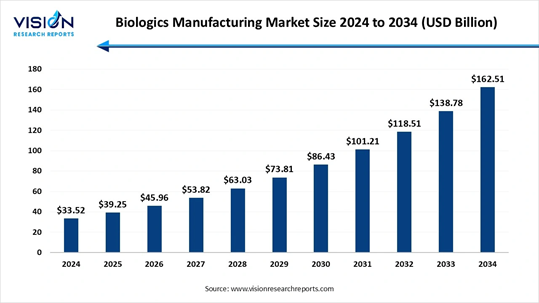

The global biologics manufacturing market size estimated at USD 33.52 billion in 2024 and is predicted to increase from USD 39.25 billion in 2025 to reach nearly USD 162.51 billion by 2034, expanding at a robust CAGR of 17.1% from 2025 to 2034, Study Published by Vision Research Reports.

The global biologics manufacturing market demonstrates exceptionally strong long-term expansion, growing more than fourfold (4.14×) from 2025 to 2034. This acceleration is fueled by rising chronic disease prevalence, rapid breakthroughs in monoclonal antibodies, expansion of cell and gene therapy pipelines, growing adoption of RNA-based therapeutics, and increasing investment in advanced bioprocessing technologies.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Preview the Report Before You Buy – Get Sample Pages 👉 https://www.visionresearchreports.com/report/sample/41782

What is Biologics Manufacturing?

Biologic manufacturing can be defined as the process of producing medicine with the help of living organisms. Biotech and pharmaceutical companies all over the world make use of this approach in order to produce biologics like mAbs (monoclonal antibodies) or mRNA vaccines, at both, small and large scale. Central practices in biomanufacturing consist of various stages of production, from upstream processes involving cell culturing and harvesting to downstream processes that focus on purification and formulation.

This market’s growth is primarily driven by increasing demand for biopharmaceuticals, expansion of biological production capacities and various advancements being made in cell and gene therapy manufacturing technologies.

Biologics Manufacturing Market Key Highlights:

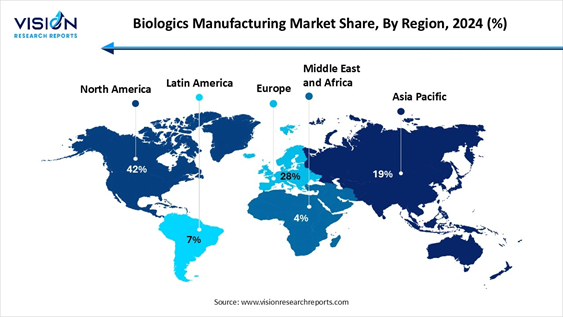

• By region, North America held the largest market share of 42% in 2024.

• By region, Asia-Pacific is estimated to expand the fastest during the forecast period.

• By modality, the monoclonal antibodies segment captured by the maximum market share in 2024.

• By modality, the cell and gene therapies segment is expected to grow at the fastest rate during the forecast period.

• By disease type, the oncology segment registered the maximum market share in 2024.

• By disease type, the infectious diseases segment is predicted to grow at a remarkable CAGR from 2025 to 2034.

• By source, the mammalian segment generated the maximum market share in 2024.

• By source, the microbial segment is expected to grow at the fastest CAGR during the forecast period.

• By manufacturing, in-house segment contributed the largest market share in 2024.

• By manufacturing, the outsourcing expected to grow at the notable CAGR from 2025 to 2034.

What are the Growth Factors in the Biologics Manufacturing Market?

The biologics market has maintained strong growth momentum throughout these years and shows promising potential in the near future as well. This is due to the fact that biopharmaceutical innovation and targeted therapies continue to reshape the treatment landscape across domains like oncology, immunology and rare diseases. The rising prevalence of chronic conditions globally, favorable reimbursement policies and accelerated regulatory pathways have further reinforced widespread adoption.

Biologics, including monoclonal antibodies, recombinant proteins and cell-based therapies, have showed superior efficacy and specificity, thus driving demand among clinicians and patients who are seeking improved outcomes than compared to other conventional small-molecule drugs. Manufacturing capabilities have also expanded with the help of investments in single-use bioprocessing, modular facilities, and advanced analytics. This in turn ensures scalable and GMP-compliant production. Strategic collaborations between biotech innovators are also gaining traction, and established pharmaceutical companies continue to support robust pipelines and global commercialization.

What are the Key Trends in the Biologics Manufacturing Market?

• Technological advancements continue to play a vital role in the evolution of the biologics contract manufacturing market. Continuous processing, single-use bioreactors and other innovative technologies lead to improved efficiency, enhanced product quality and faster time-to-market for biologics.

• Strategic partnerships between pharmaceutical companies and CMOs are on the rise, becoming a crucial factor to help navigate the complex and evolving regulatory landscape, ensure compliance with global regulations and facilitate efficient product approvals.

• Contract manufacturing organizations (CMOs) are actively responding to the rising need for biologics by investing in advanced technologies and streamlined processes. This helps them to offer faster development timelines and efficient production capabilities.

• The market is seen continuously adopting advanced technologies like single-use bioreactors, continuous manufacturing processes and artificial intelligence to optimize production processes and ensure product quality.

Discover the Full Market Insights 👉

https://www.visionresearchreports.com/biologics-manufacturing-market/41782

Biologics Manufacturing Market Dynamics

What are the Major Challenges in the Biologics Manufacturing Market?

Despite various growth prospects, the market does have its fair share of challenges that could potentially hinder its growth and development. Biosimilars, while similar in function, are quite different, and their entry into the market poses a threat to biologic’s market share and profitability. Biosimilars enter the market at lower prices, which then creates pricing pressures that force original biologic manufacturers to reconsider their pricing strategies.

This intensified competition can result in a shift in consumer preferences and market dynamics. Biologic manufacturers are forced to strategically adapt or modify their approaches, potentially exploring innovations and new formulations or emphasizing superior efficacy and safety. This can drive up competition and slow down market expansion.

What are the Key Opportunities in the Biologics Manufacturing Market?

The biologics manufacturing market is opening up new avenues of opportunities due to a high level of innovation in the manufacturing process, improvements in bioprocessing technologies, single-use systems, automation and digital controls. These advancements allow for increased productivity, scalability and better product quality. The market range is also seen to be growing, ranging from customized cell and gene therapies all the way to next-generation monoclonal antibodies, which is due to increasing experiments in formulation and delivery techniques. This innovative dynamic in the market helps to shorten development timelines and also strengthens competitive differentiation.

One more such opportunity is the rise of biosimilar development. With patents continuing to expire on several high-value biologic drugs, there is now a growing opportunity for the development of biosimilars, and bio-CMOs seem to be well-positioned to utilize their expertise. The market is also increasingly focusing on the aspect of specialization, catering to specific areas of biologics manufacturing such as monoclonal antibodies, gene therapies or viral vectors. This specialization enables helps to provide a higher level of expertise which is tailored to the unique needs of different therapeutic categories.

Biologics Manufacturing Market Report Coverage

|

Report Attribute |

Key Statistics |

|

Market Size in 2025 |

USD 39.25 Billion |

|

Market Size in 2026 |

USD 45.96 Billion |

|

Market Size in 2030 |

USD 86.43 Billion |

|

Market Size in 2032 |

USD 118.51 Billion |

|

Market Size by 2034 |

USD 162.51 Billion |

|

Growth rate from 2025 to 2034 |

CAGR of 17.1% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

By Modality, By Disease, By Source, By Manufacturing |

|

Companies Covered |

Samsung Biologics, Amgen Inc., Novo Nordisk A/S, AbbVie Inc., Sanofi, Johnson & Johnson Services Inc., Celltrion Healthcare Co. Ltd., Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Boehringer Ingelheim International GmbH, and Lonza. |

For

orders or inquiries, don’t hesitate to reach out: sales@visionresearchreports.com Biologics

Manufacturing Market Regional Analysis Why is

North America Dominating the Market in 2024? North America

is the undisputed leader in the biologics market, thanks to its

well-established biotech ecosystem, robust regulatory framework, and

significant R&D funding. The United States alone accounts for over 40% of

the global biologics consumption. Companies like Amgen, Pfizer, and Genentech

are headquartered here and drive innovation across every therapeutic category.

The FDA’s expedited approval programs like Fast Track and Breakthrough Therapy

designation also facilitate rapid commercialization of biologics, especially in

oncology and rare diseases. Additionally, high adoption of biosimilars and

favorable reimbursement policies contribute to the region’s leadership. What are

the Advancements in Asia Pacific? Asia-Pacific

is the fastest-growing biologics market, fueled by rising healthcare

expenditure, improving infrastructure, and strategic government support.

Countries like China, India, South Korea, and Japan are investing heavily in

biotechnology R&D and manufacturing capacity. China’s “Made in China 2025”

policy includes biologics as a strategic industry, while India’s Biopharma

Mission aims to create an end-to-end ecosystem for biopharmaceutical

innovation. Local companies like WuXi Biologics and Dr. Reddy’s are gaining

international recognition, and Western firms are partnering with APAC

manufacturers to tap into cost advantages and rapid scalability. Need a

Tailored Version of the Report? | Get Customization Options Here: https://www.visionresearchreports.com/report/customization/41782 Biologics

Manufacturing Market Segmental Analysis Modality Analysis Which Modality

Segment Dominated the Market in 2024? The

monoclonal antibodies segment dominated the market in 2024. Thid dominance is

because they are widely used to treat infectious diseases, autoimmune disorders and cancer.

Strong clinical success rates, high specificity, and fewer side effects than

compared to traditional therapies have fueled their widespread adoption. The

increasing trend toward biosimilar mAbs and technological developments in

bioprocessing further reinforces the segment's position. The cell and

gene therapies segment is expected to grow at the fastest rate during the

forecast period. This growth is driven by the increasing number of FDA and EMA

approvals, expanding clinical pipelines and strong investment inflows from

biopharma companies and venture capital firms worldwide. This segment's growth

is also attributed to the growing emphasis on personalized medicine and the expanding partnerships

between CDMOs and biopharmaceutical companies. Disease

Category Analysis Which Disease

Category Led the Market as of this Year? The Oncology

segment led the market as of this year. This dominance is due to the high

incidence of cancer worldwide and the ever increasingly need for targeted

therapies. Advanced MABs have now become standard therapeutic tools in cancer

treatment. Biologics are also critical in immuno-oncology, where they modulate

immune response against tumor cells. With ongoing clinical trials in areas like

CAR-T cell therapy and bispecific antibodies, oncology remains the most dominant

and innovation-heavy segment. The

Infectious diseases segment is seen to be the fastest-growing segment

throughout the forecast period. This segment’s growth was further propelled by

the Covid-19 pandemic and has led to continued focus on vaccine and antivirals. The success of

biologic vaccines like mRNA-based COVID-19 vaccines has prompted a surge in

development activity for other viral threats like RSV and influenza. Source Analysis Which Source

Segment Dominated the Market as of this Year? The mammalian

cells dominated the market as of this year in 2024. The advantage of this

segment is their ability to produce complex, human-like proteins with

appropriate glycosylation. These cells are also suitable for large-scale

commercial production and have a proven track record of regulatory approval. As

companies continue to innovate in microbial production to improve yield and

reduce costs, the demand for biologics will rise, solidifying this segment’s

role. The microbial

systems are expected to be the fastest-growing segment, particularly when it

comes to vaccines and recombinant proteins. These systems offer high-yield and

cost-effective production along with simplified culture requirements. These

platforms are also increasingly used for producing biosimilars and

non-glycosylated proteins. Innovations in strain engineering and fermentation

optimization are making microbial expression systems have enabled for more

versatile and scalable options. Manufacturing

Analysis Which Manufacturing

Segment Held the Largest Market in 2024? The In-house

manufacturing held the largest market share in 2024. This is because this

segment enables better control and surveillance over the production process.

Controlling the production process leads to better quality assurance, IP

protection and seamless regulatory compliance. Various firms all over the world

continue to invest in expanding their in-house capacities through advanced,

cutting edge biomanufacturing campuses. The outsourced

manufacturing sector is estimated to be the fastest growing segment during the

forecast years. particularly among emerging biotech companies and during

clinical trial phases. This growth is driven by the increasing need for

companies to reduce costs, enhance operational efficiency and lessen

time-to-market. Outsourcing also provides a level of scalability, allowing

companies to respond flexibly to the growing global demand. As biologics

developers increasingly navigate the complexities, outsourcing remains a

cost-effective and efficient solution for maintaining a competitive edge in the

market. Browse

More Insights: •

Biologics Market: https://www.visionresearchreports.com/biologics-market/41586 • Retinal

Biologics Market: https://www.visionresearchreports.com/retinal-biologics-market/41297 • Spine

Biologics Market: https://www.visionresearchreports.com/spine-biologics-market/41162 • Biological

Safety Testing Products And Services Market: https://www.visionresearchreports.com/biological-safety-testing-products-and-services-market/40932 • U.S.

Biopharmaceuticals Contract Manufacturing Market: https://www.visionresearchreports.com/us-biopharmaceuticals-contract-manufacturing-market/41212 Recent

Developments in the Biologics Manufacturing Market • In

September 2025, FUJIFILM Biotechnologies, a world-leading contract development

and manufacturing organization for biologics, vaccines and advanced therapies,

announced a significant expansion of its global partnership with Argenx SE, a

global immunology company. As part of this partnership, FUJIFILM

Biotechnologies will initiate manufacturing of Argenx’s drug substance for

efgartigimod at the Holly Springs, North Carolina, site in 2028. (Source: https://secure.businesswire.com) • In May

2025, Recipharm, a leading global contract development and manufacturing

organization (CDMO), and ProductLife Group (PLG), a global provider product

development and regulatory affairs services, announced a strategic

collaboration which is aimed at supporting bio-pharmaceutical companies in

accelerating time to clinical trials and market approval while reducing supply

chain, compliance and regulatory challenges during product development.

(Source: https://www.pharmabiz.com) Top Key

Players in the Biologics Manufacturing Market • Samsung

Biologics • Amgen Inc. • Novo

Nordisk A/S • AbbVie

Inc. • Sanofi • Johnson

& Johnson Services, Inc. • Celltrion

Healthcare Co., Ltd. • Bristol-Myers

Squibb Company • Eli Lilly

and Company • F.

Hoffmann La-Roche Ltd. Segments

Covered in the Report By

Modality • Monoclonal

Antibodies (mAbs) • Biosimilar

& Recombinant Proteins • Vaccines

(recombinant/mRNA/Viral) • Cell &

Gene Therapies • RNA-based

Therapeutics • Others By Disease

• Oncology • Infectious

Diseases • Immunological

Disorders • Cardiovascular

Disorders • Hematological

Disorders • Others By Source • Microbial • Mammalian • Others By

Manufacturing • Outsourced • In-house By Region • North

America • Europe • Asia-Pacific • Latin

America • Middle

East and Africa Instant

Delivery Available | Purchase This Exclusive Research Report Now: https://www.visionresearchreports.com/report/checkout/41782 You can place an order or ask any

questions, please feel free to contact at: sales@visionresearchreports.com About

Us Vision

Research Reports is a premier service provider offering strategic market

insights and solutions that go beyond traditional surveys. We specialize in

actionable market research, delivering in-depth qualitative insights and

strategies to global industry leaders and executives, helping them navigate

future uncertainties. Our offerings include consulting services, syndicated

market studies, and bespoke research reports. We

are committed to excellence in qualitative market research, fostering a team of

experts with deep industry knowledge. Our goal is to help clients understand

both current and future market trends, empowering them to expand their

portfolios and achieve their business objectives with the right guidance. Web: https://www.visionresearchreports.com Our

Trusted Data Partners Precedence Research | Statifacts | Nova One Advisor For

Latest Update Follow Us: LinkedIn