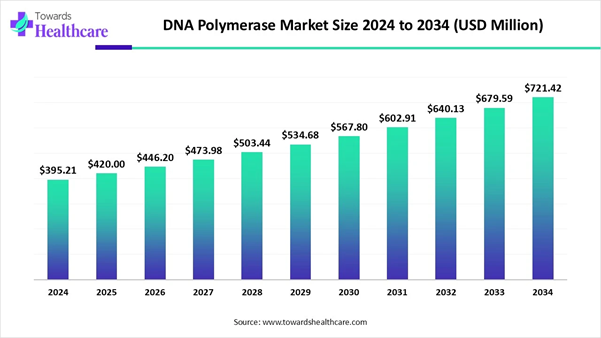

The global DNA polymerase market size is valued at USD 395.21 million in 2024 and is expected to reach USD 420 million in 2025. It is projected to grow significantly, reaching approximately USD 721.42 million by 2034, expanding at a compound annual growth rate (CAGR) of 6.24% from 2025 to 2034.

Explore a preview of critical market insights - download the DNA Polymerase Market sample report: https://www.towardshealthcare.com/download-sample/5836

Widely impacting factors are the escalating prevalence of genetic disorders, such as cystic fibrosis and Huntington's disease, growing PCR utilization, and major advancements in sequencing technologies, including next-generation sequencing, which are driving the DNA polymerase market. Along with this, raised interest in precision medicine, with a well-developed healthcare infrastructure, and other technological breakthroughs in PCR diagnostics are influencing the overall market expansion.

DNA Polymerase Market: Highlights

➢ The DNA polymerase market will likely exceed USD 395.21 million by 2024.

➢ Valuation is projected to hit USD 721.42 million by 2034.

➢ Estimated to grow at a CAGR of 6.24% from 2025 to 2034.

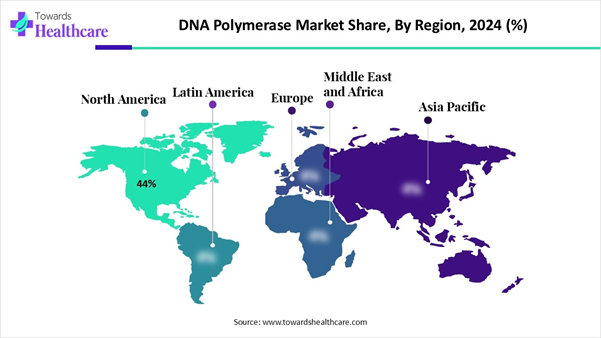

➢ North America led the global DNA polymerase market share by 44% in 2024.

➢ Asia Pacific is expected to grow at the fastest CAGR in the coming years.

➢ By type, the Taq DNA polymerase segment dominated the market in 2024.

➢ By type, the high-fidelity DNA polymerase segment is expected to register rapid growth during 2025-2034.

➢ By application type, the PCR (polymerase chain reaction) segment held the largest revenue share of the market in 2024.

➢ By application type, the DNA sequencing segment is expected to grow rapidly over the projected period.

➢ By end user, the academic & research institutes segment was dominant in the global DNA polymerase market in 2024.

➢ By end user, the pharmaceutical & biotechnology companies segment is expected to be the fastest growing in the studied years.

➢ By format, the master mixes (ready-to-use kits) segment dominated the market in 2024.

➢ By format, the lyophilized/stable formulations segment is expected to show the fastest expansion in 2025-2034.

Market Overview: Insights & Potential in 2025

An enzyme that is widely employed in DNA replication and repair in living organisms is known as DNA polymerase. In 2025, ongoing research activities will include enhanced focus on developing these enzymes for improved performance in biotechnology uses, such as DNA sequencing and PCR, especially with thermostable polymerases. As well as the application of time-lapse X-ray crystallography, offering new data on the structural mechanisms of DNA polymerases, like the binding of a third metal ion, translocation mechanisms, and fidelity checkpoints. The market is driven by the expansion of personalized medicine and advancements in sequencing technologies.

