Mergers & acquisitions

The buy brings three small molecules in preclinical development for Parkinson’s disease, amyotrophic lateral sclerosis and lysosomal storage diseases into Merck’s pipeline.

Successful drugs from Novo Nordisk and Eli Lilly are just the beginning of what one analyst says could be “the largest therapeutic class of drugs that the biopharma industry has ever seen.”

The Japanese biotechnology and food company has bought into the gene therapy space with its $620 million acquisition of Ohio-based CDMO and clinical-stage biotech Forge Biologics.

The Swiss drugmaker gains rights to RVT-3101 in the U.S. and Japan. Telavant was formed in late 2022 by Roivant and Pfizer, which had a 25% stake in the venture and retains rights to the antibody in other countries.

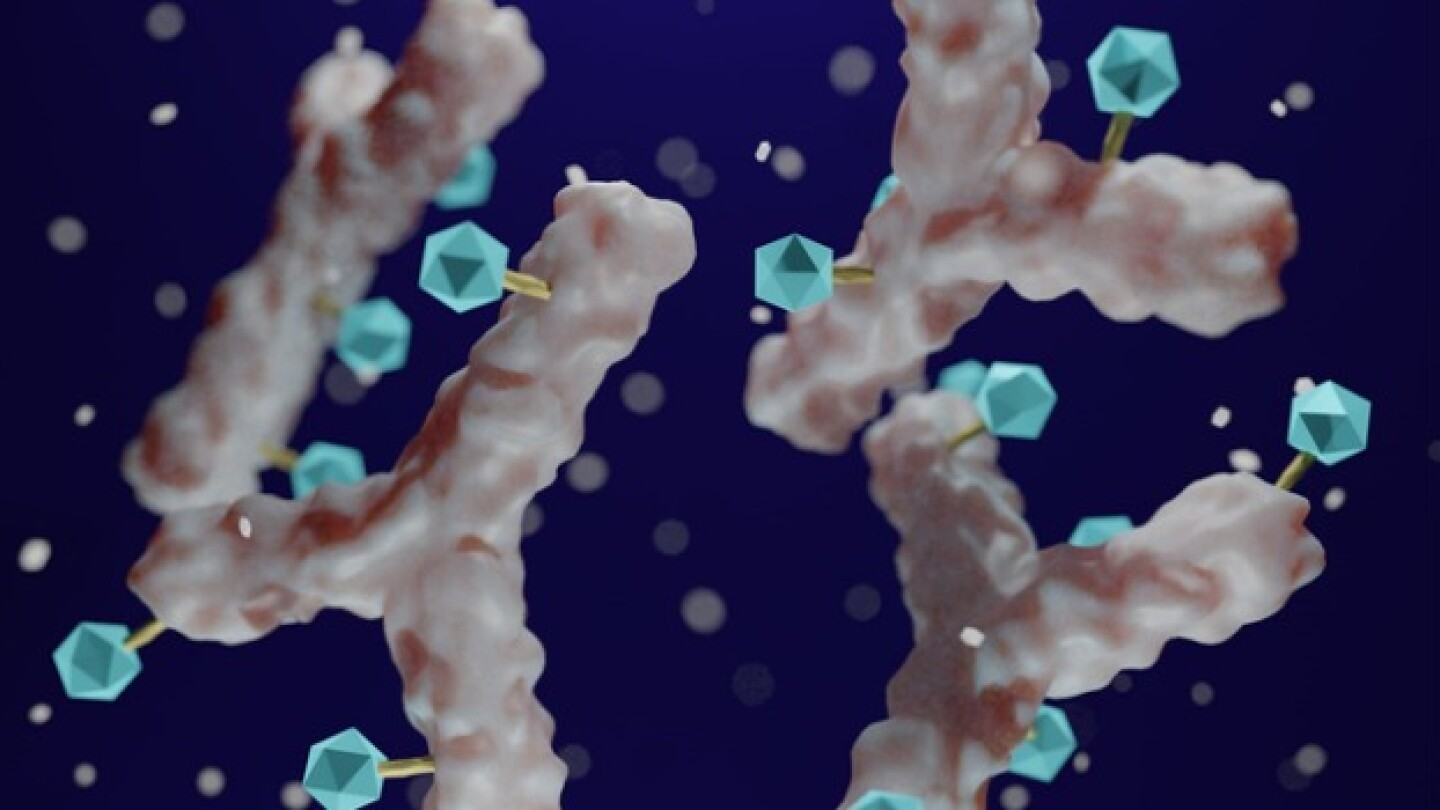

While Merck lost out to Pfizer earlier this year in snapping up Seagen, this week the company closed a deal worth a potential $22 billion with Daiichi Sankyo—further evidence of the industry’s insatiable appetite for ADC technology.

Despite increasing antitrust scrutiny across the biopharma industry, the European Commission on Thursday said it found no competitive issues with Pfizer’s buyout of the antibody-drug conjugate company.

Sail Biomedicines combines Laronde’s circular eRNA platform with Senda’s nanoparticle delivery technology in the pursuit of a new class of programmable medicines across therapeutic areas.

The Danish pharma announced Monday that it is buying a Phase III hypertension candidate from Singapore-based KBP Biosciences. It is Novo Nordisk’s third high-value purchase in as many months.

The first two weeks of October saw BMS’s $4.8 billion buyout of Mirati, Lilly’s $1.4 billion purchase of Point, Kyowa Kirin’s $387 million acquisition of Orchard and AbbVie’s $110 million Mitokinin deal.

An increase in funding share and available lab space helps to keep the Bay State’s biotech and pharma sectors strong.

PRESS RELEASES