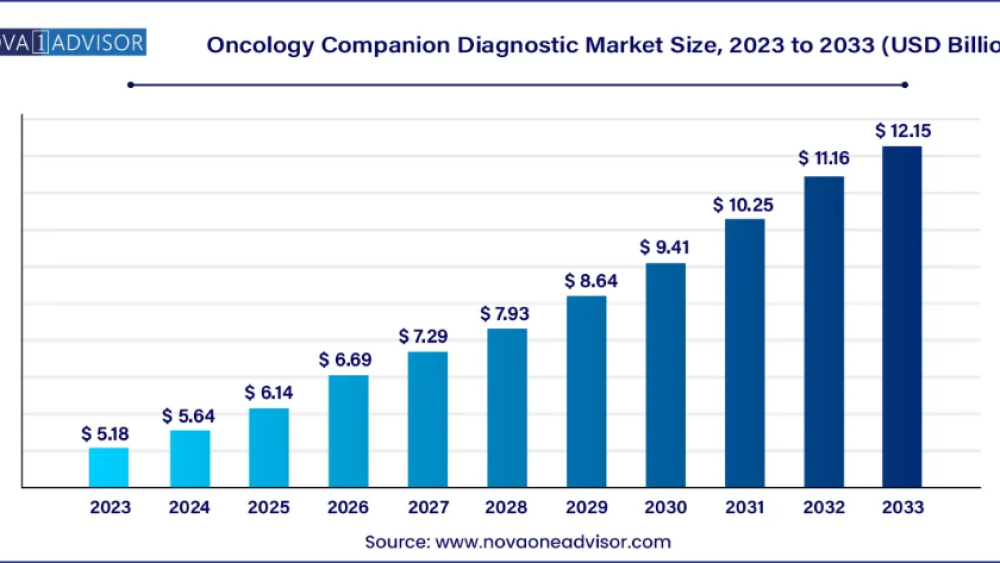

According to Nova One Advisor, the global oncology companion diagnostic market size was USD 5.18 billion in 2023, calculated at USD 5.64 billion in 2024 and is expected to reach around USD 12.15 billion by 2033, expanding at a CAGR of 8.9% from 2024 to 2033.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8852

The growth of the market is attributed to the rising emphasis on personalized medicine, the growing adoption of companion diagnostics, and the increasing prevalence of cancer. The demand for oncology companion diagnostic technologies and tests is fueled by the increasing prevalence of cancers globally. For instance, 48% of survivors in the United States have lived more than 10 years since their diagnosis, in 2022. In the United States, there are 623,405 people living with bladder, colorectal, lung, prostate, and breast cancer or metastatic melanoma and that number is expected to increase to 693,452 by the year 2025.

Companion diagnostics can improve the treatment impacts of various diseases by offering doctors with clear clinical grounds for treatment, diagnosis, and proper management of national insurance policies and patient resources by minimizing unwanted treatment of costly targeted chemotherapy drugs. This market is anticipated to witness significant growth over the forecast period due to the reduction in the cost of new drug development and increasing demand for targeted agents.

In addition, the increasing expansion of clinical trials for novel cancer treatments, rising precision medicine advancements, growing availability of targeted cancer therapies, rising cancer cases globally, and rising advancements in genomic technologies such as next-generation sequencing are further expected to drive the growth of the oncology companion diagnostic market. Furthermore, the major beneficiaries of theranostic such as clinicians, regulatory agencies, pharmaceutical companies, and patients. Theranostics helps in clinical trial costs, targeted recruitment of patients, and reducing time. Additionally, the increasing focus on the development of new companion diagnostic tests for early-stage cancer treatment and detection is another driver estimated to drive market growth.

U.S. Oncology Companion Diagnostic Market Size, Industry Report, 2033

The U.S. oncology companion diagnostic Market size was estimated at USD 1.46 billion in 2023, USD 1.59 billion in 2024, and is expected to grow at a CAGR of 9.4% to reach USD 3.58 billion by 2033.

North America dominated the market with largest revenue share of 40.19% in 2023. The dominance of the region is attributed to the presence of substantial healthcare expenditure and advanced healthcare infrastructure that are accelerating the adoption of diagnostic technologies. Additionally, leading biotechnology firms and research institutions are dedicated to emerging advanced diagnostic methods.

U.S. oncology companion diagnostic market trends

The rising competition among biotechnology companies, increasing FDA approvals for tests, rising significant technological advancements, increasing rapid adoption of companion diagnostics, and increasing prevalence of cancer is expected to drive the market growth in the U.S.

Asia Pacific is expected to grow fastest during the forecast period.

The increasing number of local companies entering the market, a growing population, enhanced infrastructure, and healthcare reforms are anticipated to accelerate the growth of the oncology companion diagnostic market in the region. In addition, the region is a significant focus for oncology advancements, with a high cancer prevalence and large population. China, India, Japan, and South Korea are the major countries in the market.

China oncology companion diagnostic market trends

China is expected to grow fastest during the forecast period due to the aging population, dietary habits, and lifestyle changes. To treat the CDx, companies are engaged in developing new therapies in China. To improve access to novel oncology therapies, the Chinese government has implemented a series of efforts.

Europe accounted for a significant share of the global oncology companion diagnostic market. This can be attributed to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost clinical research prospects in the region.

UK oncology companion diagnostic market is growing primarily due to the presence of advanced healthcare infrastructure, strategic collaborations, and introduction of innovative products are expected to drive market growth in the UK.

Oncology companion diagnostic market in France is expected to grow over the forecast period. Companies and research institutes are entering several unique partnerships to offer in-house CDx genomic testing for cancer patients in France, significantly enhancing market growth by improving diagnostic precision and personalized treatment options.

Germany oncology companion diagnostic market in is expected to witness substantial growth. The rising incidence of cancer disease is anticipated to boost demand for CDx products over the forecast period.

Latin America Oncology Companion Diagnostic Market Trends

Latin America oncology companion diagnostic market was identified as a lucrative region in this industry. The region has experienced significant growth in precision medicine technology, driven by various initiatives to boost R&D. Furthermore, collaborations among pharmaceutical companies, diagnostics firms, and service providers are enhancing access to precision medicine technologies.

The oncology companion diagnostic market in Brazil is expected to grow over the forecast period. The market is evolving with advancements in genetic testing technologies and a growing emphasis on precision medicine, driven by collaborations between global innovators and local healthcare providers.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8852

Oncology Companion Diagnostic Market Segmentation Insights

By product and service types, the Products segment led the market.

Products segment dominated the market with a share of 66.32% in 2023 due to the increasing prevalence of cancer and advancements in personalized medicine. This segment includes several types of products such as software, consumables, and instruments. These diagnostics aid oncologists' treatment plans based on the molecular profile of patients' tumors, reducing adverse effects and improving treatment efficacy. Regulatory bodies including the U.S. Food and Drug Administration developed regulations to approve companion diagnostics and ensure that these tests are effective and safe before they launch the market.

Polymerase Chain Reaction (PCR) segment dominated the market with a share of 22.19% in 2023. Real-time PCR assays are available in the market to provide high sensitivity and specificity and make them the go-to method for cancer diagnosis. For analyzing cancer markers, real-time PCR techniques are favorable options. In addition, in clinical laboratories, real-time PCR provides advantages such as the preservation of precious samples for tumor profiling, internal controls, low reagent costs, and simultaneous analysis of multiple genes.

Non-small cell lung cancer segment dominated the market with a share of 30.13% in 2023. The growing number of Non-small Cell Lung Cancer cases globally is a key driver for the market. The increasing prevalence improves the urgent need for effective diagnostic equipment to inform treatment decisions, thereby fueling market growth.

Hospitals segment dominated the oncology companion diagnostic market with a share of 52.11% in 2023. Hospitals typically have a wide array of cancer diagnostic tests. Due to the high prevalence of cancer and an aging population, hospitals are witnessing an increase in the use of cancer diagnostic products over the past few years. With the growing adoption, hospitals are increasingly embracing advancements in diagnostics. The evolution of hospital laboratories plays a vital role in meeting the changing demands of patients. Consequently, more healthcare facilities are striving to offer a diverse array of services within their environments. Hospitals are increasingly investing in advanced diagnostic technologies and collaborating with pharmaceutical companies to enhance their capabilities in personalized cancer treatment. For instance, in May 2023, the newly launched Rapid Cancer Diagnostic Service (RCDS) at NHS Borders represents a significant advancement in early cancer detection, particularly for patients presenting with vague, nonspecific symptoms.

Pathology/Diagnostic laboratory segment is anticipated to grow at fastest growth over the forecast period. The Pathology/Diagnostic laboratory plays a crucial role in the oncology companion diagnostic market. These labs are responsible for developing and implementing tests that help identify specific biomarkers in cancer patients, enabling the selection of appropriate targeted therapies. They work closely with pharmaceutical companies, healthcare providers, and patients to ensure accurate test results & effective treatment decisions. The establishment of advanced laboratories dedicated to companion diagnostic development is a significant driver of the pathology/diagnostic labs segment in the market. For instance, in July 2024, Danaher is planning to establish a CLIA and CAP-certified laboratory in the UK, followed by another facility in the U.S.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8852

Oncology companion diagnostic market insights.

Some of the major players operating in the market such as Merck KGaA, Illumina Inc., Agilent Technologies, Inc., Thermo Fisher Scientific Inc., And others. These major players are included in emerging novel Next-Generation Sequencing products, IHC systems, kits, and panels that provide sequencing efficiency and portability. Research and Development belongs to the introduction of advanced technologies in collaboration with biotechnology and pharmaceutical companies. These players have significant product portfolios with a focus on investing more in R&D activities and the presence of advanced products.

EntroGen, Inc., Guardant Health, Inc., Biosystems, and others are the major developing market participants in the market. To gain a competitive edge, these players are collaborating with other local and major players. These players focus on regional growth by exploring possibilities to develop services, NGS platforms, and companion diagnostics that enable clinical testing in laboratories.

Browse More Insights:

The following are the leading companies in the oncology companion diagnostic market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Oncology Companion Diagnostic market.

By Product & Services

About Us

Nova One Advisor is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Nova One Advisor has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defines, among different ventures present globally.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8852

The growth of the market is attributed to the rising emphasis on personalized medicine, the growing adoption of companion diagnostics, and the increasing prevalence of cancer. The demand for oncology companion diagnostic technologies and tests is fueled by the increasing prevalence of cancers globally. For instance, 48% of survivors in the United States have lived more than 10 years since their diagnosis, in 2022. In the United States, there are 623,405 people living with bladder, colorectal, lung, prostate, and breast cancer or metastatic melanoma and that number is expected to increase to 693,452 by the year 2025.

Companion diagnostics can improve the treatment impacts of various diseases by offering doctors with clear clinical grounds for treatment, diagnosis, and proper management of national insurance policies and patient resources by minimizing unwanted treatment of costly targeted chemotherapy drugs. This market is anticipated to witness significant growth over the forecast period due to the reduction in the cost of new drug development and increasing demand for targeted agents.

In addition, the increasing expansion of clinical trials for novel cancer treatments, rising precision medicine advancements, growing availability of targeted cancer therapies, rising cancer cases globally, and rising advancements in genomic technologies such as next-generation sequencing are further expected to drive the growth of the oncology companion diagnostic market. Furthermore, the major beneficiaries of theranostic such as clinicians, regulatory agencies, pharmaceutical companies, and patients. Theranostics helps in clinical trial costs, targeted recruitment of patients, and reducing time. Additionally, the increasing focus on the development of new companion diagnostic tests for early-stage cancer treatment and detection is another driver estimated to drive market growth.

- In June 2023, the U.S. Food and Drug Administration announced a new voluntary pilot program for certain oncology drug products used with certain corresponding in vitro diagnostic tests to help clinicians select appropriate cancer treatments for patients.

- North America dominated the market with largest revenue share of 40.19% in 2023.

- The Asia-Pacific market is expected to witness the fastest CAGR of over the projected period

- Products segment dominated the market with a share of 66.32% in 2023

- Services segment is expected to register fastest CAGR during the forecast period.

- Polymerase Chain Reaction (PCR) segment dominated the market with a share of 22.19% in 2023.

- Next-generation Sequencing (NGS) segment is expected to register fastest CAGR during the forecast period.

- Non-small cell lung cancer segment dominated the market with a share of 30.13% in 2023.

- Breast cancer segment is expected to register fastest CAGR during the forecast period.

- Hospitals segment dominated the oncology companion diagnostic market with a share of 52.11% in 2023.

- Pathology/Diagnostic laboratory segment is anticipated to grow at fastest growth over the forecast period.

U.S. Oncology Companion Diagnostic Market Size, Industry Report, 2033

The U.S. oncology companion diagnostic Market size was estimated at USD 1.46 billion in 2023, USD 1.59 billion in 2024, and is expected to grow at a CAGR of 9.4% to reach USD 3.58 billion by 2033.

North America dominated the market with largest revenue share of 40.19% in 2023. The dominance of the region is attributed to the presence of substantial healthcare expenditure and advanced healthcare infrastructure that are accelerating the adoption of diagnostic technologies. Additionally, leading biotechnology firms and research institutions are dedicated to emerging advanced diagnostic methods.

U.S. oncology companion diagnostic market trends

The rising competition among biotechnology companies, increasing FDA approvals for tests, rising significant technological advancements, increasing rapid adoption of companion diagnostics, and increasing prevalence of cancer is expected to drive the market growth in the U.S.

- For instance, In April 2024, the approval of the CE Mark for the VENTANA® HER2 (4B5) Rabbit Monoclonal Primary Antibody RxDx* was announced by Roche to identify metastatic breast cancer patients with low HER2 expression for whom ENHERTU® may be considered as a targeted treatment.

Asia Pacific is expected to grow fastest during the forecast period.

The increasing number of local companies entering the market, a growing population, enhanced infrastructure, and healthcare reforms are anticipated to accelerate the growth of the oncology companion diagnostic market in the region. In addition, the region is a significant focus for oncology advancements, with a high cancer prevalence and large population. China, India, Japan, and South Korea are the major countries in the market.

China oncology companion diagnostic market trends

China is expected to grow fastest during the forecast period due to the aging population, dietary habits, and lifestyle changes. To treat the CDx, companies are engaged in developing new therapies in China. To improve access to novel oncology therapies, the Chinese government has implemented a series of efforts.

- For instance, In September 2023, a leading biopharmaceutical company CStone Pharmaceuticals announced the launch of “Human platelet-derived growth factor receptor alpha (PDGFRA) Gene D842V Mutation Detection Kit” a companion diagnostic kit. CStone Pharmaceuticals focuses on the commercialization, development, and research of innovative precision medicines and immuno-oncology therapies.

Europe accounted for a significant share of the global oncology companion diagnostic market. This can be attributed to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost clinical research prospects in the region.

UK oncology companion diagnostic market is growing primarily due to the presence of advanced healthcare infrastructure, strategic collaborations, and introduction of innovative products are expected to drive market growth in the UK.

Oncology companion diagnostic market in France is expected to grow over the forecast period. Companies and research institutes are entering several unique partnerships to offer in-house CDx genomic testing for cancer patients in France, significantly enhancing market growth by improving diagnostic precision and personalized treatment options.

Germany oncology companion diagnostic market in is expected to witness substantial growth. The rising incidence of cancer disease is anticipated to boost demand for CDx products over the forecast period.

Latin America Oncology Companion Diagnostic Market Trends

Latin America oncology companion diagnostic market was identified as a lucrative region in this industry. The region has experienced significant growth in precision medicine technology, driven by various initiatives to boost R&D. Furthermore, collaborations among pharmaceutical companies, diagnostics firms, and service providers are enhancing access to precision medicine technologies.

The oncology companion diagnostic market in Brazil is expected to grow over the forecast period. The market is evolving with advancements in genetic testing technologies and a growing emphasis on precision medicine, driven by collaborations between global innovators and local healthcare providers.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8852

Oncology Companion Diagnostic Market Segmentation Insights

By product and service types, the Products segment led the market.

Products segment dominated the market with a share of 66.32% in 2023 due to the increasing prevalence of cancer and advancements in personalized medicine. This segment includes several types of products such as software, consumables, and instruments. These diagnostics aid oncologists' treatment plans based on the molecular profile of patients' tumors, reducing adverse effects and improving treatment efficacy. Regulatory bodies including the U.S. Food and Drug Administration developed regulations to approve companion diagnostics and ensure that these tests are effective and safe before they launch the market.

- For instance, In June 2023, the FDA issued final guidance, Pilot Program, oncology drugs products used with certain in vitro diagnostic tests, to describe and announce the FDA’s voluntary pilot program for certain CDER-regulated oncology drug products utilized with certain in vitro diagnostic tests.

Polymerase Chain Reaction (PCR) segment dominated the market with a share of 22.19% in 2023. Real-time PCR assays are available in the market to provide high sensitivity and specificity and make them the go-to method for cancer diagnosis. For analyzing cancer markers, real-time PCR techniques are favorable options. In addition, in clinical laboratories, real-time PCR provides advantages such as the preservation of precious samples for tumor profiling, internal controls, low reagent costs, and simultaneous analysis of multiple genes.

- For instance, In March 2023, Qiagen and Servier announced a collaboration to develop a companion diagnostic test to detect acute myeloid leukemia patients whose cancers harbor IDH1 mutations, making them investigational targeted therapies and eligible for Servier's approval.

Non-small cell lung cancer segment dominated the market with a share of 30.13% in 2023. The growing number of Non-small Cell Lung Cancer cases globally is a key driver for the market. The increasing prevalence improves the urgent need for effective diagnostic equipment to inform treatment decisions, thereby fueling market growth.

- For instance, In October 2022, the US Food and Drug Administration (FDA) approved the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody* to identify metastatic breast cancer patients with low HER2 expression for whom Enhertu® may be considered as a targeted treatment was announce by Roche.

Hospitals segment dominated the oncology companion diagnostic market with a share of 52.11% in 2023. Hospitals typically have a wide array of cancer diagnostic tests. Due to the high prevalence of cancer and an aging population, hospitals are witnessing an increase in the use of cancer diagnostic products over the past few years. With the growing adoption, hospitals are increasingly embracing advancements in diagnostics. The evolution of hospital laboratories plays a vital role in meeting the changing demands of patients. Consequently, more healthcare facilities are striving to offer a diverse array of services within their environments. Hospitals are increasingly investing in advanced diagnostic technologies and collaborating with pharmaceutical companies to enhance their capabilities in personalized cancer treatment. For instance, in May 2023, the newly launched Rapid Cancer Diagnostic Service (RCDS) at NHS Borders represents a significant advancement in early cancer detection, particularly for patients presenting with vague, nonspecific symptoms.

Pathology/Diagnostic laboratory segment is anticipated to grow at fastest growth over the forecast period. The Pathology/Diagnostic laboratory plays a crucial role in the oncology companion diagnostic market. These labs are responsible for developing and implementing tests that help identify specific biomarkers in cancer patients, enabling the selection of appropriate targeted therapies. They work closely with pharmaceutical companies, healthcare providers, and patients to ensure accurate test results & effective treatment decisions. The establishment of advanced laboratories dedicated to companion diagnostic development is a significant driver of the pathology/diagnostic labs segment in the market. For instance, in July 2024, Danaher is planning to establish a CLIA and CAP-certified laboratory in the UK, followed by another facility in the U.S.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8852

Oncology companion diagnostic market insights.

Some of the major players operating in the market such as Merck KGaA, Illumina Inc., Agilent Technologies, Inc., Thermo Fisher Scientific Inc., And others. These major players are included in emerging novel Next-Generation Sequencing products, IHC systems, kits, and panels that provide sequencing efficiency and portability. Research and Development belongs to the introduction of advanced technologies in collaboration with biotechnology and pharmaceutical companies. These players have significant product portfolios with a focus on investing more in R&D activities and the presence of advanced products.

EntroGen, Inc., Guardant Health, Inc., Biosystems, and others are the major developing market participants in the market. To gain a competitive edge, these players are collaborating with other local and major players. These players focus on regional growth by exploring possibilities to develop services, NGS platforms, and companion diagnostics that enable clinical testing in laboratories.

Browse More Insights:

- Oncology Market : The global oncology market size was estimated at USD 222.36 billion in 2023 and is projected to hit around USD 521.60 billion by 2033, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

- Biologics Market : The global biologics market size was estimated at USD 511.04 billion in 2023 and is projected to hit around USD 1,374.51 billion by 2033, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

- Non-small Cell Lung Cancer Therapeutics Market: The global non-small cell lung cancer therapeutics market size was valued at USD 19.85 billion in 2023 and is anticipated to reach around USD 66.20 billion by 2033, growing at a CAGR of 12.8% from 2024 to 2033.

- Cancer Immunotherapy Market : The global cancer immunotherapy market size was valued at USD 126.19 billion in 2023 and is projected to surpass around USD 296.01 billion by 2033, registering a CAGR of 8.9% over the forecast period of 2024 to 2033.

- U.S. Precision Medicine Market: The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033

The following are the leading companies in the oncology companion diagnostic market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Foundation Medicine, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd.

- BioMérieux

- Abbott

- Leica Biosystems

- Guardant Health, Inc.

- EntroGen, Inc.

- In November 2023, Agilent Technologies, Inc announced that the FDA approved the PD-L1 IHC 22C3 pharmDx diagnostic test to identify patients with gastric or gastroesophageal junction adenocarcinoma who are eligible for treatment with the PD-1 inhibitor pembrolizumab.

- In November 2023, The FDA approved a companion diagnostic test to identify patients with advanced HR-positive, HER2-negative breast cancer who are eligible for treatment with the combination of capivasertib (Truqap, AstraZeneca Pharmaceuticals) and fulvestrant. FDA also announced the approval of the FoundationOne CDx assay as a companion diagnostic device to recognize patients with breast cancer for treatment with fulvestrant with capivasertib.

- In April 2023, Merck announced the acquisition of Prometheus Biosciences, Inc., a biotechnology company specializing in the development of precision therapies for immune-mediated diseases. The acquisition aimed to strengthen Merck’s immunology pipeline and expand its capabilities in precision medicine.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Oncology Companion Diagnostic market.

By Product & Services

- Product

- Instrument

- Consumables

- Software

- Services

- Polymerase Chain Reaction (PCR)

- Next-generation Sequencing (NGS)

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)/Fluorescence In Situ Hybridization (FISH)

- Other Technologies

- Breast Cancer

- Non-small Cell Lung Cancer

- Colorectal Cancer

- Leukemia

- Melanoma

- Prostate Cancer

- Others

- Hospital

- Pathology/Diagnostic Laboratory

- Academic Medical Center

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

About Us

Nova One Advisor is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Nova One Advisor has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defines, among different ventures present globally.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/