Alliances

With partner Biogen mum on zuranolone’s prospects as an FDA August 5 review deadline approaches, Sage Therapeutics’ stock fell Wednesday to its lowest level in months.

Embattled SQZ Biotechnologies announced Tuesday that the Swiss biotech will not exercise its option for HPV 16 positive solid tumors under the SQZ-APC-HPV program.

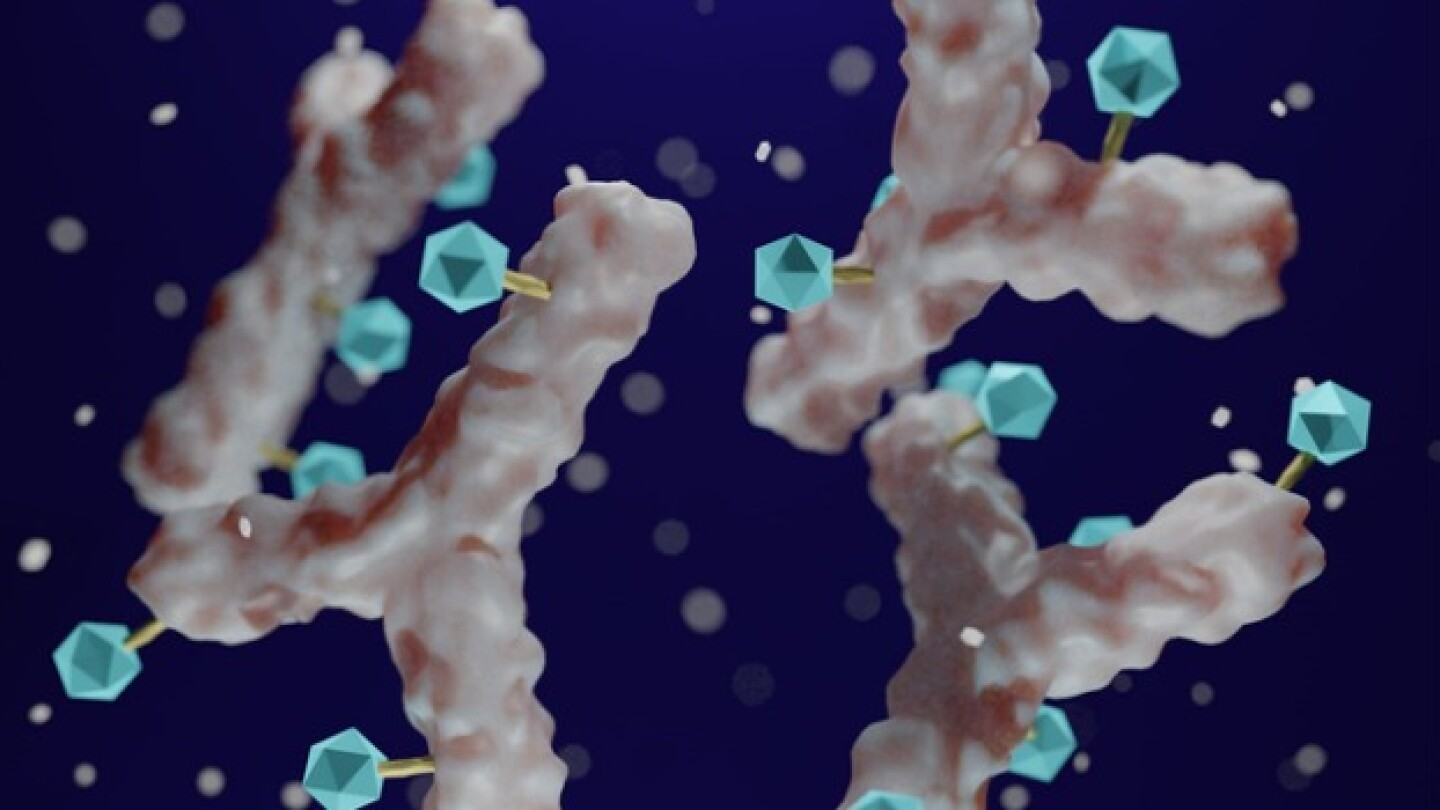

The license and option deal, for an undisclosed amount, seeks to develop potentially first-in-class antibody-drug conjugate candidates against different oncology targets.

Following two BLA rejections for its Humira biosimilar, Alvotech is expanding its partnership with Teva Pharmaceuticals, which will enable the latter to have greater involvement with quality and control.

With an upfront payment of $310 million in cash, Roche is partnering with Alnylam to develop the latter’s RNA interference candidate zilebesiran for hypertension patients with high cardiovascular risk.

The Federal Trade Commission released new draft guidelines for assessing mergers, while an Alzheimer’s conference yielded promising data and J&J kicked off Q2 earnings season with a sound beat.

The company is handing back a multivalent Shigella vaccine candidate to LimmaTech Biologics, which spun out in 2015 after GSK’s acquisition of GlycoVaxyn for $190 million.

Tuesday’s partnership will dig into Flagship’s deep ecosystem of companies and technologies to discover medicines in line with Pfizer’s core strategic areas.

This week: Cancer license deals from J&J and BeiGene, a potential $7B acquisition by Roche and confirmed $1.9B Lilly buy, EU fine for Illumina, and more legal challenges to the Inflation Reduction Act

The tech giant is investing $50 million in the Utah-based biotech to accelerate development of its AI foundation models for drug discovery.

PRESS RELEASES