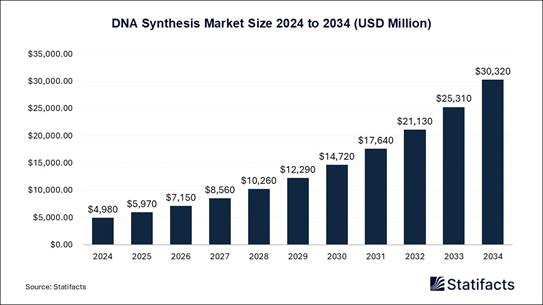

The global DNA Synthesis market size is forecasted to reach around USD 30,320 million by 2034, increasing from USD 4,980 million in 2024 and representing a remarkable CAGR of 19.8% from 2025 to 2034.

In terms of revenue, the worldwide DNA synthesis market size was valued at approximately USD 4,980 million in 2024 and is estimated to hit around USD 17,640 million by 2031. The growing demand for personalized medicine is the major factor driving the growth of the market. Also, innovations in biotechnology, coupled with the growth in gene editing technologies like CRISPR, can fuel market growth further.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8144

DNA Synthesis Market Highlights

• North America led the DNA synthesis market in 2024.

• Asia-Pacific is projected to be the fastest-growing market during the forecast period.

• By service, the oligonucleotide synthesis dominated the market in 2024.

• By service, the gene synthesis is expected to be the fastest-growing service segment during the forecast period.

• By application, the research and development was the leading application in 2024.

• By application, the therapeutics is forecasted to be the fastest-growing application in the market during the forecast period.

• By end-user, the biopharmaceutical companies dominated the market in 2024.

• By end-user, the academic and research institutes are projected to be the fastest-growing end-user segment during the forecast period.

DNA Synthesis Market Overview & Potential

The market involves the designing of DNA molecules, either artificially or naturally, for applications in areas such as drug discovery, genetic engineering, and personalized medicine. Ongoing advancements in synthesis techniques like microfluidics and enzymatic DNA synthesis are leading to more accurate, faster, and cost-effective production of synthetic DNA.

What Are the Key Drivers and Opportunities Responsible for DNA Synthesis Market?

The DNA synthesis market is primarily driven by the rapid expansion of genetic engineering, synthetic biology, and precision medicine, all of which require high-quality, customizable DNA sequences for research and product development. Advancements in gene editing technologies such as CRISPR-Cas systems, have significantly increased demand for synthesized DNA used in guide RNA design, repair templates, and engineered gene constructs.

Additionally, the growing need for biologics and cell & gene therapies is accelerating the adoption of synthetic DNA in applications such as viral vector design, antibody engineering, and vaccine development; for instance, mRNA COVID-19 vaccines required large-scale synthesis of DNA templates during manufacturing. Automation and the decreasing cost of DNA synthesis technologies also serve as major market drivers, enabling faster turnaround times and high-throughput production that benefit pharmaceutical companies, academic labs, and industrial biotech firms.

Opportunities are expanding across multiple areas, including the development of long DNA fragments for gene circuit engineering, the emergence of enzymatic DNA synthesis platforms that offer greater speed and sustainability, and the increasing use of synthetic DNA in agricultural biotechnology for creating climate-resilient crops.

Furthermore, growing interest in DNA-based data storage, demonstrated by technology companies exploring DNA as an ultra-dense, long-term archival medium presents a significant future opportunity. Collectively, these drivers and emerging applications are positioning the DNA synthesis market for strong growth as industries increasingly rely on engineered DNA for innovation, scalability, and next-generation biotechnological solutions.

What Are the Latest Trends Associated with The DNA Synthesis Market?

Advancements in Gene Editing

• The growing use of gene editing technologies like CRISPR-Cas9 is boosting demand for custom DNA sequences for precise genetic modifications in various areas.

Rise of Personalized Medicine

• As treatments become more specific to individual genetic profiles, the need for custom DNA synthesis for diagnostic and therapeutic purposes is growing significantly.

Demand for Custom DNA Sequences

• The need for specific, custom-designed DNA sequences for research and industrial applications is a core driver for market expansion.

Strategic Investments

• The market is receiving significant venture capital funding, with investments focused on high-throughput DNA isolation technologies and other innovations.

What Is the Major Challenge in The DNA Synthesis Market?

The major challenges the market is currently facing are technical limitations in synthesizing long DNA sequences precisely. Other challenges include the high cost of cutting-edge synthesis technologies and complex and evolving regulatory hurdles. Moreover, the growing demand for a standardized regulatory framework and the shortage of skilled labor can hamper market growth further.

Regional Analysis

How Did North America Dominated the DNA Synthesis Market In 2024?

North America dominated the DNA synthesis market in 2024. The dominance of the region can be attributed to the advanced healthcare infrastructure, heavy research funding, and robust demand for personalized medicine and gene therapies. Furthermore, the demand for personalised treatments for genetic disorders fuels the demand for DNA synthesis for creating customised therapies.

• In May 2024, Integrated DNA Technologies invested in a New U.S. synthetic biology manufacturing facility. The Dedicated site provides a growth runway for the manufacturing of synthetic biology products to support growing demand.

U.S. DNA Synthesis Market Trends:

• Rapid Expansion of Synthetic Biology

Startups

The U.S. hosts one of the largest clusters of synthetic biology companies,

driving demand for high-throughput DNA synthesis for engineered organisms,

metabolic pathway design, and bio-based manufacturing.

• Strong Adoption of CRISPR and Gene

Editing Tools

Widespread use of CRISPR systems in academic and commercial labs accelerates

the need for custom DNA constructs, guide RNAs, and repair templates.

• Deep Investment in Gene & Cell

Therapy Pipelines

The U.S. biopharma sector is increasing DNA template production for viral

vectors, mRNA therapies, and CAR-T programs, strengthening domestic synthesis

capacity.

• Shift Toward Automation and Enzymatic

Synthesis

Companies are adopting automated synthesizers and enzymatic DNA synthesis

platforms to reduce turnaround times and support large-scale projects.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Canada DNA Synthesis Market Trends:

• Growing Academic and Research

Collaborations

Canadian universities and research institutes are increasingly partnering with

biotech firms to access high-fidelity DNA synthesis for genomics and

agricultural biotechnology.

• Expanding Precision Medicine Programs

Government-backed initiatives in oncology and rare diseases are

increasing demand for DNA constructs used in diagnostics, biomarkers, and

targeted therapies.

• Developing Biotech Manufacturing

Infrastructure

Canada is investing in domestic biomanufacturing facilities, boosting local

demand for DNA vectors and templates for vaccine and therapeutic production.

• Focus on Sustainable and Enzymatic

Technologies

Canadian biotech firms are adopting greener DNA synthesis approaches as part of

national sustainability goals and clean-tech innovation efforts.

What Made the Asia Pacific Significantly Grow in The DNA Synthesis Market In 2024?

Asia-Pacific is observed to grow at the fastest CAGR in the market during the forecast period. The growth of the region can be credited to the growing government investment in life sciences and healthcare, along with the expanding biotech companies and research institutions in emerging economies such as China and India. In addition, a growing trend of outsourcing drug discovery can impact positive regional growth soon.

India DNA Synthesis Market Trends:

• Rising Use in Diagnostics and Genomics

Labs

DNA synthesis demand is increasing due to widespread adoption of NGS-based

diagnostics, genetic panels, and molecular pathology tools.

• Growing Biotech Startup Ecosystem

India’s emerging synthetic biology and biotech startups rely on cost-effective

DNA synthesis for developing engineered enzymes, biofuel microbes, and

therapeutic candidates.

• Government Push for Indigenous

Biomanufacturing

Initiatives like “Make in India” and “BioE3” are encouraging domestic

production of DNA components, reducing reliance on imports.

China DNA Synthesis Market Trends:

• Massive Scale-Up of Gene Editing and

Synthetic Biology Projects

China is rapidly expanding national programs in CRISPR-based therapies,

synthetic biology reactors, and engineered cell lines, driving heavy DNA

synthesis demand.

• Investment in Large-Scale

Biomanufacturing Parks

Biotech industrial zones in Shanghai, Shenzhen, and Beijing are building

high-volume DNA synthesis and vector production capacities.

• Strong Government Funding for Genomic

Medicine

National initiatives in population genomics, infectious disease research, and

oncology are supporting major procurement of synthetic DNA for assays and

therapeutic pipelines.

Shape the insights, trends and strategic planning your way 50% customization is on us!

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8144

DNA Synthesis Market Scope

|

Report Attributes |

Statistics |

|

Market Size in 2024 |

USD 4,980 Million |

|

Market Size in 2025 |

USD 5,970 Million |

|

Market Size in 2030 |

USD 14,720 Million |

|

Market Size in 2032 |

USD 21,130 Million |

|

Market Size by 2034 |

USD 30,320 Million |

|

CAGR 2025-2034 |

19.8% |

|

Leading Region in 2024 |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Years |

2025-2034 |

|

Segments Covered |

Service, Application, End-User, and Region |

|

Region Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

|

Key Players |

LGC Biosearch Technologie, Bioneer Corporation, Thermo Fisher Scientific, Inc., IBA GmbH, Twist Bioscience, Eton Bioscience, Quintara Biosciences, Eurofins Scientific, Integrated DNA Technologies, Inc, GenScript Biotech Corporation, and Others. |

DNA Synthesis Market Segmentation Analysis

Service Analysis

How did oligonucleotide synthesis segment dominate the DNA synthesis market in 2024?

The oligonucleotide synthesis segment dominated the market in 2024. The dominance of the segment can be attributed to the growing investments in R&D for oligonucleotide-based drugs and ongoing innovations in technologies such as CRISPR and next-generation sequencing (NGS). Also, Oligonucleotides are crucial for applications such as DNA sequencing and gene editing.

The gene synthesis segment is observed to be the fastest growing in the market during the forecast period. The growth of the segment can be credited to the expansion of personalized medicine along with the growing adoption of synthetic DNA in areas such as diagnostics and agriculture. Favourable government policies are growing funding for synthetic biology research.

Application Analysis

How did research and Development segment dominate the DNA synthesis market in 2024?

The research and development segment dominated the market in 2024. The dominance of the segment can be linked to the growing investments in genomics research, coupled with the rising demand for synthetic DNA in diagnostics and synthetic biology.AI and automation are enhancing the efficiency, accuracy, and speed of DNA synthesis.

The therapeutics segment is observed to be the fastest growing in the market during the forecast period. The growth of the segment can be driven by the growing use of gene therapy and preventive medicine, along with the surging need for customized treatments for various chronic conditions. The market is also witnessing an increased demand for DNA synthesis in drug development.

End-User Analysis

Which end user segment dominated the DNA synthesis market in 2024?

The biopharmaceutical companies segment dominated the market in 2024. The dominance of the segment is owed to the growing demand for gene therapies and personalized medicine, coupled with the growing use of DNA synthesis in disease diagnosis and synthetic biology. Moreover, pharmaceutical companies are rapidly outsourcing DNA synthesis services to CROs.

The academic and research institutes segment is observed to be the fastest growing in the market during the forecast period. The growth of the segment is due to rising demand for genomics research, personalized medicine, gene editing, and synthetic biology applications. The push for individualized medicine depends on the capability to synthesize specific DNA sequences for targeted therapies and research.

Browse More Research Reports:

• The global DNA storage technology market was valued at USD 10.17 million in 2024 and is projected to reach USD 23.42 million by 2034, growing at a CAGR of 8.7%. Growth is driven by the increasing need for ultra-dense, long-term data storage solutions in technology and research sectors.

• The Europe plasmid DNA manufacturing market size was calculated at USD 588.6 million in 2024 and is predicted to attain around USD 3,115.75 million by 2034, expanding at a CAGR of 18.13% from 2025 to 2034.

• The global DNA diagnostics market size was estimated at USD 27.10 billion in 2024 and is projected to be worth around USD 57.96 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034.

• The global plasmid DNA manufacturing market size surpassed USD 2,180 million in 2024 and is predicted to reach around USD 11,330 million by 2034, registering a CAGR of 17.91% from 2025 to 2034.

• The global recombinant DNA technology market size is calculated at USD 856.83 billion in 2024 and is predicted to attain around USD 1,638.85 billion by 2034, expanding at a CAGR of 6.7% from 2025 to 2034.

• The global viral vector And plasmid DNA manufacturing Market size was estimated at USD 7.19 billion in 2024 and is projected to hit around USD 46.02 billion by 2034, growing at a CAGR of 20.4% during the forecast period from 2025 to 2034.

• The U.S. DNA sequencing market size is calculated at USD 4,600 million in 2024 and is predicted to attain around USD 18,940 million by 2034, expanding at a CAGR of 15.2% from 2024 to 2034.

• The U.S. viral vector and plasmid DNA manufacturing market size accounted for USD 2,480 million in 2024 and is expected to exceed around USD 10,660 million by 2034, growing at a CAGR of 15.7% from 2025 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/8144

Top Companies in the DNA Synthesis Market:

• LGC Biosearch Technologie

• Bioneer Corporation

• Thermo Fisher Scientific, Inc.

• IBA GmbH

• Twist Bioscience

• Eton Bioscience

• Quintara Biosciences

• Eurofins Scientific

• Integrated DNA Technologies, Inc

• GenScript Biotech Corporation

Recent Developments

• In May 2025, integrated DNA Technologies and Elegen collaborated to transform the long DNA synthesis market. The partnership strengthens IDT's robust synthetic biology portfolio, comprised of gene and gene fragments, including Rapid Genes. Source: Business Wire

• In May 2025, Twist Bioscience introduced Atlas to bring DNA storage to market. Atlas Data Storage has closed a $155 million seed financing round and licensed DNA storage assets from Twist, utilising them to develop end-to-end DNA storage. Source: Blocks and Files

Segments Covered in the Report

By Service

• Oligonucleotide Synthesis

• Custom Oligonucleotide Synthesis

• Pre-designed Oligonucleotide Synthesis

• Gene Synthesis

By Application

• Research and Development

• Therapeutics

• Diagnostic

By End-User

• Biopharmaceutical Companies

• Academic and Research Institutes

• Contract Research Organizations

By Region

• North America

o U.S.

o Canada

• Asia Pacific

o China

o Japan

o India

o South Korea

o Thailand

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Sweden

o Denmark

o Norway

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa (MEA)

o South Africa

o UAE

o Saudi Arabia

o Kuwait

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/8144

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a global market intelligence and consulting leader, committed to delivering deep strategic insights that fuel innovation and transformation. With a sharp focus on the fast-evolving landscape of life sciences, we excel at navigating the intricacies of cell and gene therapies, oncology, and drug development. We empower our clients, ranging from biotech pioneers to institutional investors with the intelligence needed to lead in high-impact areas like regenerative medicine, cancer therapeutics, and precision health. Our broad expertise across the pharma-biotech value chain is backed by robust, statistically driven data for every market we cover, ensuring decisions are informed, forward-looking, and built for impact.

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Connect with Us

Ballindamm 22, 20095 Hamburg, Germany

Europe: +44 7383092044

Web: https://www.statifacts.com/

For Latest Update Follow Us: https://www.linkedin.com/company/statifacts

Our Trusted Data Partners: