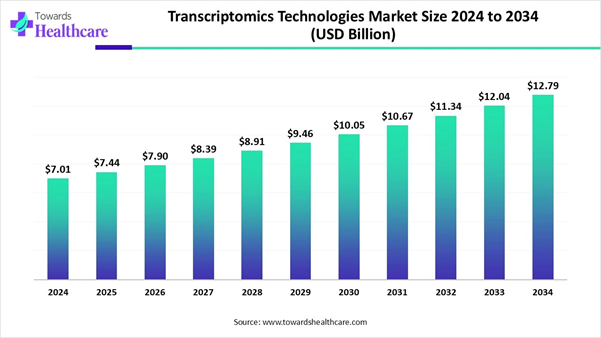

According to Towards Healthcare, the global transcriptomics technologies market size is valued at USD 7.01 billion in 2024, expected to grow to USD 7.44 billion in 2025, and is projected to reach approximately USD 12.79 billion by 2034, expanding at a CAGR of 6.24% during 2025–2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5769

Across the globe, growing demand for personalized therapies, advancements in sequencing technologies, and accelerating funding for the development of novel transcriptomics technologies are impacting the transcriptomics technologies market. Besides this, the widespread emergence of these technologies in clinical diagnostics, innovations such as single-cell transcriptomics and spatial transcriptomics, and the adoption of integrated omics technologies are fueling market growth.

The Transcriptomics Technologies Market: Highlights

➢ Transcriptomics technologies industry poised to reach USD 7.01 billion in 2024.

➢ Forecasted to grow to USD 12.79 billion by 2034.

➢ Expected to maintain a CAGR of 6.24% from 2025 to 2034.

➢ North America led the transcriptomics technologies market in 2024.

➢ Asia Pacific is expected to witness the fastest expansion during 2025-2034.

➢ By product type, the analyzers segment was dominant in the market in 2024.

➢ By product type, the software segment is expected to be the fastest-growing in the studied years.

➢ By technology, the next-generation sequencing segment held a major revenue share of the market in 2024.

➢ By technology, the polymerase chain reaction segment is expected to grow significantly in the coming years.

➢ By application, the drug discovery and research segment registered dominance in the transcriptomics technologies market in 2024.

➢ By application, the diagnostics segment is expected to grow rapidly during 2025-2034.

➢ By end-user, the pharmaceuti cal and biotechnology companies segment led the market in 2024.

➢ By end-user, the academic research and government institutes segment is expected to grow fastest over the projected period.

Market Overview: Broader Developments in Sequencing Technologies

Primarily, various transcriptomics technologies are highly used in the analysis of a comprehensive set of RNA transcripts in cells or tissues, which further offer insights into gene expression and cellular processes. Whereas, the global transcriptomics technologies market is propelled by increasing demand for precision medicine and developments in Next-Generation Sequencing (NGS). Nowadays, this market encompasses different developments, such as single-cell RNA sequencing (scRNA-seq), spatial transcriptomics, and the integration of artificial intelligence (AI) and machine learning (ML).

Report Scope

|

Metric |

Details |

|

Market Size in 2025 |

USD 7.44 Billion |

|

Projected Market Size in 2034 |

USD 12.79 Billion |

|

CAGR (2025 - 2034) |

6.24% |

|

Leading Region |

North America |

|

Market Segmentation |

By Product Type, By Technology, By Application, By End-Use, By Region |

|

Top Key Players |

Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN N.V., 10x Genomics, Inc., Bio-Rad Laboratories, Inc., Roche Holding AG, Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Limited, Fluidigm Corporation |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Emergence of Novel Transcriptomics: Major Potential

The global transcriptomics technologies market is experiencing milestone applications of emerging technologies, particularly spatial transcriptomics and single-cell transcriptomics. Mainly, technologies such as Xenium, Molecular Cartography, and MERSCOPE enable mapping gene expression within tissues at a cellular or subcellular level, offering excellent insights into tissue organization and cellular interactions.

However, single-cell transcriptomics provides the analysis of gene expression in individual cells, enabling a detailed view of cell heterogeneity and function within a tissue.

Barrier in Regulation and Standardization: Major Limitation

Restricted standardized protocols in various platforms may create inappropriateness in data generation and interpretation, which can hinder reproducibility and comparison of results in the studies. Alongside, a diverse regulatory landscape around the numerous regions is disturbing the adoption and commercialization of new transcriptomics technologies.

The Transcriptomics Technologies Market: Regional Analysis

In 2024, North America held the dominating revenue share of the market. In this region, the market comprises wider drug discovery applications, and the development of customized medicine is fueling the adoption of transcriptomics technologies.

Additionally, commercial-scale expression-atlas projects, frequently assisted by public-private collaborations, further drive the demand for transcriptomics in North America. Also, North America is leveraging AI for data analysis and interpretation with integrated transcriptomics with other omics data types.

In North America, the US has a robust research and healthcare infrastructure, as well as wide-ranging R&D investments in omics are fueling the transcriptomics technologies market expansion. Also, growing adoption of novel sequencing technologies, microarrays, and real-time PCR in the U.S.’s major hub of pharmaceutical and biotechnology companies.

For instance,

• In January 2025, Takara Bio USA Holdings, Inc. acquired Curio Bioscience, a developing company in the field of spatial genomics, adding spatial biology to its broad portfolio of single-cell omics solutions.

The broad application of different omics in the development of newer therapeutics and diagnostics is driving the respective market growth.

For instance,

• In February 2025, the DNAstack-led consortium launched the Canadian Platform for AI in Health, a new $17.5M project to boost software for making AI-driven discoveries in genomics and healthcare.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

The Asia Pacific is Estimated to Grow at the Fastest CAGR During 2025-2034

In the upcoming era, the Asia Pacific will expand rapidly in the transcriptomics technologies market. Across the ASAP, increasing adoption of single-cell and spatial transcriptomics, accelerating collaborations among different companies and other organizations involved in drug discovery and omics research activities. Also, the ASAP countries like China and Japan, with growing healthcare spending and developing sophisticated bioinformatics tools, are boosting the market development.

Primarily, China has been fostering a transcriptomics landscape, with the inclusion of advances in spatial transcriptomics, single-cell RNA sequencing (scRNA-seq), and the development of data repositories, such as the China National GeneBank Sequence Archive (CNSA).

For instance,

• In September 2024, China-based startup MGI launched a new nanopore sequencing product with advanced CycloneSEQ technology.

In Japan, the rising adoption of single-cell RNA sequencing (scRNA-seq) and spatial transcriptomics technologies is propelling the expansion of the transcriptomics technologies market.

For instance,

• In July 2025, Pythia Biosciences and TOMY Digital Biology made a strategic partnership to boost scRNA-seq research in Japan.

The Transcriptomics Technologies Market: Segmentation Analysis

By product type analysis

The analyzers segment held the biggest share of the market in 2024. The emergence of various analyzers in the different omics tasks is assisting overall segment expansion. They mainly consist of sequencing-based analyzers, which are employed in high-throughput RNA sequencing (RNA-Seq), and microarray-based analyzers enable simultaneous analysis of the expression levels of thousands of genes. Moreover, for gene expression analysis, qPCR systems are employed as a quantitative method.

On the other hand, the software segment will grow at a rapid CAGR in the transcriptomics technologies market. In the respective market, different software is used to accelerate the visualization of gene expression patterns within tissues, allowing insights into tissue organization and cellular interactions in spatial transcriptomics. The application of BioBam's OmicsBox in increased cell-type annotation for single-cell and long-read datasets, and the University of Toronto established a single-cell generative pre-trained transformer (scGPT) model for estimating gene manipulation impacts and integrating data.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By technology analysis

In 2024, the next-generation sequencing segment led the transcriptomics technologies market. This technology has transformed transcriptomics by providing high-throughput analysis of RNA, enabling meaningful insights into gene expression, alternative splicing, and non-coding RNA activity. As well as NGS technologies like RNA-Seq, assist researchers in studying completely about transcriptome, identifying novel transcripts, and analyzing gene expression patterns under different parameters.

The polymerase chain reaction segment is predicted to expand at a notable CAGR as these technologies possess various types, such as qPCR for quantification, RT-PCR for nucleic acid conversion, and amplification of DNA sequences. PCR-based transcriptomics are employed in studying gene expression changes connected with diseases, ultimately expanding the identification of biomarkers or therapeutic targets.

By application analysis

In the transcriptomics technologies market, the drug discovery and research segment dominated in 2024. Eventually, numerous omics types are employed in the elucidation of drugs' effects on gene expression, offering crucial data regarding their mechanism of action. This further helps in optimizing drug efficacy and reducing side effects. In oncology, transcriptomics allows for the detection of those genes incorporated in cancer development and progression, leading to the development of targeted therapies.

Although the diagnostics segment is anticipated to grow at the fastest CAGR during the forecast period, these kinds of diagnostics involve certain advantages, like the allowance of detailed molecular information. Transcriptomics supports the determination of novel biomarkers for disease diagnosis, prognosis, and treatment response. Moreover, in infectious diseases, transcriptomics is applied to detect the cause of an infection and to monitor the host's immune response.

By end-user analysis

The pharmaceutical and biotechnology companies segment held a dominating share of the transcriptomics technologies market in 2024. Mainly, these companies provide a variety of products and services, like instruments, reagents, and software, that boost many transcriptomics applications. Also, transcriptomics is increasingly emerging in widespread drug discovery, development, and diagnostics. The microarrays and RNA sequencing (RNA-Seq) technologies have immense significance in these robust companies for their respective applications.

And, the academic research and government institutes segment is predicted to expand rapidly during 2025-2034, due to the greater application of developing new transcriptomics technologies in academic institutions in R&D, coupled with several collaborations among private organizations and biotechnology firms. In addition, government funding for genomics research, including transcriptomics, is a crucial driver of innovation and technology development. Besides this, academic institutions offer the essential training and education for the next generation of scientists in transcriptomics.

Access the Healthcare Dashboard: https://www.towardshealthcare.com/access-dashboard

Transcriptomics Technologies Market Companies:

• Illumina, Inc.

• Thermo Fisher Scientific Inc.

• Agilent Technologies, Inc.

• QIAGEN N.V.

• 10x Genomics, Inc.

• Bio-Rad Laboratories, Inc.

• Roche Holding AG

• Pacific Biosciences of California, Inc.

• Oxford Nanopore Technologies Limited

• Fluidigm Corporation

Widespread Applications of Transcriptomics in Different Industries

|

Industry/Company |

Latest Updates |

|

Gene Solutions (May 2025) |

Partnered with NEWCL Biomedical Laboratory to develop an advanced Next-Generation Sequencing (NGS) laboratory in Taiwan |

|

Vgenomics (April 2025) |

Made a strategic partnership with Meril Genomics to provide complementary advanced genomic diagnostics to hospitals and research centers throughout India. |

|

Ambry Genetics (August 2024) |

Launched a novel multiomic exomereveal test for rare disease |

|

Thermo Fisher (January 2024) |

Introduced next-gen Invitrogen TaqMan Cells-to-CT Express Kit to allow drug developers to acquire newer treatments to market quickly. |

What are Major Drifts in the Transcriptomics Technologies Market?

➢ In July 2025, the US-based New England Biolabs (NEB) unveiled the NEBNext Low-bias Small RNA Library Prep Kit, developed to reduce biased representation of small RNA species in sequencing data.

➢ In April 2025, Biocartis introduced a fully automated, real-time quantitative polymerase chain reaction (qPCR) assay (Idylla) to identify hypermutated phenotypes associated with mutations in POLE and POLD1 in endometrial cancer.

➢ In March 2025, ABL Diagnostics, an Euronext-listed player in molecular diagnostics, partnered with Riken Genesis Co. to offer an enhanced range of real-time PCR assays (qPCR) (UltraGene), including syndromic testing panels.

➢ In August 2024, Siemens Healthcare launched an indigenous RT-PCR Kit for rapid monkeypox detection.

Browse More Insights of Towards Healthcare:

The global sequencing consumables market was valued at USD 8.54 billion in 2024, rose to USD 10.49 billion in 2025, and is projected to reach USD 66.79 billion by 2034, expanding at a CAGR of 22.84% from 2024 to 2034.

The global cholera vaccines market was valued at USD 94.5 million in 2024, grew to USD 103.99 million in 2025, and is anticipated to reach USD 246 million by 2034, advancing at a CAGR of 10.04% between 2024 and 2034.

The global automated and closed cell therapy processing systems market stood at USD 1.45 billion in 2024, increased to USD 1.74 billion in 2025, and is forecasted to reach USD 8.86 billion by 2034, growing at a CAGR of 19.84% during 2025–2034.

The global biotechnology reagents & kits market reached USD 733.17 billion in 2024, expanded to USD 813.38 billion in 2025, and is expected to hit USD 2,070.55 billion by 2034, rising at a CAGR of 10.94% from 2024 to 2034.

The global cell culture vessels market was valued at USD 4.28 billion in 2024 and is projected to achieve USD 17.59 billion by 2034, progressing at a CAGR of 15.18% during 2024–2034.

The global medical biomimetics market stood at USD 35.85 billion in 2024, climbed to USD 38.59 billion in 2025, and is estimated to reach USD 74.87 billion by 2034, recording a CAGR of 7.64% from 2025 to 2034.

The global optical genome mapping market was valued at USD 130.53 million in 2024, rose to USD 162.27 million in 2025, and is projected to attain USD 1,150.73 million by 2034, expanding at a CAGR of 26.8% between 2024 and 2034.

The global multiomics market reached USD 2.76 billion in 2024, increased to USD 3.18 billion in 2025, and is forecasted to grow to USD 11.46 billion by 2034, advancing at a CAGR of 15.32% during 2024–2034.

The global miRNA sequencing and assay market stood at USD 391.73 million in 2024, rose to USD 443.95 million in 2025, and is anticipated to reach USD 1,369.11 million by 2034, growing at a CAGR of 13.33% between 2024 and 2034.

The global upstream bioprocessing market was valued at USD 24.15 billion in 2023 and is projected to reach USD 105.46 billion by 2034, expanding at a CAGR of 14.34% from 2024 to 2034.

Transcriptomics Technologies Market Segmentation:

By Product Type

• Analyzers

• Reagent Kits

• Software

By Technology

• Microarrays

• Gene Regulation Technologies

• Polymerase Chain Reaction

• Next-Generation Sequencing

By Application

• Clinical

• Diagnostics

• Toxicogenomics

• Comparative transcriptomics studies

• Drug discovery and research

• Bioinformatics

By End-Use

• Academic Research and Government Institutes

• Hospitals and Diagnostic Centers

• Pharmaceutical and Biotechnology companies

By Region

• North America

• U.S.

• Canada

• Asia Pacific

• China

• Japan

• India

• South Korea

• Thailand

• Europe

• Germany

• UK

• France

• Italy

• Spain

• Sweden

• Denmark

• Norway

• Latin America

• Brazil

• Mexico

• Argentina

• Middle East and Africa (MEA)

• South Africa

• UAE

• Saudi Arabia

• Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5769

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest