Overactive Bladder Market Outlook 2024-2034:

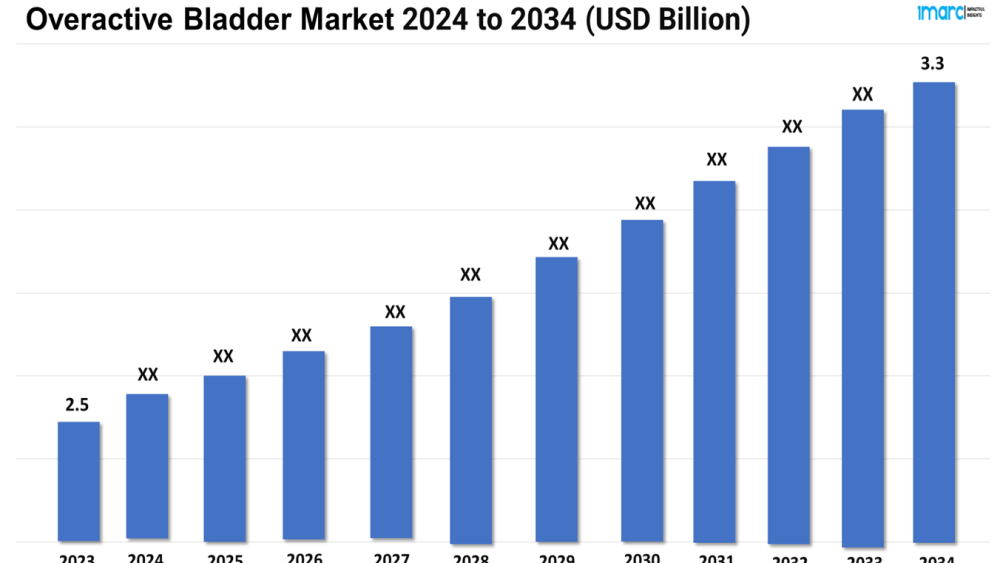

The overactive bladder market size reached a value of USD 2.5 Billion in 2023. Looking forward, the market is expected to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.42% during 2024-2034.

The market is driven by a surge in demand for advanced treatments, including new pharmacological therapies and neuromodulation techniques. There's increasing adoption of minimally invasive procedures and digital health tools for better symptom management. Rising patient awareness and a focus on personalized care further drive market growth.

Innovative Treatments: Driving the Overactive Bladder Market

Innovative treatments are revolutionizing the overactive bladder (OAB) market, addressing unmet needs, and offering new hope for patients. Recent advancements in pharmacological therapies are at the forefront of this transformation. Newer antimuscarinic agents, such as darifenacin and solifenacin, provide enhanced efficacy and tolerability compared to older drugs. Additionally, beta-3 adrenergic agonists like mirabegron offer a novel mechanism of action, improving bladder capacity and reducing symptoms with a different side effect profile. Neuromodulation techniques represent another significant breakthrough in OAB treatment. Sacral nerve stimulation (SNS) and percutaneous tibial nerve stimulation (PTNS) have emerged as effective options for patients who do not respond to conventional medications. SNS involves implanting a small device to stimulate the sacral nerve, influencing bladder control and significantly reducing symptoms. PTNS is a less invasive option, involving periodic electrical stimulation of the tibial nerve to achieve similar therapeutic benefits.

Request a PDF Sample Report: https://www.imarcgroup.com/overactive-bladder-market/requestsample

Botulinum toxin injections, specifically Botox, are also making waves in the market. Administered directly into the bladder wall, Botox temporarily paralyzes the overactive muscles, leading to substantial symptom relief and extended intervals between treatments. This approach has shown effectiveness in patients with refractory OAB, providing a viable alternative to surgery. The market is also seeing the integration of digital health solutions, which complement these innovative treatments. Mobile apps and wearable devices are helping patients track symptoms, medication adherence, and treatment outcomes, enhancing the overall management of OAB. These advancements collectively contribute to a more personalized and effective approach to managing overactive bladder, improving patient quality of life and expanding treatment options beyond traditional therapies. As research continues, further innovations are expected to enhance the effectiveness and accessibility of OAB treatments.

Digital Health Solutions: Contributing to Market Expansion

Digital health solutions are transforming the overactive bladder market by providing innovative tools to enhance patient management and care. These solutions leverage technology to improve symptom tracking, treatment adherence, and overall patient engagement. One significant advancement is the development of mobile apps designed specifically for OAB management. These apps allow patients to record their symptoms, monitor fluid intake, and track the effectiveness of their treatments. By offering real-time data and insights, these apps empower patients to make informed decisions about their health and adjust their management strategies accordingly. Wearable devices are another key component of digital health solutions in the OAB market. These devices, often equipped with sensors, can monitor bladder activity and urinary patterns, providing valuable data that can be shared with healthcare providers. This continuous monitoring helps in tailoring treatments to individual needs and improving the precision of diagnosis and management.

Telemedicine platforms are also playing a crucial role in the digital transformation of OAB care. These platforms enable remote consultations and follow-ups, reducing the need for frequent in-person visits and increasing accessibility for patients who may have mobility issues or live in remote areas. Through virtual consultations, patients can discuss their symptoms, adjust their treatment plans, and receive support from healthcare professionals without the constraints of traditional clinic visits. Moreover, digital health solutions often integrate with electronic health records (EHRs), facilitating seamless communication between patients and providers. This integration ensures that all relevant data is available for informed decision-making and enhances the coordination of care. Overall, digital health solutions are driving significant improvements in the management of overactive bladder, offering patients greater convenience, personalization, and support. As technology continues to advance, these solutions are expected to further enhance the quality of OAB care and patient outcomes.

Minimally Invasive Procedures:

Minimally invasive procedures are increasingly shaping the overactive bladder market by offering effective treatment options with reduced risks and recovery times compared to traditional surgical methods. These procedures are designed to address the symptoms of OAB—such as frequent urination, urgency, and incontinence—while minimizing patient discomfort and operational complexity. One prominent minimally invasive approach is sacral nerve stimulation (SNS). This technique involves implanting a small device that delivers electrical impulses to the sacral nerves, which are crucial in bladder control. By modulating nerve activity, SNS helps regulate bladder contractions and alleviate OAB symptoms. It is particularly beneficial for patients who have not responded well to medication, offering a significant improvement in quality of life with a procedure that requires only a small incision and minimal hospital stay.

Another innovative treatment is percutaneous tibial nerve stimulation (PTNS). PTNS involves inserting a thin needle near the tibial nerve in the ankle, through which electrical impulses are delivered to influence bladder function. This procedure is less invasive than SNS, requires no general anesthesia, and involves only a series of outpatient treatments. PTNS is well-suited for patients seeking an alternative to more invasive interventions, providing effective symptom relief with minimal discomfort. Botulinum toxin injections, commonly known as Botox, represent another key advancement in minimally invasive treatments for OAB. Botox is injected directly into the bladder wall, where it works by paralyzing the overactive bladder muscles and reducing urinary urgency and frequency. The procedure is typically performed in a clinical setting and offers substantial symptom relief with a relatively straightforward recovery process. These minimally invasive procedures collectively enhance the OAB market by offering patients effective, less disruptive treatment options. They address the limitations of conventional methods and align with the growing demand for treatments that balance efficacy with patient comfort and convenience.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7291&method=587

Leading Companies in the Overactive Bladder Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global overactive bladder market, several notable companies are developing and adopting new and advanced treatments for OAB. This includes novel pharmacological options, such as next-generation antimuscarinics and beta-3 adrenergic agonists, as well as new neuromodulation techniques like SNS and PTNS. Urovant Sciences and Sumitomo Pharma have been investing heavily in their manufacturing capacities in recent months.

Urovant Sciences reported positive topline results from its Phase 2a, double-blind, placebo-controlled exploratory study of URO-902, an investigational, novel, locally injected gene therapy product (plasmid human cDNA encoding maxi-K channel) in patients with overactive bladder who had not responded well to oral therapies.

Apart from this, Sumitomo Pharma America received FDA approval for its supplemental New Drug Application (sNDA) for vibegron (GEMTESA), a beta-3 adrenergic receptor (β3) agonist, dosed once-daily (75 mg), for the treatment of men with overactive bladder (OAB) symptoms receiving pharmacological therapy for benign prostatic hyperplasia (BPH). If approved, vibegron will be the first and only beta-3 agonist used to treat men with OAB symptoms who are taking pharmaceutical treatment for BPH.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7291&flag=E

Regional Analysis:

The major markets for overactive bladder include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for overactive bladder while also representing the biggest market for its treatment. This can be attributed to the rising awareness of OAB among both patients and healthcare providers.

Moreover, mobile apps and wearable devices are increasingly used for monitoring symptoms, tracking treatment efficacy, and providing personalized management plans. These tools enhance patient engagement and provide healthcare providers with valuable data to tailor treatments more effectively.

Apart from this, minimally invasive treatments, such as Botox injections and various neuromodulation techniques, are becoming more popular. These procedures offer significant symptom relief with less recovery time and fewer complications compared to traditional surgical approaches. The shift towards these methods reflects a growing preference for less invasive options that align with the broader trend towards outpatient and office-based treatments.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

This report offers a comprehensive analysis of current overactive bladder marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

Neuroendocrine Carcinoma Market: The 7 major neuroendocrine carcinoma market reached a value of US$ 1.3 Billion in 2023, and projected the 7MM to reach US$ 2.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.14% during the forecast period from 2024 to 2034.

Osteoporosis Market: The 7 major osteoporosis market reached a value of US$ 10.2 Billion in 2023, and projected the 7MM to reach US$ 14.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.49% during the forecast period from 2024 to 2034.

Polycystic Kidney Disease Market: The 7 major polycystic kidney disease market reached a value of US$ 358.2 Million in 2023, and projected the 7MM to reach US$ 622.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.15% during the forecast period from 2024 to 2034.

Post-Partum Depression Market: The 7 major post-partum depression market reached a value of US$ 4.4 Billion in 2023, and projected the 7MM to reach US$ 50.2 Billion by 2034, exhibiting a growth rate (CAGR) of 24.68% during the forecast period from 2024 to 2034.

Post-Traumatic Stress Disorder Market: The 7 major post-traumatic stress disorder market reached a value of US$ 1.8 Billion in 2023, and projected the 7MM to reach US$ 3.2 Billion by 2034, exhibiting a growth rate (CAGR) of 5.18% during the forecast period from 2024 to 2034.

Rheumatoid Arthritis Market: The 7 major rheumatoid arthritis market reached a value of US$ 27.5 Billion in 2023 and projected the 7MM to reach US$ 33.8 Billion by 2034, exhibiting a growth rate (CAGR) of 1.88% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The overactive bladder market size reached a value of USD 2.5 Billion in 2023. Looking forward, the market is expected to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.42% during 2024-2034.

The market is driven by a surge in demand for advanced treatments, including new pharmacological therapies and neuromodulation techniques. There's increasing adoption of minimally invasive procedures and digital health tools for better symptom management. Rising patient awareness and a focus on personalized care further drive market growth.

Innovative Treatments: Driving the Overactive Bladder Market

Innovative treatments are revolutionizing the overactive bladder (OAB) market, addressing unmet needs, and offering new hope for patients. Recent advancements in pharmacological therapies are at the forefront of this transformation. Newer antimuscarinic agents, such as darifenacin and solifenacin, provide enhanced efficacy and tolerability compared to older drugs. Additionally, beta-3 adrenergic agonists like mirabegron offer a novel mechanism of action, improving bladder capacity and reducing symptoms with a different side effect profile. Neuromodulation techniques represent another significant breakthrough in OAB treatment. Sacral nerve stimulation (SNS) and percutaneous tibial nerve stimulation (PTNS) have emerged as effective options for patients who do not respond to conventional medications. SNS involves implanting a small device to stimulate the sacral nerve, influencing bladder control and significantly reducing symptoms. PTNS is a less invasive option, involving periodic electrical stimulation of the tibial nerve to achieve similar therapeutic benefits.

Request a PDF Sample Report: https://www.imarcgroup.com/overactive-bladder-market/requestsample

Botulinum toxin injections, specifically Botox, are also making waves in the market. Administered directly into the bladder wall, Botox temporarily paralyzes the overactive muscles, leading to substantial symptom relief and extended intervals between treatments. This approach has shown effectiveness in patients with refractory OAB, providing a viable alternative to surgery. The market is also seeing the integration of digital health solutions, which complement these innovative treatments. Mobile apps and wearable devices are helping patients track symptoms, medication adherence, and treatment outcomes, enhancing the overall management of OAB. These advancements collectively contribute to a more personalized and effective approach to managing overactive bladder, improving patient quality of life and expanding treatment options beyond traditional therapies. As research continues, further innovations are expected to enhance the effectiveness and accessibility of OAB treatments.

Digital Health Solutions: Contributing to Market Expansion

Digital health solutions are transforming the overactive bladder market by providing innovative tools to enhance patient management and care. These solutions leverage technology to improve symptom tracking, treatment adherence, and overall patient engagement. One significant advancement is the development of mobile apps designed specifically for OAB management. These apps allow patients to record their symptoms, monitor fluid intake, and track the effectiveness of their treatments. By offering real-time data and insights, these apps empower patients to make informed decisions about their health and adjust their management strategies accordingly. Wearable devices are another key component of digital health solutions in the OAB market. These devices, often equipped with sensors, can monitor bladder activity and urinary patterns, providing valuable data that can be shared with healthcare providers. This continuous monitoring helps in tailoring treatments to individual needs and improving the precision of diagnosis and management.

Telemedicine platforms are also playing a crucial role in the digital transformation of OAB care. These platforms enable remote consultations and follow-ups, reducing the need for frequent in-person visits and increasing accessibility for patients who may have mobility issues or live in remote areas. Through virtual consultations, patients can discuss their symptoms, adjust their treatment plans, and receive support from healthcare professionals without the constraints of traditional clinic visits. Moreover, digital health solutions often integrate with electronic health records (EHRs), facilitating seamless communication between patients and providers. This integration ensures that all relevant data is available for informed decision-making and enhances the coordination of care. Overall, digital health solutions are driving significant improvements in the management of overactive bladder, offering patients greater convenience, personalization, and support. As technology continues to advance, these solutions are expected to further enhance the quality of OAB care and patient outcomes.

Minimally Invasive Procedures:

Minimally invasive procedures are increasingly shaping the overactive bladder market by offering effective treatment options with reduced risks and recovery times compared to traditional surgical methods. These procedures are designed to address the symptoms of OAB—such as frequent urination, urgency, and incontinence—while minimizing patient discomfort and operational complexity. One prominent minimally invasive approach is sacral nerve stimulation (SNS). This technique involves implanting a small device that delivers electrical impulses to the sacral nerves, which are crucial in bladder control. By modulating nerve activity, SNS helps regulate bladder contractions and alleviate OAB symptoms. It is particularly beneficial for patients who have not responded well to medication, offering a significant improvement in quality of life with a procedure that requires only a small incision and minimal hospital stay.

Another innovative treatment is percutaneous tibial nerve stimulation (PTNS). PTNS involves inserting a thin needle near the tibial nerve in the ankle, through which electrical impulses are delivered to influence bladder function. This procedure is less invasive than SNS, requires no general anesthesia, and involves only a series of outpatient treatments. PTNS is well-suited for patients seeking an alternative to more invasive interventions, providing effective symptom relief with minimal discomfort. Botulinum toxin injections, commonly known as Botox, represent another key advancement in minimally invasive treatments for OAB. Botox is injected directly into the bladder wall, where it works by paralyzing the overactive bladder muscles and reducing urinary urgency and frequency. The procedure is typically performed in a clinical setting and offers substantial symptom relief with a relatively straightforward recovery process. These minimally invasive procedures collectively enhance the OAB market by offering patients effective, less disruptive treatment options. They address the limitations of conventional methods and align with the growing demand for treatments that balance efficacy with patient comfort and convenience.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7291&method=587

Leading Companies in the Overactive Bladder Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global overactive bladder market, several notable companies are developing and adopting new and advanced treatments for OAB. This includes novel pharmacological options, such as next-generation antimuscarinics and beta-3 adrenergic agonists, as well as new neuromodulation techniques like SNS and PTNS. Urovant Sciences and Sumitomo Pharma have been investing heavily in their manufacturing capacities in recent months.

Urovant Sciences reported positive topline results from its Phase 2a, double-blind, placebo-controlled exploratory study of URO-902, an investigational, novel, locally injected gene therapy product (plasmid human cDNA encoding maxi-K channel) in patients with overactive bladder who had not responded well to oral therapies.

Apart from this, Sumitomo Pharma America received FDA approval for its supplemental New Drug Application (sNDA) for vibegron (GEMTESA), a beta-3 adrenergic receptor (β3) agonist, dosed once-daily (75 mg), for the treatment of men with overactive bladder (OAB) symptoms receiving pharmacological therapy for benign prostatic hyperplasia (BPH). If approved, vibegron will be the first and only beta-3 agonist used to treat men with OAB symptoms who are taking pharmaceutical treatment for BPH.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7291&flag=E

Regional Analysis:

The major markets for overactive bladder include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for overactive bladder while also representing the biggest market for its treatment. This can be attributed to the rising awareness of OAB among both patients and healthcare providers.

Moreover, mobile apps and wearable devices are increasingly used for monitoring symptoms, tracking treatment efficacy, and providing personalized management plans. These tools enhance patient engagement and provide healthcare providers with valuable data to tailor treatments more effectively.

Apart from this, minimally invasive treatments, such as Botox injections and various neuromodulation techniques, are becoming more popular. These procedures offer significant symptom relief with less recovery time and fewer complications compared to traditional surgical approaches. The shift towards these methods reflects a growing preference for less invasive options that align with the broader trend towards outpatient and office-based treatments.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the overactive bladder market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the overactive bladder market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current overactive bladder marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

Neuroendocrine Carcinoma Market: The 7 major neuroendocrine carcinoma market reached a value of US$ 1.3 Billion in 2023, and projected the 7MM to reach US$ 2.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.14% during the forecast period from 2024 to 2034.

Osteoporosis Market: The 7 major osteoporosis market reached a value of US$ 10.2 Billion in 2023, and projected the 7MM to reach US$ 14.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.49% during the forecast period from 2024 to 2034.

Polycystic Kidney Disease Market: The 7 major polycystic kidney disease market reached a value of US$ 358.2 Million in 2023, and projected the 7MM to reach US$ 622.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.15% during the forecast period from 2024 to 2034.

Post-Partum Depression Market: The 7 major post-partum depression market reached a value of US$ 4.4 Billion in 2023, and projected the 7MM to reach US$ 50.2 Billion by 2034, exhibiting a growth rate (CAGR) of 24.68% during the forecast period from 2024 to 2034.

Post-Traumatic Stress Disorder Market: The 7 major post-traumatic stress disorder market reached a value of US$ 1.8 Billion in 2023, and projected the 7MM to reach US$ 3.2 Billion by 2034, exhibiting a growth rate (CAGR) of 5.18% during the forecast period from 2024 to 2034.

Rheumatoid Arthritis Market: The 7 major rheumatoid arthritis market reached a value of US$ 27.5 Billion in 2023 and projected the 7MM to reach US$ 33.8 Billion by 2034, exhibiting a growth rate (CAGR) of 1.88% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800