Statistic Table

|

Metric |

Details |

|

Market Size in 2025 |

USD 420 Million |

|

Projected Market Size in 2034 |

USD 721.42 Million |

|

CAGR (2025 - 2034) |

6.24% |

|

Leading Region |

North America Share by 44% |

|

Market Segmentation |

By Type, By Application, By End User, By Format, By Region |

|

Top Key Players |

Thermo Fisher Scientific Inc., New England Biolabs (NEB), QIAGEN N.V., F. Hoffmann-La Roche Ltd., Takara Bio Inc., Agilent Technologies, Inc., Promega Corporation, Merck KGaA (Sigma-Aldrich), Bioneer Corporation, Bio-Rad Laboratories, Inc., Lucigen Corporation (now part of LGC Biosearch Technologies), Enzymatics (acquired by QIAGEN), Zymo Research Corporation, Jena Bioscience GmbH, GenoVision Inc., Toyobo Co., Ltd., Vazyme Biotech Co., Ltd., ABclonal Technology, GenScript Biotech Corporation, Norgen Biotek Corp. |

You can place an order or ask any

questions, please feel free to contact us at sales@towardshealthcare.com Widespread Adoption in Biotechnology and

Forensic Science: Market’s Major Potential The global DNA polymerase market is

experiencing different applications in various domains, particularly in

biotechnology areas in which DNA

polymerases are crucial in gene editing, synthetic biology, and the

development of bioengineered products. Besides this, in case of

point-of-care testing will support the market growth. The significant property

of DNA, being specific to each individual, makes DNA polymerase a vital tool in

forensic science for producing large samples from small ones, accelerating

analysis. Major Breakthroughs in DNA Polymerase

Market: Company/Organizations Recent Updates QIAGEN (June 2025) Partnered with Tracer Biotechnologies to expand blood-based mRD

testing for solid tumors QIAGEN (April 2025) Expanded its digital PCR portfolio with new lentivirus solutions

to strengthen cell and gene therapy quality control Bio-Rad Laboratories, Inc. (October 2024) Launched high-precision Vericheck ddPCR empty-full capsid kit to

advance the development of safe and effective gene therapies. Thermo Fisher Scientific (June 2024) Collaborated with National University Hospital and Mirxes to

accelerate access to advanced genomic testing for early cancer detection in

Singapore. New England Biolabs (November 2023) Introduced new NEBNext UltraExpress™ DNA and RNA kits for faster,

easier NGS library prep workflows.

What is the Major Challenge in DNA

Polymerase Market? Restricted Access in Developing Areas

and Changing Enzyme Performance: Major Limitation Due to poor cold chain infrastructure and

high expenditure, hurdles are arising in the distribution of DNA polymerases to

developing regions where testing is required. Sometimes, enzyme performance may

change due to its purity, stability, and specificity, potentially influencing

the reliability of assays and research results. Gain instant access to detailed data

sets and segmented figures with the DNA Polymerase Market databook: https://www.towardshealthcare.com/download-databook/5836 Regional Analysis DNA Polymerase Market in North America: In 2024, North America held a major revenue

share by 44% of the market, with its robust healthcare infrastructure, strong

research funding, and the increasing adoption of techniques such as PCR and

NGS. Also, this region emphasizes the development and commercialization of

generic biologics, allied with the arrival of patents on a few drugs, which are

creating new opportunities for this market. Other impacting factors are advancements

in genomic research, personalized medicine, and the rising cases of

chronic diseases are fueling the market expansion. Whereas, the U.S. in North America is

experiencing crucial expansion in the DNA polymerase market. Due to this

region’s government is supporting for initiatives and funding for precision

medicine, CRISPR-based innovations, and research in biotechnology is driving

the development of novel approaches. For instance, • In March 2025,

Integrated DNA Technologies (IDT), a global leader in genomic solutions, and

Elegen, the leader in next-generation DNA manufacturing, partnered to provide

IDT customers early access to Elegen’s ENFINIA™ Plasmid DNA, a long and

high-complexity clonal gene synthesis service. On the other hand, Canada’s market is

propelled by accelerating

uses in molecular diagnostics, genomics research, and personalized

medicine. As well as advanced healthcare infrastructure, government

initiatives, and technological advancements are also encouraging the DNA

polymerase market growth. The Asia Pacific is predicted to Grow At

the fastest CAGR in the Studied Years During 2025-2034, the Asia Pacific will

register a rapid expansion, due to its surge in the number of biotechnology

industries and academic institutions actively involved in DNA polymerase

research and development. As this region is experiencing a rise in instances of

genetic conditions is fueling the growth in awareness, coupled with increased

demand for demand for DNA polymerase in diagnostic and research

applications. In Asia, India has a major

pool of biopharmaceutical companies, which are boosting the need for

DNA polymerase in the development

of novel biologics by using advanced technologies, like PCR. Along with

this, the Indian government is increasingly investing in healthcare

infrastructure and research, especially in genomics, vaccines, and customized

treatments are propelling the market expansion. For instance, • In July 2025,

Bio-Rad Laboratories, Inc., a global company in life science research and

clinical diagnostics products, launched four new Droplet Digital™ PCR (ddPCR™)

platforms. However, China is also experiencing immense

growth in the DNA polymerase market, with enhanced leverage on technological

advancements, with a raised focus on genomic research activities. As well as

China's universal healthcare model and widespread focus on disease surveillance

and diagnostics are incorporating to the fastest growth rate in the

Asia-Pacific PCR devices circumstances. Get the latest insights on life science

industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership The DNA

Polymerase Market: Segmentation Analysis By type analysis The Taq DNA polymerase segment held a

dominating revenue share of the market in 2024. As this type of DNA polymerase

is necessary for PCR, which is applied to expand specific DNA sequences for

different uses, such as research, diagnostics, and forensics. Moreover, as

compared to other DNA polymerases, Taq polymerase is a more inexpensive choice

for many uses, making it a popular option for researchers and laboratories. Whereas, the high-fidelity DNA polymerase

segment is estimated to grow rapidly, due to its numerous advantages in

accurate DNA replication for PCR-based diagnostics for infectious diseases and

genetic testing. Widely involved in next-generation sequencing (NGS) and

other advanced sequencing methods dependent on high-fidelity DNA polymerases

for accurate DNA amplification and analysis is driving the segment growth. By application type analysis In 2024, the PCR (polymerase chain

reaction) segment dominated the DNA polymerase market. Around the world, PCR

has a vital role in clinical diagnostics, including pathogen detection, genetic

testing, and cancer diagnosis, coupled with increased demand for DNA

polymerases. Although in the case of the detection of genetic alterations

that may impact drug response, it allows the progress

of targeted therapies customized to each patient. Furthermore, the DNA sequencing segment is

anticipated to register the fastest growth during 2025-2034. Escalating

applications of this segment in many research areas, such as genomics, molecular

biology, and biotechnology, are driving the overall market growth. Inclusion of

government-funded projects aimed at sequencing large populations, like the

Genome Japan Project, is fueling the segment's development. By end user analysis The academic & research institutes

segment led in the global DNA polymerase market in 2024. The segment is driven

by accelerated alliances among research institutions and companies, as well as

publicly funded research programs, which are further assisting the demand for DNA

polymerases. As well as growing demand for DNA sequencing, gene

therapy, and the expanding role of PCR in different research

applications. And, the pharmaceutical & biotechnology

companies segment will show the fastest expansion, due to the rising global

burden of genetic disorders and infectious diseases are impelling demand for

novel and tailored treatment with escalated adoption of DNA polymerase in these

developments. Also, these companies are the main consumers of DNA for drug

discovery, development, and production processes. By format analysis In 2024, the master mixes (ready-to-use

kits) segment held the biggest share of the global DNA polymerase market.

Incorporation of many benefits of this segment, like convenience, decreased

setup time, and reduced contamination risks. These pre-mixed solutions,

containing DNA polymerase, dNTPs, MgCl2, and buffer, which help in PCR and qPCR

workflows, making them popular among researchers and diagnostic labs. However, the lyophilized/stable

formulations segment is predicted to grow fastest in the predicted timeframe.

Mainly, the segment is experiencing escalating demand for reliable and

long-lasting enzymes, especially in molecular diagnostics and

research. Other growth factors are the broad need for increased

stability in PCR and other DNA-based assays, mainly in restraining

environments, as well as the convenience and easily accessible nature offered

by lyophilized products. Elevate your

healthcare strategy with Towards Healthcare. Enhance efficiency and drive

better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting DNA Polymerase Market Companies: • Thermo Fisher Scientific Inc. • New England Biolabs (NEB) • QIAGEN N.V. • F. Hoffmann-La Roche Ltd. • Takara Bio Inc. • Agilent Technologies, Inc. • Promega Corporation • Merck KGaA (Sigma-Aldrich) • Bioneer Corporation • Bio-Rad Laboratories, Inc. • Lucigen Corporation (now part of LGC

Biosearch Technologies) • Enzymatics (acquired by QIAGEN) • Zymo Research Corporation • Jena Bioscience GmbH • GenoVision Inc. • Toyobo Co., Ltd. • Vazyme Biotech Co., Ltd. • ABclonal Technology • GenScript Biotech Corporation • Norgen Biotek Corp. What is Going Around the Globe? ➢ In July 2025, the United Mitochondrial Disease Foundation's

(UMDF) venture philanthropy arm, The Mito Fund, invested in Pretzel

Therapeutics, a Massachusetts-based company with research facilities in

Mölndal, Sweden, on novel treatments for POLG and mtDNA depletion-related

mitochondrial diseases. ➢ In June 2025, DeepMind unveiled Alphagenome to estimate how DNA

variants affect gene regulation. ➢ In May 2025, Biotium expanded its Cheetah™ Taq Portfolio with new

formulations for rapid cycling PCR and proximity extension assays. DNA Polymerase Market Segmentation By Type • Taq DNA Polymerase • Thermostable,

widely used in standard PCR • High-Fidelity DNA Polymerase • Engineered for

proofreading and accurate DNA amplification • Reverse Transcriptase (for cDNA

synthesis) • Hot-Start DNA Polymerase • Long-Range DNA Polymerase • Specialized/Modified Polymerases (e.g.,

GC-rich templates, uracil-tolerant) By Application • PCR (Polymerase Chain Reaction) • Routine

amplification, diagnostics, and pathogen detection • Cloning & Mutagenesis • DNA Sequencing • NGS Library Preparation • qPCR & RT-PCR • Isothermal Amplification (e.g., LAMP,

RPA) • Molecular Diagnostics • Forensic Analysis By End User • Academic & Research Institutes • Pharmaceutical & Biotechnology

Companies • Clinical & Diagnostic Laboratories • Contract Research Organizations (CROs) • Forensic Labs • Agricultural Genomics Centers By Format • Standalone Enzymes • Master Mixes (Ready-to-use kits) • Lyophilized/Stable Formulations By Region • North America • U.S. • Canada • Asia Pacific • China • Japan • India • South Korea • Thailand • Europe • Germany • UK • France • Italy • Spain • Sweden • Denmark • Norway • Latin America • Brazil • Mexico • Argentina • Middle East and Africa (MEA) • South Africa • UAE • Saudi Arabia • Kuwait Get the complete strategic outlook and

market forecast, download the full DNA Polymerase Market report now: https://www.towardshealthcare.com/price/5836 You can place an order or ask any

questions, please feel free to contact us at sales@towardshealthcare.com Gain access to the

latest insights and statistics in the healthcare industry by subscribing to our

Annual Membership. Stay updated on healthcare industry segmentation with

detailed reports, market trends, and expert analysis tailored to your needs.

Stay ahead of the curve with valuable resources and strategic recommendations.

Join today to unlock a wealth of knowledge and opportunities in the dynamic

world of healthcare: Get a Subscription About Us Towards Healthcare is a leading global provider of technological solutions, clinical

research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we

build strategic partnerships that generate actionable insights and

transformative breakthroughs. As a global strategy consulting firm, we empower

life science leaders to gain a competitive edge, drive research excellence, and

accelerate sustainable growth. Precedence Research | Statifacts | Towards Packaging | Towards

Automotive | Towards Food and

Beverages | Towards

Chemical and Materials | Towards Consumer

Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire Find us on social platforms: LinkedIn | Twitter | Instagram Browse More Insights of Global Market Insights: DNA and Biotechnology Sector (2024–2034) Mitochondrial DNA Market The global mitochondrial

DNA market is valued at USD 348.85 million in 2024, expected to reach

USD 373.4 million in 2025, and is projected to grow to approximately USD 687.99

million by 2034, expanding at a CAGR of 7.04% from 2025 to 2034. GMP Plasmid DNA Manufacturing Market The global GMP

plasmid DNA manufacturing market is estimated at USD 250 million in

2024, expected to rise to USD 273.35 million in 2025, and further reach USD

608.57 million by 2034, registering a CAGR of 9.34% during the forecast period. DNA Read, Write, and Edit Market The global DNA

read, write, and edit market is valued at USD 7.35 billion in 2024,

forecast to grow to USD 8.35 billion in 2025, and projected to reach USD 26.46

billion by 2034, growing at a strong CAGR of 13.63% between 2025 and 2034. DNA Vaccine Market The global DNA

vaccine market stands at USD 553.89 million in 2024, projected to grow

to USD 590 million in 2025, and reach around USD 1,041.68 million by 2034,

expanding at a CAGR of 6.52% from 2025 to 2034. APAC Viral Vector & Plasmid DNA

Manufacturing Market The APAC

viral vector and plasmid DNA manufacturing market is valued at USD 1.38

billion in 2024, projected to reach USD 1.68 billion in 2025, and surge to USD

10.01 billion by 2034, expanding at a rapid CAGR of 21.93% from 2025 to 2034. DNA Diagnostics Market The global DNA

diagnostics market was estimated at USD 10.69 billion in 2023, and is

projected to grow steadily to USD 17.44 billion by 2034, registering a CAGR of

4.55% from 2024 through 2034. Plasmid DNA Manufacturing Market The global plasmid

DNA manufacturing market was valued at USD 1.85 billion in 2023, and is

projected to reach USD 12.27 billion by 2034, exhibiting a robust CAGR of

18.77% during the forecast timeline. Viral Vector & Plasmid DNA Manufacturing

Market The global viral

vector and plasmid DNA manufacturing market was valued at USD 6.01

billion in 2023, and is projected to grow significantly to USD 43.04 billion by

2034, rising at a CAGR of 20.7% from 2024 onwards. Nanoparticle Synthesis System Market The global nanoparticle

synthesis system market is valued at USD 0.7 billion in 2024, expected

to grow to USD 0.78 billion in 2025, and projected to reach USD 2.05 billion by

2034, expanding at a CAGR of 11.34% from 2025 to 2034. Animal Biotechnology Market The global animal

biotechnology market is calculated at USD 28.17 billion in 2024,

expected to grow to USD 30.97 billion in 2025, and is projected to reach USD

72.6 billion by 2034, advancing at a CAGR of 9.93% between 2025 and 2034.