difficulties in translating preclinical results to human outcomes further slow progress. Additionally, increasing competition, data integration issues, and the need for advanced technologies add pressure on companies to innovate efficiently.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Functional Workflow/stage Insights

How did the Hit Identification Segment Dominate the Drug Discovery Market in 2024?

The hit identification segment held the largest market share in 2024 because it represents the critical first phase of drug discovery, where vast compound libraries are screened to find potential drug candidates. Growing adoption of high-throughput screening, advanced AI algorithms, and computational modelling accelerated target compound matching. Increased investment in early-stage research and the need to shorten discovery timelines further strengthened this segment's dominance in the overall workflow

The target discovery & validation segment is projected to grow at the fastest CAGR due to rising demand for precise, therapeutic targeted therapies, driven by advances in genomics and AI-powered analytics. These technologies enable a deeper understanding of disease mechanisms and faster identification of high-value targets. Increasing investment in personalized medicine, expanding biomarker research, and the push to reduce downstream R&D failure further accelerate growth in this early high-impact stage of drug development.

By modality Insights

What made the Small Molecules Segment Dominant in the Drug Discovery Market in 2024?

The small molecules segment is expected to grow at the fastest CAGR because these drugs are easier to synthesize, highly stable, and cost-effective to manufacture at scale. Their ability to target a wide range of diseases, strong oral bioavailability, and well-established regulatory pathways further accelerate adoption. Advances in AI-driven screening, structure-based drug design, and combinatorial chemistry are boosting discovery efficiency, making small molecules increasingly attractive for rapid therapeutic development.

The biologics segment is expected to grow at the fastest CAGR due to rising demand for highly targeted, effective therapies for cancer, autoimmune, and rare diseases. Advancements in genetic engineering, monoclonal antibody development, and cell-based technologies are accelerating innovation. Strong investment in personalized medicine, improved manufacturing platforms, and expanding clinical success rates further strengthen biologics adoption, positioning them as a key driver of next-generation therapeutic development.

By Technology/platform Insights

Why the High-throughput Screening (HTS) & Compound libraries Segment Dominated the Drug Discovery Market in 2024?

The high-throughput screening (HTS) & compound libraries segment dominated the market because these platforms enable rapid testing of thousands of compounds, significantly accelerating early drug discovery. Their ability to quickly identify promising hits, combined with automation, robotics, and advanced assay technologies, improves efficiency and reduces development timelines. Widespread adoption by pharmaceutical and biotech companies, along with continuous expansion of diverse compound libraries, further strengthened this segment's leading position in 2024.

The computational/in-silico drug discovery segment is expected to grow at the fastest CGR because AI, machine learning, and predictive modelling greatly speed up target identification and compound screening. These tools lower R&D costs, improve accuracy in assessing drug-target interactions, and reduce the need for extensive laboratory experiments. Growing adoption of virtual screening, integration with big data, and rising demand for faster, more efficient drug development further drive this segment's rapid expansion.

By Insights

Why Did the Full-service CROs/discovery CDMOs Segment Dominate the Drug Discovery Market in 2024?

The full-service CRO/discovery CDMO segment held the largest market share in 2024 because biopharma companies increasingly relied on integrated partners that offer end-to-end discovery, preclinical, and development support. These providers reduce costs, shorten timelines, and streamline complex workflows through advanced technologies, specialized expertise, and global infrastructure. Their ability to manage everything from target discovery to candidate optimization made them the preferred choice for accelerating R&D efficiency and reducing operational burdens.

The SaaS/platform providers segment is expected to grow at the fastest CAGR as cloud-based drug discovery tools offer scalable, cost-efficient access to AI, analytics, and modeling technologies. These platforms enable real-time data integration, collaborative R&D, and rapid virtual screening without major infrastructure investments. Increasing digital transformation in pharma, rising demand for automation, and the shift toward subscription-based, on-demand solutions further accelerate the adoption of SaaS platforms during the forecast period.

By End-user Insights

How does the Large Pharmaceutical Companies Segment dominate the Drug Discovery Market in 2024?

The large pharmaceutical comanies segment dominated the market in 2024 because these firms have substantial R&D budgets, extensive global infrastructure, and strong capabilities to adopt advanced drug discovery technologies. Their ability to fund large-scale projects, leverage AI and High-throughput platforms, and run extensive clinical pipelines gives them a competitive edge. Additionally, strategic partnership with CROs, biotech firms, and technology providers further strengthened their leadership in driving innovation and revenue generation.

The small virtual biotech/startups segment is expected to grow at the fastest CAGR because these companies increasingly leverage AI-cloud platforms and outsourced R&D to accelerate drug discovery without heavy infrastructure costs. Their agility, focus on niche or high-value targets, and strong venture funding enable rapid innovation. Growing collaboration with CROs, CDMOs, and technology providers further supports faster development cycles, making virtual biotech a key driver of next-generation drug discovery.

By Therapeutic Focus Area Insights

What made the Oncology Segment Dominant in the Drug Discovery Market in 2024?

The oncology segment led the drug discovery market because cancer remains a leading global health challenge with high prevalence and mortality. Rising demand for targeted therapies, immune-oncology drugs, and precision medicine drives substantial R&D investment. Advances in AI, genomics, and biomarker discovery enable faster identification of novel cancer targets, improving treatment efficiency. Strong funding, regulatory support, and unmet medical needs further reinforce oncology's dominant share in drug discovery.

The CNS/neurology segment is expected to grow at the fastest CAGR due to the increasing prevalence of neurological disorders, such as Alzheimer’s, Parkinson’s, and multiple sclerosis. Rising demand for innovative therapies, advancements in AI-driven target identification, and highly unmet medical needs are driving investments. Integration of computational modelling, biomarker research, and personalized medicine approaches further accelerates drug discovery in CNS disorders, making this segment a key growth area in the forecast period.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Regional Analysis

How is North America contributing to the Expansion of the Drug Discovery Market?

North America dominated the market in 2024 due to its well-established pharmaceutical and biotechnology infrastructure, high R&D investment, and early adoption of advanced technologies like AI, high-throughput screening, and computational modeling. Strong presence of leading global pharma companies, government initiatives supporting innovation, and robust clinical trial networks contributed to the region’s leadership. Additionally, increasing demand for novel therapeutics, precision medicine, and oncology-focused research further strengthened North America’s significant revenue share in the market.

U.S. drug discovery expands through AI-driven target identification, advanced biologics engineering, and rising CRO support, improving hit optimization efficiency and accelerating progress across oncology, neurology, immunology, and rare-disease therapeutic initiatives.

How is Asia-Pacific Accelerating the Drug Discovery Market?

Asia Pacific is anticipated to grow at the fastest CAGR due to rising investments in pharmaceutical R&D, expanding biotechnology infrastructure, and increasing adoption of AI and high-throughput drug discovery technologies. Growing prevalence of chronic and infectious diseases, supportive government initiatives, and a large, cost-effective talent pool further drive market growth. Additionally, collaborations between global pharma companies and regional startups accelerate innovation and strengthen the region’s role in drug discovery.

China’s drug discovery market strengthens through expanded government investment, rapid AI adoption, growing biologics engineering capacity, and increased licensing-out partnerships that accelerate development of innovative oncology, immunology, and metabolic-disease therapies.

Recent Developments in the Drug Discovery Market

➤ In July 2025, Microsoft launched BioEmu-1, an AI platform designed to analyze protein dynamics and accelerate drug discovery. Using deep learning, it can generate thousands of protein structures per hour on a single GPU, enabling faster and more efficient identification of therapeutic targets.

➤ In March 2024, C4 Therapeutics partnered with Merck KGaA, Darmstadt, Germany, to target key oncogenic proteins. C4T will use its TORPEDO platform to develop protein degraders, while Merck KGaA will handle clinical development and commercialization of resulting drug candidates.

Who are Leading the Drug Discovery Market Key Players List

● Pfizer Inc.

● GlaxoSmithKline PLC

● Merck and Co. Inc.

● Agilent Technologies Inc.

● Eli Lilly and Company

● Hoffmann-La Roche Ltd

● Bayer AG

● Abbott Laboratories Inc.

● Shimadzu Corp

● AstraZeneca

● Sanofi

● Polpharma Biologics Group

● Novartis AG

● Takeda Pharmaceutical Company Limited.

● Teva Pharmaceutical Industries Ltd.

Segment Covered in the report

By Functional Workflow/Stage

● Hit identification (HTS, fragment-based, virtual screening, phenotypic screens)

● Target discovery & validation (genomics, proteomics, CRISPR screens)

● Hit-to-lead & lead optimization (medchem, SAR, ADMET optimization)

● Biologics discovery (antibody, peptide, protein engineering)

● Preclinical candidate selection & IND-enabling studies (tox, PK/PD)

● Translational & biomarker development (in vitro to in vivo bridging)

By Modality

● Small Molecules (traditional chemotypes)

● Biologics (monoclonal antibodies, recombinant proteins)

● Oligonucleotides & RNA therapeutics

● Peptides & macrocytes

● Cell & gene therapy enablement (discovery of vectors/targets)

By Technology/Platform

● High-throughput screening (HTS) & compound libraries

● Computational/in silico discovery (docking, physics-based, AI/ML)

● Fragment-based discovery & structure-based design (SBDD)

● Phenotypic screening & cell-based assays (organoids, iPSC models)

● Structural biology (Cryo-EM, X-ray, NMR)

● ADMET and in silico safety prediction platforms

By Service Model/Provider Type

● Full service CROs/discovery CDMOs (end-to-end discovery outsourcing)

● SaaS/platform providers (computational chemistry, ELN, LIMS)

● Niche specialist providers (assay development, structural biology, ADMET)

● Integrated partnerships (platform licensing, milestone deals)

● In-house R&D (pharma and large biotech internal spend)

By End-User

● Large pharmaceutical companies

● Mid-sized biotech

● Small virtual biotech/startups

● Academic & translational research institutes

By Therapeutic Area Focus

● Oncology

● CNS/neurology

● Infectious diseases & antivirals

● Immunology/inflammation

● Metabolic & cardiovascular diseases

● Rare diseases/orphan indications

By Region

· North America

· South America

· Europe

· Asia Pacific

· MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6217

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest