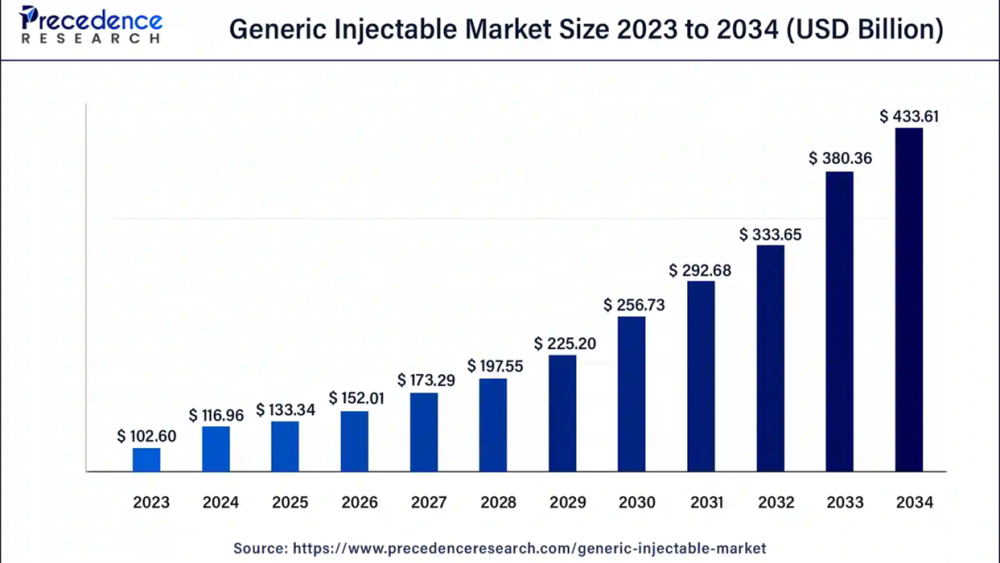

The global generic injectable market size was estimated at USD 102.60 billion in 2023 and is expected to attain around US$ 433.61 billion by 2034, growing at a CAGR of 14% from 2024 to 2034. FDA Generic Drugs Program ensures that generic medicines, which utilize the same active ingredients as their brand-name counterparts, maintain equivalent efficacy and safety profiles. This thorough evaluation, coupled with stringent inspections of manufacturing facilities and continuous post-market safety monitoring, guarantees that generic medicines meet the highest standards. As a result, these robust regulatory measures significantly contribute to the growth of the generic injectable market, fostering increased trust and adoption among healthcare providers and patients alike.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.precedenceresearch.com/sample/2180

Market Overview

The generic injectable market is experiencing rapid growth due to the availability of generic drugs, which are formulated to match already marketed brand-name drugs in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. These drugs demonstrate bioequivalence, ensuring they deliver the same clinical benefits as their brand-name counterparts. Containing identical active ingredients and used at the same doses to treat identical conditions, generic medicines differ only in name, appearance, and packaging. The development of generic medicines is permitted only after the expiration of the exclusivity period granted to the innovator company by law, which provides data and market exclusivity under pharmaceutical legislation. This regulatory framework ensures that once exclusivity ends, the market opens to generic manufacturers, driving significant market growth through increased competition and accessibility.

Report Highlights

· North America has accounted market share of 46% in 2023.

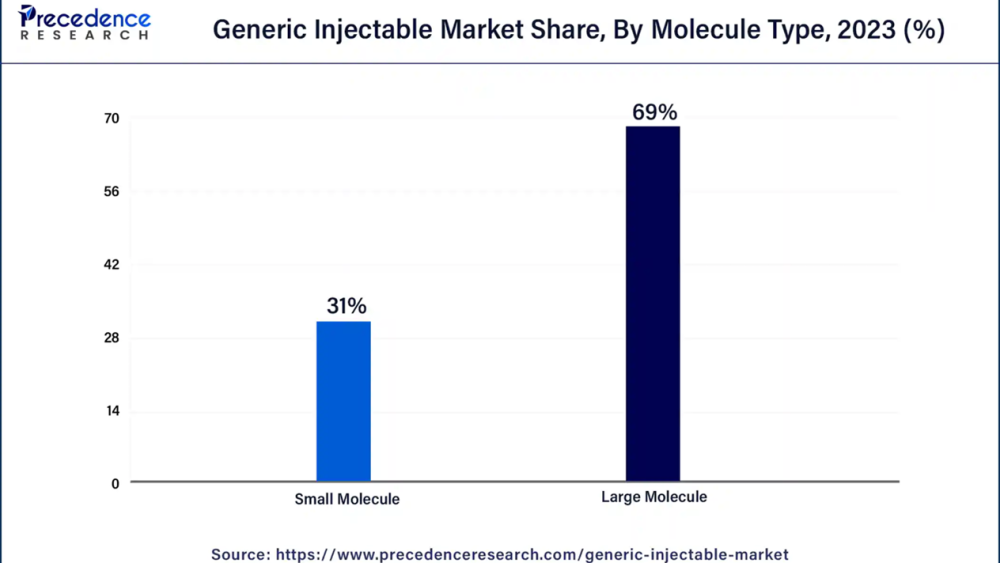

· The large molecule type segment has captured market share of 69% in 2023.

· The small molecule segment has accounted for 31% market share in 2023.

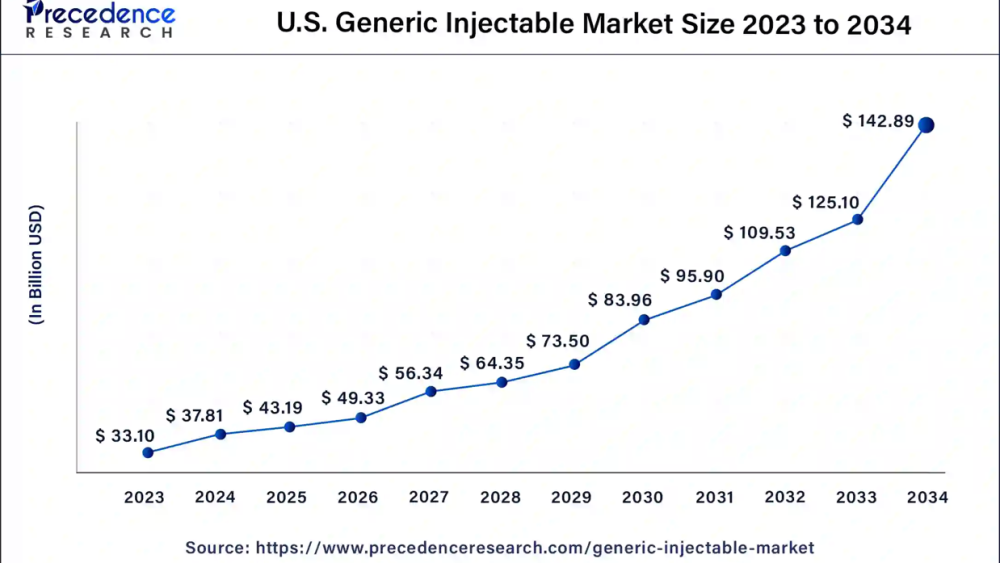

· The U.S. generic injectable market size is expected to reach around USD 142.89 billion by 2034, growing at a CAGR of 14.2% from 2024 to 2034.

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2180

Regional Stance

North America, particularly the United States, leads the generic injectables market with the highest growth rate. In the U.S., 90% of prescriptions filled are for generic drugs, underscoring their crucial role in the healthcare system. The widespread availability of generics fosters market competition, making treatments more affordable and accessible to a broader patient base. The low cost of generic drugs has also pressured some manufacturers, driving them out of business. These challenges, the region's commitment to increasing generic drug availability continues to bolster its market dominance and growth.

Asia Pacific significantly contributes to the growth of the generic injectables market. Generic drug manufacturers in this region benefit from reduced costs, as they bypass expenses associated with drug discovery and preclinical and clinical trials. Consequently, generics are available at lower prices, offering substantial savings in drug expenditures for countries. In India, where per capita out-of-pocket healthcare expenditure is among the highest globally, the affordability of generic drugs presents a crucial opportunity for cost savings. Healthcare providers and policymakers in the Asia Pacific region recognize the value of keeping drug prices affordable, and generic drugs serve as a vital tool for reducing overall healthcare expenses, thereby supporting market expansion.

We value your investment, get customization@ https://www.precedenceresearch.com/customization/2180

Report Highlights

By Product Type

Monoclonal antibodies are projected to hold the highest market share within the generic injectables sector. Administered intravenously, these protein-based treatments can occasionally cause infusion reactions, particularly during initial administration. Their extensive application in treating various diseases, including certain cancers, underscores their market dominance. The development process involves identifying the specific antigen to target, ensuring the efficacy and specificity of these therapies. The substantial demand for monoclonal antibodies, driven by their therapeutic versatility and effectiveness, solidifies their leading position in the market.

By Molecule Type

The increased research and development in large molecules are driving substantial growth and opportunity in the generic injectables market. Large molecule drugs encompass a diverse range of recombinant expressions, with the manufacturing process predominantly occurring in specialized clean areas. These areas, akin to those used in pivotal manufacturing processes for parenteral pharmaceuticals, require stringent design, primary engineering control, and maintenance to ensure product safety. A sterile environment, classified as Grade A or ISO Class 5, is essential for all open handling of large molecule drugs to prevent contamination. This rigorous approach to manufacturing underscores the potential of large molecules in expanding market share and delivering safe, effective generic injectable.

The small molecule segment is anticipated to experience a higher CAGR during the forecast period. Typically synthesized chemically, small molecule medications including those with complex structures like paclitaxel, with an 854 Da molecular weight can also be produced recombinantly in cell cultures. Predominantly formulated and packaged as orally administered pills, these medications are distributed systemically throughout the body. Their ability to penetrate cells and elicit precise biological responses underscores their therapeutic efficacy. This dynamic growth trajectory reflects the segment's potential to significantly impact the market, driven by advancements in chemical synthesis and recombinant production techniques.

By Application

The oncology segment dominates the generic injectable market, with essential chemotherapy drugs such as cisplatin, carboplatin, and methotrexate widely used. Generic drugs play a crucial role in oncology, as some anticancer treatments are only available in generic forms. In clinical practice, generics are integral to the treatment and cure of conditions like acute lymphoblastic leukemia in children and early-stage breast cancer. Beyond chemotherapy, generic drugs are extensively utilized in supportive care, underscoring their broad application and vital importance in comprehensive cancer treatment regimens.

The diabetes segment is experiencing the strongest CAGR growth in the forecast period. Effective diabetes management relies on patient access and adherence to prescribed drug regimens, with the overall cost of care being a critical factor influencing accessibility. Utilizing generic drugs is a strategic approach to enhancing access and reducing costs. These drugs serve as medically appropriate alternatives to brand-name medications, offering the same safety and efficacy. Consequently, the adoption of generics in diabetes care significantly improves patient outcomes and reduces financial burdens, driving robust growth in this market segment.

By Distribution Channel

Hospital pharmacies are poised to hold the largest market share in the distribution of generic injectables. As a pivotal department within hospitals, hospital pharmacies manage the procurement, storage, compounding, dispensing, manufacturing, testing, packaging, and distribution of drugs. This department also shoulders the responsibility for pharmaceutical research and education, conducted by professional and competent pharmacists. Their comprehensive role in the drug supply chain ensures the efficient and effective delivery of medications, reinforcing their dominance in the market and their critical contribution to patient care.

Market Dynamics

Driver

Generic Utilization and Formulary Management

Efficient generic utilization and proactive formulary management are pivotal in generating substantial cost savings across healthcare systems. Protecting the supply of existing generics while promoting the development of additional lower-cost alternatives to branded medications is crucial. With several high-cost specialty drugs losing patent protection, there are emerging opportunities to enhance value and realize significant savings, thereby fostering robust growth in the generic injectable market. This strategic approach not only expands accessibility to affordable treatments but also supports broader healthcare affordability.

Restraint

Challenges in the Generic Medication Landscape

The generic medication landscape faces significant challenges, primarily driven by declining prices that erode manufacturers profitability. Drugs with low sales volumes pose a particular strain on the supply chain, especially when investments are needed for facility upgrades and safety standards compliance. Some manufacturers opt to exit the market rather than invest in these necessary upgrades, leading to a concentration of production under a single company. This consolidation limits competition and innovation, thereby constraining the growth potential of the generic injectable market Its broader cost-saving benefits.

Opportunity

Expanding Demand for Prefilled Syringes

The use of prefilled syringes is poised for significant growth across diverse therapeutic sectors beyond traditional applications like anticoagulants and vaccines. Pharmaceutical companies stand to benefit from several advantages, including minimized drug waste, extended product shelf life, and enhanced market share. For healthcare providers, prefilled syringes offer efficient, reliable, and convenient drug administration methods. They provide accurate, pre-measured doses, reduce dosing errors, and mitigate risks of microbial contamination. These benefits not only improve patient safety and treatment outcomes but also create compelling opportunities for expansion within the generic injectable market, driven by increasing demand and adoption of prefilled syringe technologies.

Recent Developments

· In May 2024, Hikma entered the Spanish generic injectables market, bolstering its European presence.

· In March 2023, Hikma expanded its impact in Canada with the launch of new sterile injectable medicines.

· In May 2023, Lupin announced the acquisition of the French pharmaceutical company Medisol.

Key Players in the Generic Injectable Market

· DR. Reddys Laboratries Ltd

· Baxter International

· Mylan N.A

· Teva Pharmaceuticals

· Astra Zeneca Plc

· Sanofi S.A

· Fresenius Kabi

· Pfizer Inc

· Cipla Ltd

· Merck & Co. Inc

· Novartis AG

· Sun Pharmaceutical Industries Ltd

· Aurobindo Pharma Limited

· Samsung Biologics Co Ltd

· Biocon

· Lupin,Ltd

· Astrazeneca

· GlaxoSmithKline Plc

· Hikma Pharmaceuticals

· Cosette Pharmaceutical, Inc

· Johnson & Johnson Services, Inc

· Sanofi SA

· Amgen Inc.

· Bristol- Myers Squibb Company

· Piramal Pharma Solutions

· Merck KGaA

Market Segmentation

· By Product Type

o Chemotherapy agents

o Small molecule antibiotics

o Vaccines

o Peptide antibiotics

o Blood factors

o Peptide hormone

o Insulin

o Cytokines

o Immunoglobin

o Monoclonal Antibodies

· By Molecular Type

o Small Molecule

o Large Molecule

· By Application

o Oncology

o Diabetes

o Infectious Diseases

o Blood Disorders

o Musculoskeletal Disorders

o Hormonal Disorders

o Pain Management

o CNS Diseases

o Cardiovascular Diseases

· By Administration

o Intravenous (IV)

o Intramuscular (IM)

o Subcutaneous (SC)

· By Distribution Channel

o Hospital pharmacy

o Retail pharmacy

o Drug stores

o Online pharmacy

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2180

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@precedenceresearch.com

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.precedenceresearch.com/sample/2180

Market Overview

The generic injectable market is experiencing rapid growth due to the availability of generic drugs, which are formulated to match already marketed brand-name drugs in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. These drugs demonstrate bioequivalence, ensuring they deliver the same clinical benefits as their brand-name counterparts. Containing identical active ingredients and used at the same doses to treat identical conditions, generic medicines differ only in name, appearance, and packaging. The development of generic medicines is permitted only after the expiration of the exclusivity period granted to the innovator company by law, which provides data and market exclusivity under pharmaceutical legislation. This regulatory framework ensures that once exclusivity ends, the market opens to generic manufacturers, driving significant market growth through increased competition and accessibility.

| Report Coverage | Details |

| Generic Injectable Market Size | USD 433.61 Billion By 2034 |

| Generic Injectable Market Growth Rate | CAGR of 14% from 2024 to 2034 |

| U.S. Generic Injectable Market Size | USD 142.89 billion by 2034 |

· North America has accounted market share of 46% in 2023.

· The large molecule type segment has captured market share of 69% in 2023.

· The small molecule segment has accounted for 31% market share in 2023.

· The U.S. generic injectable market size is expected to reach around USD 142.89 billion by 2034, growing at a CAGR of 14.2% from 2024 to 2034.

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2180

Regional Stance

North America, particularly the United States, leads the generic injectables market with the highest growth rate. In the U.S., 90% of prescriptions filled are for generic drugs, underscoring their crucial role in the healthcare system. The widespread availability of generics fosters market competition, making treatments more affordable and accessible to a broader patient base. The low cost of generic drugs has also pressured some manufacturers, driving them out of business. These challenges, the region's commitment to increasing generic drug availability continues to bolster its market dominance and growth.

Asia Pacific significantly contributes to the growth of the generic injectables market. Generic drug manufacturers in this region benefit from reduced costs, as they bypass expenses associated with drug discovery and preclinical and clinical trials. Consequently, generics are available at lower prices, offering substantial savings in drug expenditures for countries. In India, where per capita out-of-pocket healthcare expenditure is among the highest globally, the affordability of generic drugs presents a crucial opportunity for cost savings. Healthcare providers and policymakers in the Asia Pacific region recognize the value of keeping drug prices affordable, and generic drugs serve as a vital tool for reducing overall healthcare expenses, thereby supporting market expansion.

We value your investment, get customization@ https://www.precedenceresearch.com/customization/2180

Report Highlights

By Product Type

Monoclonal antibodies are projected to hold the highest market share within the generic injectables sector. Administered intravenously, these protein-based treatments can occasionally cause infusion reactions, particularly during initial administration. Their extensive application in treating various diseases, including certain cancers, underscores their market dominance. The development process involves identifying the specific antigen to target, ensuring the efficacy and specificity of these therapies. The substantial demand for monoclonal antibodies, driven by their therapeutic versatility and effectiveness, solidifies their leading position in the market.

By Molecule Type

The increased research and development in large molecules are driving substantial growth and opportunity in the generic injectables market. Large molecule drugs encompass a diverse range of recombinant expressions, with the manufacturing process predominantly occurring in specialized clean areas. These areas, akin to those used in pivotal manufacturing processes for parenteral pharmaceuticals, require stringent design, primary engineering control, and maintenance to ensure product safety. A sterile environment, classified as Grade A or ISO Class 5, is essential for all open handling of large molecule drugs to prevent contamination. This rigorous approach to manufacturing underscores the potential of large molecules in expanding market share and delivering safe, effective generic injectable.

The small molecule segment is anticipated to experience a higher CAGR during the forecast period. Typically synthesized chemically, small molecule medications including those with complex structures like paclitaxel, with an 854 Da molecular weight can also be produced recombinantly in cell cultures. Predominantly formulated and packaged as orally administered pills, these medications are distributed systemically throughout the body. Their ability to penetrate cells and elicit precise biological responses underscores their therapeutic efficacy. This dynamic growth trajectory reflects the segment's potential to significantly impact the market, driven by advancements in chemical synthesis and recombinant production techniques.

By Application

The oncology segment dominates the generic injectable market, with essential chemotherapy drugs such as cisplatin, carboplatin, and methotrexate widely used. Generic drugs play a crucial role in oncology, as some anticancer treatments are only available in generic forms. In clinical practice, generics are integral to the treatment and cure of conditions like acute lymphoblastic leukemia in children and early-stage breast cancer. Beyond chemotherapy, generic drugs are extensively utilized in supportive care, underscoring their broad application and vital importance in comprehensive cancer treatment regimens.

The diabetes segment is experiencing the strongest CAGR growth in the forecast period. Effective diabetes management relies on patient access and adherence to prescribed drug regimens, with the overall cost of care being a critical factor influencing accessibility. Utilizing generic drugs is a strategic approach to enhancing access and reducing costs. These drugs serve as medically appropriate alternatives to brand-name medications, offering the same safety and efficacy. Consequently, the adoption of generics in diabetes care significantly improves patient outcomes and reduces financial burdens, driving robust growth in this market segment.

By Distribution Channel

Hospital pharmacies are poised to hold the largest market share in the distribution of generic injectables. As a pivotal department within hospitals, hospital pharmacies manage the procurement, storage, compounding, dispensing, manufacturing, testing, packaging, and distribution of drugs. This department also shoulders the responsibility for pharmaceutical research and education, conducted by professional and competent pharmacists. Their comprehensive role in the drug supply chain ensures the efficient and effective delivery of medications, reinforcing their dominance in the market and their critical contribution to patient care.

Market Dynamics

Driver

Generic Utilization and Formulary Management

Efficient generic utilization and proactive formulary management are pivotal in generating substantial cost savings across healthcare systems. Protecting the supply of existing generics while promoting the development of additional lower-cost alternatives to branded medications is crucial. With several high-cost specialty drugs losing patent protection, there are emerging opportunities to enhance value and realize significant savings, thereby fostering robust growth in the generic injectable market. This strategic approach not only expands accessibility to affordable treatments but also supports broader healthcare affordability.

Restraint

Challenges in the Generic Medication Landscape

The generic medication landscape faces significant challenges, primarily driven by declining prices that erode manufacturers profitability. Drugs with low sales volumes pose a particular strain on the supply chain, especially when investments are needed for facility upgrades and safety standards compliance. Some manufacturers opt to exit the market rather than invest in these necessary upgrades, leading to a concentration of production under a single company. This consolidation limits competition and innovation, thereby constraining the growth potential of the generic injectable market Its broader cost-saving benefits.

Opportunity

Expanding Demand for Prefilled Syringes

The use of prefilled syringes is poised for significant growth across diverse therapeutic sectors beyond traditional applications like anticoagulants and vaccines. Pharmaceutical companies stand to benefit from several advantages, including minimized drug waste, extended product shelf life, and enhanced market share. For healthcare providers, prefilled syringes offer efficient, reliable, and convenient drug administration methods. They provide accurate, pre-measured doses, reduce dosing errors, and mitigate risks of microbial contamination. These benefits not only improve patient safety and treatment outcomes but also create compelling opportunities for expansion within the generic injectable market, driven by increasing demand and adoption of prefilled syringe technologies.

Recent Developments

· In May 2024, Hikma entered the Spanish generic injectables market, bolstering its European presence.

· In March 2023, Hikma expanded its impact in Canada with the launch of new sterile injectable medicines.

· In May 2023, Lupin announced the acquisition of the French pharmaceutical company Medisol.

Key Players in the Generic Injectable Market

· DR. Reddys Laboratries Ltd

· Baxter International

· Mylan N.A

· Teva Pharmaceuticals

· Astra Zeneca Plc

· Sanofi S.A

· Fresenius Kabi

· Pfizer Inc

· Cipla Ltd

· Merck & Co. Inc

· Novartis AG

· Sun Pharmaceutical Industries Ltd

· Aurobindo Pharma Limited

· Samsung Biologics Co Ltd

· Biocon

· Lupin,Ltd

· Astrazeneca

· GlaxoSmithKline Plc

· Hikma Pharmaceuticals

· Cosette Pharmaceutical, Inc

· Johnson & Johnson Services, Inc

· Sanofi SA

· Amgen Inc.

· Bristol- Myers Squibb Company

· Piramal Pharma Solutions

· Merck KGaA

Market Segmentation

· By Product Type

o Chemotherapy agents

o Small molecule antibiotics

o Vaccines

o Peptide antibiotics

o Blood factors

o Peptide hormone

o Insulin

o Cytokines

o Immunoglobin

o Monoclonal Antibodies

· By Molecular Type

o Small Molecule

o Large Molecule

· By Application

o Oncology

o Diabetes

o Infectious Diseases

o Blood Disorders

o Musculoskeletal Disorders

o Hormonal Disorders

o Pain Management

o CNS Diseases

o Cardiovascular Diseases

· By Administration

o Intravenous (IV)

o Intramuscular (IM)

o Subcutaneous (SC)

· By Distribution Channel

o Hospital pharmacy

o Retail pharmacy

o Drug stores

o Online pharmacy

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2180

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@precedenceresearch.com