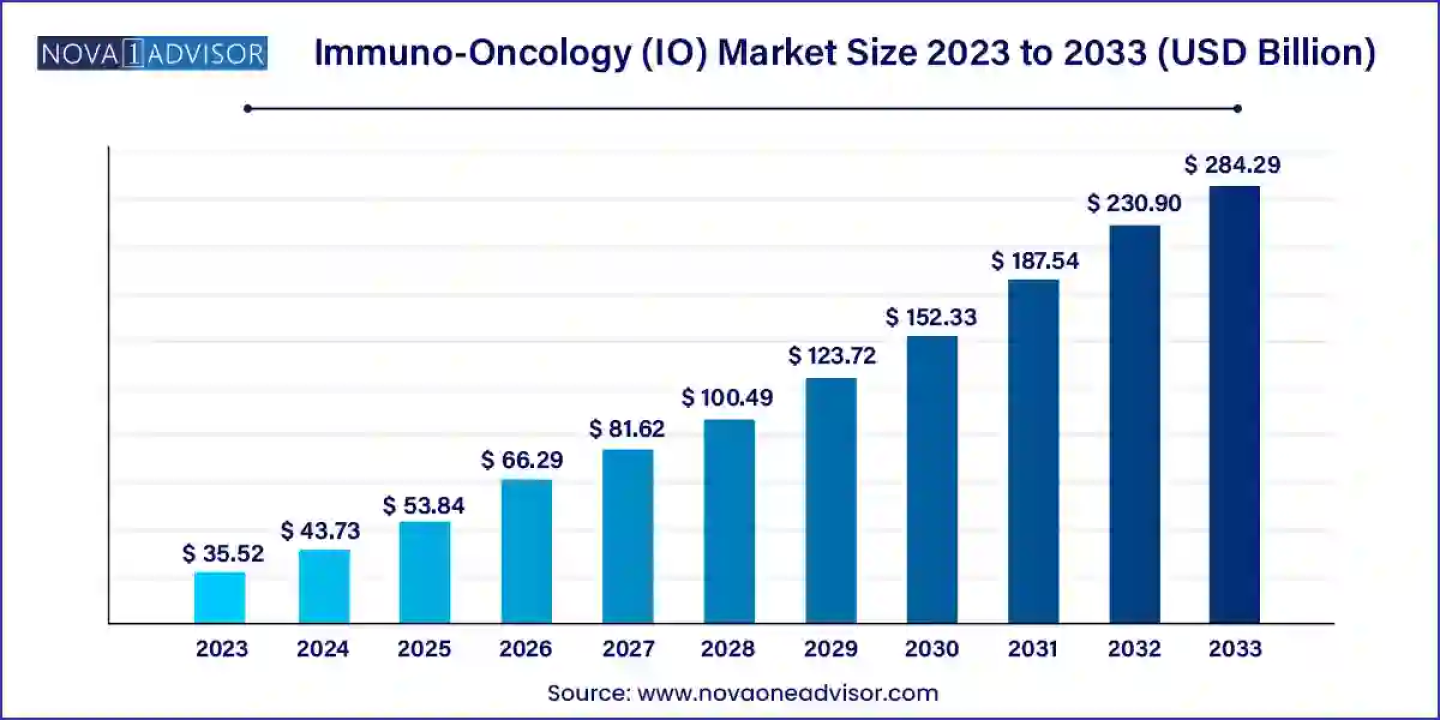

According to recent study by nova one advisor, the global immuno-oncology (IO) market size was estimated at USD 43.73 billion in 2023 and is projected to hit around USD 284.29 billion by 2033, growing at a CAGR of 23.12% during the forecast period from 2024 to 2033.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8512

The growth of the immuno-oncology market is being propelled by its pivotal role in equipping the immune system with the tools necessary to recognize and combat tumours.

The immuno-oncology market is experiencing rapid growth driven by the adoption of cancer immunotherapy, a groundbreaking approach that harnesses the body's immune system to prevent, control, and eradicate cancer. This form of treatment encompasses a diverse range of modalities, including targeted antibodies, cancer vaccines, adoptive cell transfer, tumor-infecting viruses, checkpoint inhibitors, cytokines, and adjuvants. As a subset of biotherapy, immunotherapies utilize biological materials derived from living organisms to modulate the body's immune response against cancer.

Furthermore, advancements in genetic engineering have enabled the development of gene therapies, enhancing immune cells' ability to combat cancer. These innovative treatments can be utilized alone or in conjunction with traditional therapies such as surgery, chemotherapy, radiation, or targeted therapies to augment their efficacy. This expansive array of options underscores the growing significance of immuno-oncology in reshaping cancer treatment paradigms and driving market expansion.

https://www.novaoneadvisor.com/report/customization/8512

Immuno-Oncology (IO) Market Dynamics

Driver

Innovative Combinations in Immuno-Oncology

The advancement of immuno-oncology hinges on strategic innovation, particularly in exploring novel combinations to extend its benefits to a broader patient population and revolutionize treatment outcomes. Continuous research into immuno-oncology molecules and potential medicines, alongside the exploration of new mechanisms such as bispecific antibodies, novel checkpoint inhibitors, T cell engagers, and cell therapies, aims to foster sustained immune responses. These assets are being evaluated in combinations with diverse modalities, both within and outside portfolios, including antibody drug conjugates, which hold promise in potentially supplanting conventional chemotherapy in immuno-oncology protocols.

By introducing innovative immuno-oncology combinations and unique dosing strategies, the aim is to redefine the standard of care for advanced-stage diseases, facilitating clinically significant and enduring responses for patients. This focus on innovation serves as a primary driver behind the growth trajectory of the immuno-oncology market.

High Cost of Treatment

Several challenges hinder the expansive potential of the immuno-oncology market. Chief among these is the occurrence of drug resistance, wherein cancer cells evolve during treatment, impeding T-cell infiltration into tumors. The inability to accurately predict treatment efficacy and patient response, alongside the necessity for additional biomarkers, poses significant constraints. The emergence of resistance to cancer immunotherapies, coupled with the lack of optimized clinical study designs to ascertain efficacy, further exacerbates these limitations. Moreover, the high costs associated with treatment contribute to the market's restrictions. Addressing these challenges is essential to unlock the full potential of immuno-oncology and overcome barriers to market growth.

Opportunity

Recent Advancement in Technology

Recent advancements highlighting the role of the immune system in biological therapies, particularly those targeting the tumor microenvironment, present a significant opportunity for the immuno-oncology market. Progress in utilizing immune cells, T cells pivotal in cell-mediated immunity, has demonstrated success in clinical trials for treating malignant tumors. With cancer immunotherapies focusing on T lymphocytes emerging as a primary strategy, recent studies underscore the potential of T cells in enhancing cancer treatments, including checkpoint blockade, adoptive cellular therapy, and cancer vaccinology. Cancer vaccines, which bolster the immune system to combat cancer cells, create a promising avenue for growth within the immuno-oncology market.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8512

immuno-oncology (io) market Trends:

By Type Insights

In the immuno-oncology market, the immune checkpoint inhibitors segment holds sway, emerging as the dominant type of immunotherapy. One such drug targets the checkpoint protein CTLA-4, while others act against PD-1 or its partner protein PD-L1. Immune checkpoint inhibitors represent a pivotal category within immunotherapy, playing a crucial role in thwarting proteins that inhibit the immune system's attack on cancer cells. In April 2022, Regeneron Pharmaceuticals, Inc. finalized its acquisition of Checkmate Pharmaceuticals, Inc., signaling its commitment to advancing cancer therapeutics.

By Indication Insights

In the immuno-oncology market, the blood cancer segment emerges as a pivotal indication, commanding a substantial share. Immunotherapy, also known as biological therapy, harnesses the body's immune system to combat cancer, typically resulting in fewer short-term side effects compared to chemotherapy. Noteworthy immunotherapies employed in blood cancer treatment include Chimeric Antigen Receptor (CAR) T-cell therapy, cytokine treatment, donor lymphocyte infusion, monoclonal antibody therapy, radioimmunotherapy, reduced-intensity allogeneic stem cell transplantation, and therapeutic cancer vaccines. This focus on blood cancer underscores the significance of immunotherapy in addressing diverse malignancies and highlights its pivotal role in reshaping treatment approaches within this indication.

By End User Insights

In the immuno-oncology market, the hospital segment emerged as the dominant end-user segment in 2023. While many immunotherapy cancer treatments can be administered at home orally or through outpatient IV infusions, hospitals play a crucial role in providing comprehensive care for cancer patients. Immunotherapy treatments vary in their mechanisms, with some aiding the immune system in inhibiting or decelerating cancer cell growth, while others facilitate the immune system in eradicating cancer cells or preventing metastasis. This dominance of hospitals underscores their pivotal position in delivering advanced cancer care and highlights the integral role they play in administering immunotherapy treatments to patients.

Recent Developments

https://www.novaoneadvisor.com/report/checkout/8512

Immuno-Oncology (IO) Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Immuno-Oncology (IO) market.

By Type

https://www.novaoneadvisor.com/report/checkout/8512

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8512

The growth of the immuno-oncology market is being propelled by its pivotal role in equipping the immune system with the tools necessary to recognize and combat tumours.

The immuno-oncology market is experiencing rapid growth driven by the adoption of cancer immunotherapy, a groundbreaking approach that harnesses the body's immune system to prevent, control, and eradicate cancer. This form of treatment encompasses a diverse range of modalities, including targeted antibodies, cancer vaccines, adoptive cell transfer, tumor-infecting viruses, checkpoint inhibitors, cytokines, and adjuvants. As a subset of biotherapy, immunotherapies utilize biological materials derived from living organisms to modulate the body's immune response against cancer.

Furthermore, advancements in genetic engineering have enabled the development of gene therapies, enhancing immune cells' ability to combat cancer. These innovative treatments can be utilized alone or in conjunction with traditional therapies such as surgery, chemotherapy, radiation, or targeted therapies to augment their efficacy. This expansive array of options underscores the growing significance of immuno-oncology in reshaping cancer treatment paradigms and driving market expansion.

- In December 2023, the BioMed X Institute and Ono Pharmaceutical initiated a collaborative effort in cancer research.

- In January 2024, Merck announced its acquisition of Harpoon Therapeutics, diversifying its oncology pipeline.

- North America dominated the market with the largest share in 2023.

- By type, the immune checkpoint inhibitors segment dominated in the immuno-oncology market.

- By indication, the blood cancer held a significant share of the immuno-oncology market.

- By end user, hospitals dominated the immuno-oncology market.

https://www.novaoneadvisor.com/report/customization/8512

Immuno-Oncology (IO) Market Dynamics

Driver

Innovative Combinations in Immuno-Oncology

The advancement of immuno-oncology hinges on strategic innovation, particularly in exploring novel combinations to extend its benefits to a broader patient population and revolutionize treatment outcomes. Continuous research into immuno-oncology molecules and potential medicines, alongside the exploration of new mechanisms such as bispecific antibodies, novel checkpoint inhibitors, T cell engagers, and cell therapies, aims to foster sustained immune responses. These assets are being evaluated in combinations with diverse modalities, both within and outside portfolios, including antibody drug conjugates, which hold promise in potentially supplanting conventional chemotherapy in immuno-oncology protocols.

By introducing innovative immuno-oncology combinations and unique dosing strategies, the aim is to redefine the standard of care for advanced-stage diseases, facilitating clinically significant and enduring responses for patients. This focus on innovation serves as a primary driver behind the growth trajectory of the immuno-oncology market.

- In May 2024, Boehringer Ingelheim and OSE Immunotherapeutics expanded their collaboration to develop pioneering treatments for cancer and cardio-renal-metabolic diseases.

- In November 2023, AbbVie announced its acquisition of ImmunoGen, including its flagship cancer therapy ELAHERE (mirvetuximab soravtansine-gynx), to enhance its portfolio in solid tumor treatment.

High Cost of Treatment

Several challenges hinder the expansive potential of the immuno-oncology market. Chief among these is the occurrence of drug resistance, wherein cancer cells evolve during treatment, impeding T-cell infiltration into tumors. The inability to accurately predict treatment efficacy and patient response, alongside the necessity for additional biomarkers, poses significant constraints. The emergence of resistance to cancer immunotherapies, coupled with the lack of optimized clinical study designs to ascertain efficacy, further exacerbates these limitations. Moreover, the high costs associated with treatment contribute to the market's restrictions. Addressing these challenges is essential to unlock the full potential of immuno-oncology and overcome barriers to market growth.

Opportunity

Recent Advancement in Technology

Recent advancements highlighting the role of the immune system in biological therapies, particularly those targeting the tumor microenvironment, present a significant opportunity for the immuno-oncology market. Progress in utilizing immune cells, T cells pivotal in cell-mediated immunity, has demonstrated success in clinical trials for treating malignant tumors. With cancer immunotherapies focusing on T lymphocytes emerging as a primary strategy, recent studies underscore the potential of T cells in enhancing cancer treatments, including checkpoint blockade, adoptive cellular therapy, and cancer vaccinology. Cancer vaccines, which bolster the immune system to combat cancer cells, create a promising avenue for growth within the immuno-oncology market.

- In April 2024, the BioMed X Institute in Heidelberg initiated a new immuno-oncology research project in collaboration with Merck, aiming to explore novel avenues in cancer treatment.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8512

immuno-oncology (io) market Trends:

- Advancements in Immunotherapy: The field of immunotherapy continues to advance, with ongoing research into novel immunotherapeutic agents such as immune checkpoint inhibitors, CAR-T cell therapy, and cancer vaccines. These treatments aim to harness the body's immune system to target and destroy cancer cells more effectively.

- Combination Therapies: Combination therapies involving multiple immunotherapeutic agents or combining immunotherapy with other treatment modalities such as chemotherapy, radiation therapy, or targeted therapy are gaining traction. These combinations have shown potential for enhanced efficacy and improved patient outcomes.

- Biomarker Development: Biomarkers play a crucial role in predicting response to immunotherapy and identifying patients who are most likely to benefit from treatment. Efforts are ongoing to discover and validate biomarkers that can accurately predict treatment response and guide clinical decision-making.

- Expansion into New Indications: While initially focused on a few cancer types, such as melanoma and lung cancer, immuno-oncology is expanding into new indications. Research is underway to explore the efficacy of immunotherapy in a broader range of cancer types, including rare cancers and those with traditionally poor treatment outcomes.

- Personalized Medicine: Personalized medicine approaches, including the use of biomarkers and genomic profiling, are becoming increasingly important in immuno-oncology. Tailoring treatment regimens to individual patients based on their unique molecular profiles and immune characteristics holds promise for optimizing therapeutic outcomes.

- Regulatory Landscape: Regulatory agencies are continuously evaluating and updating guidelines for the development and approval of immunotherapies. The regulatory landscape for IO products is evolving, with a focus on ensuring both safety and efficacy while facilitating timely access to innovative treatments for patients.

- Investment and Collaboration: The immuno-oncology market continues to attract significant investment from pharmaceutical companies, biotech firms, and investors. Collaboration between industry players, academic institutions, and research organizations is also prevalent, driving innovation and the development of new therapies.

- Patient Access and Affordability: Despite the clinical success of immuno-oncology therapies, ensuring patient access to these treatments remains a challenge. Issues such as high costs, reimbursement policies, and disparities in healthcare access can impact the availability of immunotherapies to patients who could benefit from them.

By Type Insights

In the immuno-oncology market, the immune checkpoint inhibitors segment holds sway, emerging as the dominant type of immunotherapy. One such drug targets the checkpoint protein CTLA-4, while others act against PD-1 or its partner protein PD-L1. Immune checkpoint inhibitors represent a pivotal category within immunotherapy, playing a crucial role in thwarting proteins that inhibit the immune system's attack on cancer cells. In April 2022, Regeneron Pharmaceuticals, Inc. finalized its acquisition of Checkmate Pharmaceuticals, Inc., signaling its commitment to advancing cancer therapeutics.

By Indication Insights

In the immuno-oncology market, the blood cancer segment emerges as a pivotal indication, commanding a substantial share. Immunotherapy, also known as biological therapy, harnesses the body's immune system to combat cancer, typically resulting in fewer short-term side effects compared to chemotherapy. Noteworthy immunotherapies employed in blood cancer treatment include Chimeric Antigen Receptor (CAR) T-cell therapy, cytokine treatment, donor lymphocyte infusion, monoclonal antibody therapy, radioimmunotherapy, reduced-intensity allogeneic stem cell transplantation, and therapeutic cancer vaccines. This focus on blood cancer underscores the significance of immunotherapy in addressing diverse malignancies and highlights its pivotal role in reshaping treatment approaches within this indication.

By End User Insights

In the immuno-oncology market, the hospital segment emerged as the dominant end-user segment in 2023. While many immunotherapy cancer treatments can be administered at home orally or through outpatient IV infusions, hospitals play a crucial role in providing comprehensive care for cancer patients. Immunotherapy treatments vary in their mechanisms, with some aiding the immune system in inhibiting or decelerating cancer cell growth, while others facilitate the immune system in eradicating cancer cells or preventing metastasis. This dominance of hospitals underscores their pivotal position in delivering advanced cancer care and highlights the integral role they play in administering immunotherapy treatments to patients.

Recent Developments

- In November 2023, Boehringer Ingelheim expanded its immuno-oncology portfolio through the acquisition of bacterial cancer therapy specialist T3 Pharma.

- In February 2024, AbbVie completed its acquisition of ImmunoGen, further strengthening its presence in the immuno-oncology market.

- In May 2024, Biogen bolstered its late-stage pipeline and expanded its immunology portfolio through an agreement to acquire Human Immunology Biosciences.

- In August 2022, Ipsen and Marengo Therapeutics forged a strategic partnership to advance precision immuno-oncology candidates into clinical development.

- In March 2024, Gilead and Xilio entered into an exclusive license agreement for the Tumor-Activated IL-12 Program, aiming to enhance cancer treatment options. · In January 2023, Prokarium and Ginkgo Bioworks announced a partnership to explore targets for RNA therapeutics and immuno-oncology.

- In February 2024, Astellas and Kelonia Therapeutics initiated a research and license agreement to develop novel immuno-oncology therapeutics.

https://www.novaoneadvisor.com/report/checkout/8512

Immuno-Oncology (IO) Market Top Key Companies:

- Bristol Myers Squibb Company (US),

- Novartis AG (Switzerland),

- F. Hoffmann-LA Roche Ltd. (Switzerland),

- Merck & Co., Inc. (US),

- GSK Plc. (UK),

- Eli Lilly and Company (US),

- Fresenius Kabi AG (Germany),

- Pfizer Inc. (US),

- AbbVie Inc. (US),

- Genentech Inc. (US),

- Sanofi (France),

- AstraZeneca (UK),

- among others

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Immuno-Oncology (IO) market.

By Type

- Immune Cell Therapy (CAR-T)

- Monoclonal Antibodies

- Checkpoint Inhibitors

- Cytokines

- Cancer Vaccines

- Others

- IDO1i

- Oncolytic virus

- STING agonist

- TLR agonist

- TIL

- MEKi

- TIGIT

- CPI

- GITR agonist

- TGF-b trap

- A2AR antagonist/CD73i

- LAG-3

- Anti-CTLA-4

- MAGE-A3, VEGF

- HDAC

- STING

- TIM-3

- TGF-Beta

- OX40

- Others

- Malignant Tumors

- Benign Tumors

- Others

- Hospitals

- Specialty Clinics

- Others

- Hospital Pharmacy

- Retail Pharmacy

- Others

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

https://www.novaoneadvisor.com/report/checkout/8512

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/