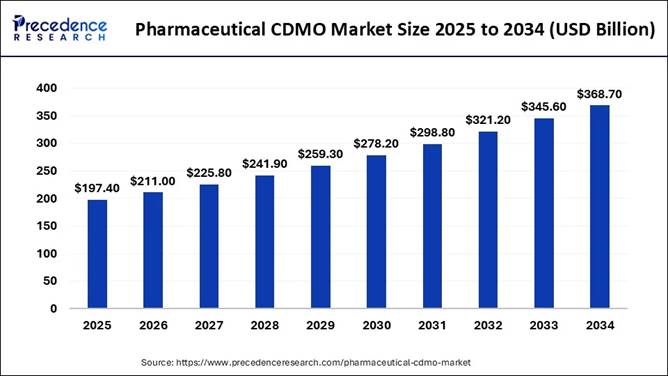

According to Precedence Research, the global pharmaceutical CDMO market size is expected to be worth USD 368.70 billion by 2034, increasing from USD 197.40 billion in 2025, with a healthy CAGR of 7.2% between 2024 and 2034.

The global pharmaceutical CDMO (Contract Development and Manufacturing Organization) market is projected to reach over $368.70 billion by 2034, driven by the rising demand for biologics, advanced therapies, and complex drug formulations.

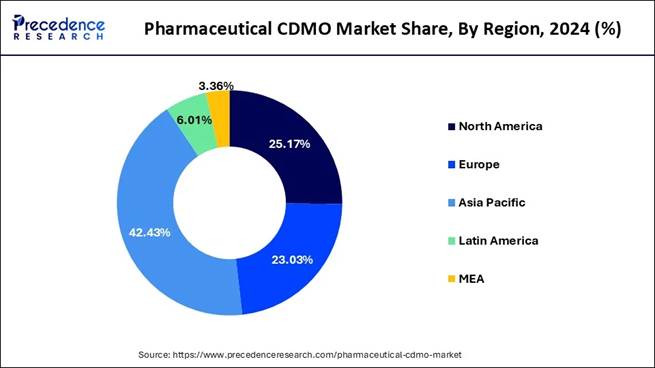

Asia Pacific leads the market with significant cost advantages and manufacturing capacities, while Europe remains a hub for high-quality and specialized pharmaceutical production. Key growth factors include the increasing complexity of drug pipelines, the need for faster commercialization, and strategic outsourcing of API and finished dosage formulation manufacturing. Despite challenges such as regulatory compliance and capacity constraints, CDMOs are becoming essential innovation partners in modern pharmaceutical development.

Note: This report

is readily available for immediate delivery. We can review it with you in a

meeting to ensure data reliability and quality for decision-making.

📥 Download

Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/2936

Pharmaceutical CDMO Market Key Takeaways

🔹 Asia Pacific Dominates: The region commanded the largest market share of 42.43% in 2024, solidifying its position as the global hub for cost-effective and high-capacity pharmaceutical CDMO services.

🔹 Europe’s Strong Growth Trajectory: Europe is poised for robust expansion, expected to register a CAGR of 7.7% over the forecast period, driven by its expertise in high-quality biologics and advanced therapies.

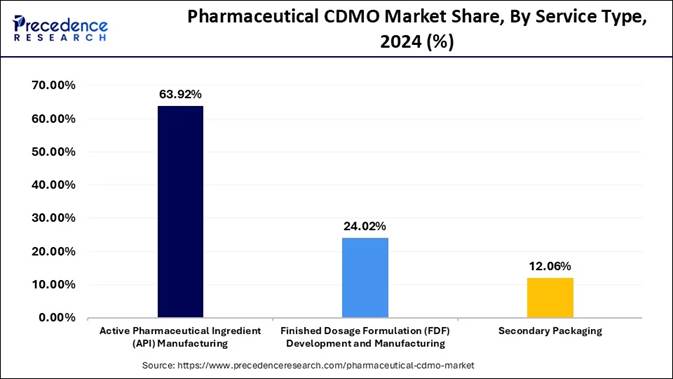

🔹 API Manufacturing Leads the Way: Active Pharmaceutical Ingredient (API) manufacturing held a commanding 63.92% share in 2024, reflecting the strategic importance of outsourced API production in modern pharma.

🔹 FDF Segment Accelerates Rapidly: Finished Dosage Formulation (FDF) development and manufacturing is set to experience the fastest growth, with a CAGR of 7.9% from 2025 to 2034, driven by demand for complex formulations and integrated solutions.

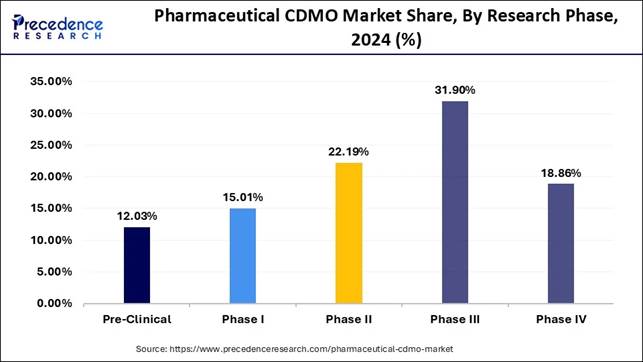

🔹 Phase III Dominates Clinical Outsourcing: The Phase III segment captured the highest share at 31.90% in 2024, highlighting CDMOs’ critical role in large-scale late-stage trials and commercialization readiness.

🔹 Phase II on a Fast Track: The Phase II segment is projected to grow at a CAGR of 7.5%, reflecting the increasing reliance on CDMOs for mid-stage development and rapid scale-up of novel therapies.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Pharmaceutical CDMO Market Size, by Service Type 2022 to 2024 (USD Billion)

|

Service Type |

2022 |

2023 |

2024 |

|

Active Pharmaceutical Ingredient (API) Manufacturing |

103.7 |

110.4 |

117.6 |

|

Finished Dosage Formulation (FDF) Development and Manufacturing |

39.4 |

42.3 |

45.4 |

|

Secondary Packaging |

19.4 |

20.6 |

21.8 |

Pharmaceutical CDMO Market Size, by Research Phase 2022 to 2024 (USD Billion)

|

Research Phase |

2022 |

2023 |

2024 |

|

Pre-clinical |

19.6 |

20.9 |

22.3 |

|

Phase I |

24.4 |

26 |

27.8 |

|

Phase II |

36.3 |

38.8 |

41.5 |

|

Phase III |

51.7 |

55.1 |

58.7 |

|

Phase III |

30.5 |

32.4 |

34.5 |

Don’t Miss Out! | Grab Your Discounted Report Before Prices

Go Up! 👉

https://www.precedenceresearch.com/checkout/2936

Is the CDMO Revolution Redefining the Future of Pharma?

The pharmaceutical CDMO market is undergoing a transformative surge as companies increasingly rely on specialized outsourcing partners to enhance speed, scalability, and scientific precision. Rising pipeline complexity, paired with the pressure for faster commercialization, has pushed innovators to collaborate with CDMOs for end-to-end development and manufacturing solutions. This market is further energized by the growing demand for cell and gene therapies, biologics, and personalized medicines, all of which require sophisticated capabilities that many pharma companies prefer to access externally.

Strategic alliances, flexible capacity models, and global expansion of manufacturing networks are becoming defining pillars of the industry's growth. Ultimately, CDMOs are evolving from mere service providers into essential innovation partners, shaping the very architecture of modern pharmaceutical development.

What Factors Are Powering the CDMO Boom in Pharma?

The pharmaceutical CDMO market is accelerating as drug developers face mounting pressure to shorten development timelines and reduce operational complexity. The surge in biologics, cell therapies, and high-potency drugs is driving companies to seek specialized expertise that CDMOs uniquely provide. Rising R&D costs and capacity constricts are further pushing innovators toward outsourcing as a strategic, not just economic, choice. Together, these forces are shaping a landscape where CDMOs have become indispensable, and timely pharmaceutical solutions.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

What Roadblocks Still Restrain the CDMO Revolution?

Despite its rapid rise, the pharmaceutical CDMO market continues to face sevral entrenched barriers that slow its full-scale adoption. Many innovators remain wary of relinquishing control over sensitive intellectual property, especially when outsourcing complex biologics or next-gen therapies. Quality variability across CDMOs particularly between established global players and emerging regional vendors creates hesitation, as inconsistencies can jepordise regulatory approvals and patient safety.

Capacity limitations also remain a bottleneck, with high-demand technologies such as sterile fill-finish, viral vectors, and HPAPI manufacturing often facing long wait times. Additionally, regulatory expectations are becoming increasingly stringent, making it difficult for CDMOs in developing regions to keep pace with global compliance standards. Cultural misalignment, communication gaps, and a lack of deep strategic partnership further hinder trust, slowing the transition from transactional outsourcing to long-term co-creation.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/pharmaceutical-cdmo-market

Pharmaceutical CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market Size (2024) |

USD 184.90 Billion |

|

Market Size (2025) |

USD 197.40 Billion |

|

Market Size (2026) |

USD 211.00 Billion |

|

Market Size (2034) |

USD 368.70 Billion |

|

Growth Rate (2025–2034) |

CAGR of 7.15% |

|

Largest Market (2023/2024) |

Asia Pacific (42.5% share in 2023) |

|

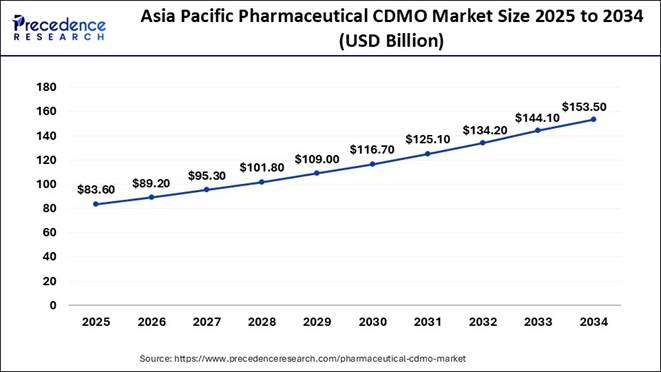

Asia Pacific Market Size (2025) |

USD 83.60 Billion |

|

Asia Pacific Market Size (2034) |

USD 153.50 Billion |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Service Type, Research Phase, Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Dominant Service Segment (2023) |

API Manufacturing – 63.7% share |

|

Fastest-Growing Service Segment |

Finished Dosage Formulation (FDF) – CAGR 7.9% (2024–2034) |

|

Dominant Research Phase (2023) |

Phase III – 31.8% share |

|

Fastest-Growing Research Phase |

Phase II – CAGR 7.5% |

|

Key Market Drivers |

Rising biologics production, demand for advanced therapies, increasing outsourcing of complex manufacturing, cost-efficient operations, expanding pipelines of specialty drugs, rapid scale-up needs |

|

Emerging Opportunities |

Growth in cell & gene therapy manufacturing, HPAPI demand, integrated CDMO models, digitalized manufacturing, modular and continuous processing |

|

Major Market Challenges |

Regulatory complexities, capacity limitations in biologics, high capital investments, IP protection concerns, quality variability across vendors |

|

Industry Trends |

Shift toward end-to-end CDMO partnerships, expansion of global manufacturing footprints, adoption of automation & AI in production, rising preference for single-source outsourcing |

|

Target Audience |

Pharma & biotech companies, API manufacturers, investors, contract research organizations, regulatory agencies |

|

Report Availability |

Immediate delivery with customizable regional or chapter-wise options |

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Case Study: Accelerating Biologics Commercialization Through CDMO Partnership

Client: Mid-sized Biopharmaceutical Company

Region: North America

Therapy Area: Oncology (Biologics – Monoclonal Antibody)

Challenge: Scaling from Phase II to Commercial Manufacturing

Background

A mid-sized biopharmaceutical company developing a breakthrough monoclonal antibody for oncology faced significant challenges transitioning from Phase II to Phase III and commercial manufacturing. The organization lacked large-scale biologics capacity, specialized analytical capabilities, and regulatory expertise needed for global submissions.

To overcome scale-up constraints and accelerate market entry, the company partnered with a leading Pharmaceutical CDMO specializing in biologics development and manufacturing.

Key Challenges

🔹 Limited in-house manufacturing capacity to support Phase III clinical trials

🔹 Complex biologics scale-up requirements, including cell line optimization and process intensification

🔹 Need for GMP-compliant large-scale production and global regulatory alignment

🔹 Tight timelines to maintain competitive advantage in a crowded oncology pipeline

CDMO Solution Approach

The CDMO implemented a full-service biologics development and manufacturing strategy:

➢

Process Optimization:

Advanced upstream and downstream process optimization improved overall yields

by 28%.

➢

Tech Transfer & Scale-Up:

Seamless transfer from 200L to 2,000L bioreactors enabled rapid scale-up with

consistent quality.

➢

Integrated FDF Capabilities:

Complete fill-finish services minimized outsourcing fragmentation and reduced

risk.

➢

Regulatory Support:

Provided end-to-end documentation for FDA and EMA submission, including

comparability studies.

➢

Accelerated Timelines:

Lean project management reduced Phase III manufacturing timelines by

approximately 22%.

Results & Impact

🔹Phase III trial material delivered 2 months ahead of schedule

🔹Manufacturing costs reduced by 18% through process efficiencies

🔹Successful FDA and EMA regulatory submissions with zero major observations

🔹Commercial launch executed 6 months earlier, enabling stronger market positioning

🔹Projected revenue boost: ~USD 120 million in the first year post-launch due to early entry

Key Takeaway

This case demonstrates how strategic collaboration with a specialized CDMO can accelerate biologics development, enhance manufacturing reliability, and significantly reduce time-to-market. As biologics and advanced therapies continue to dominate the pipeline, CDMOs are becoming essential innovation partners enabling pharmaceutical companies to scale efficiently and competitively.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2936

Pharmaceutical CDMO Market Regional Insight:

What is the Asia Pacific Pharmaceutical CDMO Market Size?

The Asia Pacific pharmaceutical CDMO market size is valued at USD 83.60 billion in 2025 and is anticipated to reach nearly USD 153.50 billion by 2034, growing at a solid CAGR of 6.95% from 2025 to 2034.

Why is Asia Pacific Becoming the New Epicenter of CDMO Momentum?

Asia Pacific is rapidly emerging as a powerhouse in the CDMO landscape, fuelled by expanding manufacturing capacities and a highly cost-competitive environment. The region benefits from a deepening pool of scientific talent, making it preferred destination for both early-stage development and large-scale pharmaceutical production.

Companies are increasingly drawn to its agility, where timelines are shorter and innovation cycles move at an accelerated pace. This blend of capability and cost-efficiency is transforming Asia Pacific into a strategic global hub for outsourcing drug development.

Note: This report is readily available for

immediate delivery. We can review it with you in a meeting to ensure data

reliability and quality for decision-making.

📥 Download

Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/2936

China Pharmaceutical CDMO Market Analysis:

China continues to anchor the region’s growth, propelled by heavy investments in biologics, advanced modalities, and world-class manufacturing praks. India Complements this strength with its expertise in generics, complex formulations, and end-to-end development services.

Japan and South Korea are rising as premium markets, specializing in high-precision biologics and advanced therapy manufacturing. Collectively, these countries create a multi-tiered ecosystem that caters to every segment of the CDMO value chain from early research to commercial scale production.

What is the Europe Pharmaceutical CDMO Market Size?

The Europe Pharmaceutical CDMO market size was valued at USD 45.68 billion in 2024 and is predicted to grow from USD 49.09 billion in 2025 to USD 88.84 billion by 2034, expanding at a CAGR of 7.62% from 2025 to 2034.

Europe Pharmaceutical CDMO Market Key Takeaways

🔹 Germany led the European pharmaceutical CDMO market by holding the largest share of 30% in 2024.

🔹 France is projected to expand at a CAGR of 7.9% during the forecast period.

🔹 By service type, the API segment held the highest market share of 64% in 2024.

🔹 By phase, the phase III segment accounted for the biggest market share of 32% in 2024.

🔹 By phase, the phase II segment is expected to grow at a significant CAGR of 8% during the forecast period.

Is Europe Reinventing its Role as the Scientific Backbone of CDMOs?

Europe remains the bastion if pharmaceutical excellence, with its CDMO market anchored in deep regulatory maturity and strong scientific heritage. The region prioritises high-quality manufacturing, making it is trusted destination for complex biologics, sterile injectables, and specialized therapies. A growing emphasis on innovation particularly in cell and gene therapy, has strengthened Europe’s position as a premium outsourcing market.

Europe Pharmaceutical CDMO Market Companies

➢ Seqens

➢ Recipharm Venture Fund

➢ CordePharma

➢ Siegfried Holdings AG

➢ Lonza Group Ltd

➢ Boehringer Ingelheim

➢ Catalent

➢ AGC Biologics

➢ 3P Biopharmaceuticals

➢ Adragos Pharma

➢ Axplora

➢ Biovian Oy

Germany Pharmaceutical CDMO Market:

Germany stands out for its precision-driven engineering and GMP-intensive manufacturing capabilities, especially within advanced biologics. Switzerland fortifies the region with its high-quality standards and concentration of global pharma headquarters, making it a preferred hub for high-complexity projects.

The UK contributes through its thriving biotech environment and world-renowned R&D infrastructure. Together, these countries form a cohesive European powerhouse built on innovation, quality, and decades of scientific leadership.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/5562

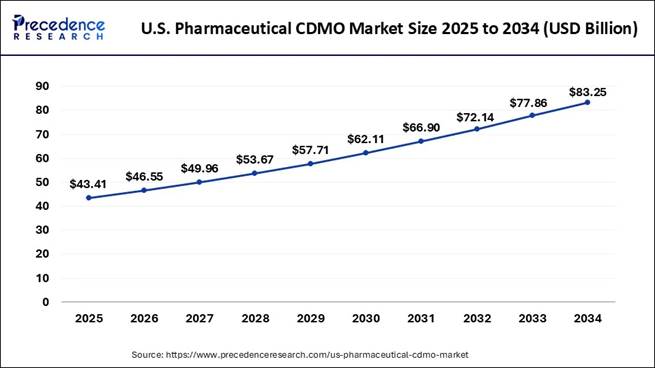

How Big is the U.S. Pharmaceutical CDMO Market?

According to Precedence Research, the U.S. pharmaceutical CDMO market size is evaluated at USD 43.41 billion in 2025 and is expected to cross USD 83.25 billion by 2034, with a strong CAGR of 7.47% from 2025 to 2034.

U.S. Pharmaceutical CDMO Market Key Takeaways

🔹 By service type, the active pharmaceutical ingredient (API) manufacturing segment contributed the highest market share of 64% in 2024.

🔹 By service type, the finished dosage formulation (FDF) development and manufacturing segment is projected to grow at a significant CAGR of 8.2% during the forecast period.

🔹 By research phase, the phase III segment captured the biggest market share of 32% in 2024.

🔹 By research phase, the phase II segment is expected to grow at a solid CAGR of 7.8% during the forecast period.

U.S. Pharmaceutical CDMO Market Companies

➢ Thermo Fisher Scientific Inc.

➢ Laboratory Corporation of America Holdings

➢ Catalent, Inc

Note: This report is readily available for

immediate delivery. We can review it with you in a meeting to ensure data

reliability and quality for decision-making.

📥 Download

Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/5314

Pharmaceutical CDMO Market Segmentation Insights

Service Types Insights

Why Do Active pharmaceutical ingredients continue to reign Supreme in CDMO services?

Active pharmaceutical ingredients remain the anchor of CDMO demand because they form the scientific and commercial backbone of drug manufacturing. Their complexity, regulatory stringency, and need for specialized infrastructure make outsourcing not just economical but strategically essential for pharma companies.

CDMOs dominate this space by offering deep process expertise, scalable capacity, and continuous innovation in synthesis and purification. As drug pipelines expand into high-potency APIs and niche therapeutic categories, CDMOs solidify their position as the preferred partners for API production.

Finished dosage formulations are accelerating rapidly as pharma companies seek turnkey partners who can convert molecules into patient-ready products with speed and precision. The surge in complex dosage forms such as controlled-release tablets, injectables, and biologic delivery systems has amplified the need for specialized CDMO capabilities. Companies value integrated solutions that cover formulation, packaging, stability testing, and commercial production under one roof. This holistic model positions FDF services as the fastest-growing and most sought-after segment in the CDMO sphere.

Research Phase Insights

Why phase III is Climbing the Stairs in Pharmaceutical CDMO Market?

Phase III trials dominate CDMO utilisation because they represent the most resource-intensive and operationally demanding stage of clinical research. At this point, drug candidates require large-scale production, stringent quality protocols, and efficient global distribution all of which CDMOs are optimally equipped to deliver. Sponsors prefer outsourcing during this phase to minimise risk, enhance cost efficiency, and meet accelerated regulatory timelines. As Phase III success becomes the final gateway to market approval, CDMO partnerships become indispensable.

Phase II continues to be the fastest-growing segment because the surge in late-stage pipelines demands rapid scale-up and sophisticated manufacturing expertise. With more biopharmaceuticals advancing to late-stage development, CDMOs are increasingly relied upon to ensure consistency, compliance, and seamless production transitions.

The pressure to shorten time-to-market further amplifies outsourcing needs, especially for complex biologics and novel delivery platforms. This makes Phase III a pivotal growth engine, driving long-term expansion in CDMO capabilities and infrastructure.

✚ Related Topics You May Find Useful:

➡️ Active Pharmaceutical Ingredients (API) CDMO Market: Explore how global pharma outsourcing is accelerating demand for high-quality API development and manufacturing

➡️ Pharmaceutical CDMO for Formulations Market: Discover how formulation innovation and dosage optimization are reshaping drug development strategies

➡️ Small Molecule Innovator CDMO Market: Track how R&D pipelines and early-stage innovation are boosting demand for agile small-molecule CDMOs

➡️ Ophthalmic Drug CDMO Market: Understand how rising vision disorders and sterile delivery systems are expanding ophthalmic outsourcing needs

➡️ Sterile Injectables CDMO Market: Analyze how aseptic manufacturing and biologics growth are transforming sterile injectable production

➡️ Pharmaceutical Manufacturing Market: Gain insights into how advanced technologies and global supply networks are reshaping pharma production

➡️ Investigational New Drug (IND) CDMO Market: See how accelerated clinical timelines and regulatory readiness are driving demand for IND-focused CDMOs

➡️ Vaccine CDMO Market: Explore how global immunization programs and complex biologics are fueling large-scale vaccine outsourcing

➡️ Topical Drugs CDMO Market: Discover how skin-friendly formulations and dermatology innovations are boosting demand for topical drug manufacturing

➡️ AI-Integrated CDMO Process Optimization Market: Learn how AI-driven automation and predictive analytics are redefining CDMO efficiency and quality control

➡️ Biologics CDMO Market: Understand how monoclonal antibodies, cell therapies, and biosimilars are reshaping the biologics outsourcing landscape

➡️ Pharmaceutical Contract Manufacturing Market: Analyze how end-to-end outsourcing solutions are evolving to meet the needs of global pharma companies

What is going around the globe?

Across the world, the clinical trials landscape is undergoing a profound transformation, shaped by technological leaps, shifting regulatory mindsets, and evolving expectations from patients and sponsors.

Countries are racing to modernize their trial ecosystems, not just to attract global research but to accelerate therapies from bench to bedside. A strong emphasis is emerging on quicker approvals, real-world data integration, and decentralized models that make trials more accessible and inclusive.

Top Companies in the Pharmaceutical CDMO Market

➢ Thermo Fisher Scientific Inc.

➢ Samsung Biologics

➢ Laboratory Corporation of America Holdings

➢ Siegfried Holding Ag

➢ Catalent, Inc

➢ Lonza Group AG

➢ Recipharm Ab

➢ Piramal Pharma Solutions

➢ Cordenpharma International

➢ Cambrex Corporation

➢ Wuxi Apptec

Pharmaceutical CDMO Market Competitive Landscape

Industry Leaders: What Sets Them Apart

These companies dominate because they offer scale, global manufacturing networks, biologics capabilities, and comprehensive one-stop solutions.

|

Company |

Key Strengths |

Why It Matters for Decision-Makers |

|

Lonza Group |

Strong biologics manufacturing, HPAPI expertise, large global footprint. |

Ideal partner for complex molecules and long-term biologics pipelines. |

|

Catalent Inc. |

Advanced oral solid dose, gene therapy capabilities, strong fill-finish network. |

Perfect fit for companies scaling biologics and viral vector production. |

|

Thermo Fisher Scientific |

End-to-end CDMO model, biologics + small molecules, global capacity expansion. |

De-risking partner with diversified capabilities across modalities. |

|

Samsung Biologics |

Massive biomanufacturing capacity, rapid scale-up, high compliance. |

Best choice for speed-to-market and large-volume biologics production. |

|

Fujifilm Diosynth |

Strong in microbial & mammalian biologics, cutting-edge facilities. |

Suited for companies needing quality biologics development + manufacturing. |

Emerging Powerhouses: Who’s Rising Fast

These CDMOs shine because they are agile, innovation-driven, and often offer competitive pricing.

|

Company |

Strengths |

Strategic Advantage |

|

Wuxi AppTec / Wuxi Biologics |

Flexible “follow the molecule” model, strong biologics pipeline support. |

Favored by startups & mid-size biotechs for speed and integrated services. |

|

Siegfried Holding |

API-focused, strong presence in regulated markets. |

Great for companies needing reliable API quality and scale. |

|

Recipharm |

Strong FDF portfolio, sterile manufacturing. |

Advantageous for inhalation, injectables, and niche formulations. |

|

Cambrex |

Small molecule APIs, drug substance innovation. |

Solid partner for early-stage and late-stage small-molecule clients. |

Specialized / Niche CDMOs: Perfect for Targeted Needs

These companies excel in specific, high-value segments.

|

Niche |

Leading CDMOs |

Why Consider Them |

|

Cell & Gene Therapy CDMOs |

Catalent, Thermo Fisher, Lonza, Wuxi Advanced Therapies |

Ideal for ATMP pipelines where expertise and compliance are critical. |

|

High-Potency APIs (HPAPI) |

Lonza, Sterling Pharma, Piramal Pharma |

Best for oncology and specialty drugs. |

|

Fill-Finish / Injectable Specialists |

Vetter Pharma, Baxter BioPharma Solutions |

Perfect for sterile manufacturing with high regulatory standards. |

Pharmaceutical CDMO Market Segmentation

By Service Type

🔹Active Pharmaceutical Ingredient (API) Manufacturing

→ Small Molecule

→ Large Molecule

→ High Potency (HPAPI)

🔹Finished Dosage Formulation (FDF) Development and Manufacturing

→ Solid Dose Formulation

→ Liquid Dose Formulation

→ Injectable Dose Formulation

🔹Secondary Packaging

By Research Phase

🔹Pre-clinical

🔹Phase I

🔹Phase II

🔹Phase III

🔹Phase IV

By Region

🔹North America

🔹Europe

🔹Asia-Pacific

🔹Latin America

🔹Middle East and Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/2936

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Digital Therapeutics: How software-based interventions are restructuring chronic-disease management and clinical-grade behavioral therapy

➡️ Life Sciences Growth: Forces driving expansion across biotech, biopharma, and advanced therapeutic platforms

➡️ Viral Vector Gene Therapy Manufacturing: Manufacturing constraints, scalability limits, and innovations shaping next-generation gene-delivery systems

➡️ Wellness Transformation: How prevention-centric health models are shifting consumer behavior, product pipelines, and care delivery

➡️ Generative AI in Healthcare: How generative models are unlocking new diagnostics, clinical automation, and patient-care innovations

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: