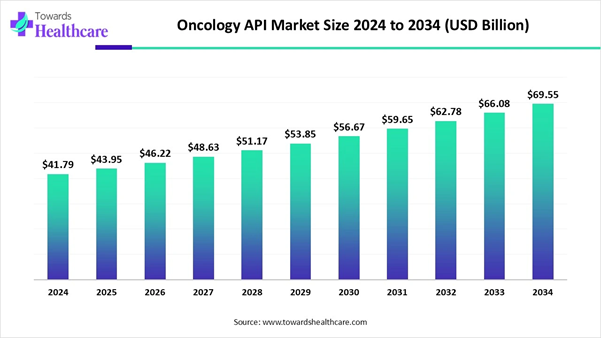

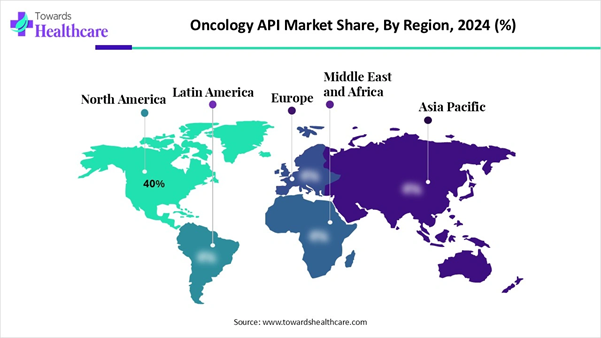

According to market projections, the global oncology API market, valued at USD 41.79 billion in 2024, is anticipated to reach USD 69.55 billion by 2034, growing at a CAGR of 5.24% over the next decade. The rising prevalence of cancer and the growing demand for personalized medicines bolster market growth. The availability of state-of-the-art research and development facilities and favorable regulatory landscapes contribute to North America’s dominance.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6105

Key Takeaways

➤ Oncology API sector pushed the market to USD 41.79 billion by 2024.

➤ Long-term projections show USD 69.55 billion valuation by 2034.

➤ Growth is expected at a steady CAGR of 5.24% in between 2025 to 2034.

➤ North America held a major revenue share of approximately 40% in the market in 2024.

➤ Asia-Pacific is expected to host the fastest-growing market in the coming years.

➤ By product type, the synthetic oncology APIs segment dominated the market with a share of approximately 55% in 2024.

➤ By product type, the biologic oncology APIs segment is expected to witness the fastest growth in the market over the forecast period.

➤ By drug class, the chemotherapy APIs segment accounted for the highest revenue share of approximately 35% in the market in 2024.

➤ By drug class, the targeted therapy APIs segment is expected to expand rapidly in the market in the coming years.

➤ By manufacturing type, the captive/in-house manufacturing segment led the market with a share of approximately 60% in 2024.

➤ By manufacturing type, the contract/outsourced manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period.

➤ By formulation use, the oral drugs segment registered its dominance over the global market with a share of approximately 45% in 2024.

➤ By formulation use, the injectable drugs segment is expected to show the fastest growth over the forecast period.

➤ By distribution channel, the direct supply to pharma companies segment contributed the biggest revenue share of approximately 50% in the market in 2024.

➤ By distribution channel, the contract development & manufacturing organizations (CDMOs/CMOs) segment is expected to grow with the highest CAGR in the market during the studied years.

How oncology API Market Powering the Next Era of Therapeutics?

The oncology API market is undergoing a change due to significant change as cancer treatment is becoming more beleaguered, potent, and personalized. Producers are progressively moving their production to highly controlled, contamination-free, free environments to be able to fulfill the rigorous standards set for cancer drugs.

Simultaneously, pharma innovators' collaborations with API producers are deepening to formulation speed, and thus, they can provide a scalable supply sooner. The shift to biologics and next-gen modalities is affecting the development, test, and manufacture of APIs. In general, the market is at a strong point of convergence between scientific breakthroughs and the urgent global need, which, thus, makes oncology APIs one of the most vibrant segments in the pharmaceutical landscape.

Key Indicators and Highlights

|

Table |

Scope |

|

Market Size in 2025 |

USD 43.95 Billion |

|

Projected Market Size in 2034 |

USD 69.55 Billion |

|

CAGR (2025 - 2034) |

5.24% |

|

Leading Region |

North America 40% |

|

Market Segmentation |

By Product Type, By Drug Class, By Manufacturing Type, By Formulation Use, By Distribution Channel, By Region |

|

Top Key Players |

Pfizer Inc., Novartis AG, Bristol-Myers Squibb, Roche Holding AG, Merck & Co., Inc., AstraZeneca PLC, Johnson & Johnson (Janssen Pharmaceuticals), Eli Lilly and Company, Amgen Inc., Sanofi S.A., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Lupin Pharmaceuticals, Biocon Ltd., WuXi AppTec, Lonza Group AG, Samsung Biologics |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Authoritative Forces Are Fueling the Surge of the Oncology API Market?

The oncology API market volume is going up on the global demand for cancer treatments that are more precise, potent, and targeted. As oncologists are moving away from broad, spectrum chemotherapies and towards personalized and molecularly defined therapies, manufacturers must produce APIs of that have unprecedented purity and complexity. The rise of immunotherapies, antibodies drug conjugates, and next, gen small molecules to the utmost level aggravates the need for advanced API capabilities.

Pharmaceutical companies are also giving more oncology API production work to third parties to have faster development timelines and supply continuity that is reliable. On the other hand, regulatory bodies are elevating quality expectations must get cleaner, more sophisticated production systems ready. All these scientific, clinical, and operational forces are, in fact, creating big momentum behind the rapid expansion of the oncology API market.

What Hidden Barriers Are Still Holding Back the Oncology API Market’s Full Potential?

Through the rise of the oncology API market, it is still facing a step set of challenges that originate from the complexity of modern cancer drugs. Most of the oncology APIs require ultra-high purity and multi-step synthesis, thus the manufacturing is both technically challenging and very expensive. The plants must work under very strict contamination-free, free conditions, and if there is even a slight deviation, it can result in the entire batch being discarded.

The regulatory expectations are getting higher; thus, the manufacturers feel even more pressure to upgrade their equipment, documentation, and quality systems. Supply chain vulnerabilities, mainly for very important parts such as critical raw materials and specialized intermediates, are causing slow production timelines. These scientific, regulatory, and operational barriers that are interwoven with each other make scaling oncology API manufacturing one of the most difficult challenges in the pharmaceutical industry.

Regional Insight

Why Does North America Continue to Dominate the Oncology API Market?

North America is dominating the Oncology API market by 40%, driven by the region of the three biggest research ecosystems, pharmaceutical and biotech, that are the most advanced in the world. Across the region, companies are flooding with money, high-potency API facilities to help them to make a shift toward targeted cancer therapies and complicated formulations. The strong presence of oncology, focused innovators, combined with deep access to capital, continues to drive manufacturers to frequently change technology and augment production lines. Although being very strict, regulatory clarity acts as a growth promoter because it gives companies a stable quality framework within which they can operate. The large-scale partnerships between API manufacturers, cancer research institutes, and pharma companies are speeding up the development and commercialization as well.

What Makes Asia Pacific the Fastest, Growing Powerhouse?

Asia Pacific is fastest growing in the Oncology API market, because the countries there in are swiftly expanding their pharmaceutical manufacturing capabilities and pouring money into high, potency production infrastructure. The region combines very efficiently priced manufacturing with the rapidly growing talent pool that is highly skilled in chemistry, biologics, and advanced oncology processes.

A progressive cancer burden in the whole of Asia is also speeding up domestic demand for high-quality APIs, thereby pushing manufacturers to expand their capacity at a rate that has never been seen before. To remain competitive globally, many companies have decided to switch production from traditional small-molecule to complex oncology APIs. The governments in the region are all advocating for API self-sufficiency, thus there is more money and incentives for high-potency API capabilities.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segment Insights

Product Type

Why Synthetic Oncology is Oncology API Market?

The synthetic oncology is dominating oncology API market, due to the essence, synthetics form the basic framework of various long-established cancer treatments. These APIs utilize familiar chemical processes, which enable producers to quickly augment their output with the required quality and stability by using the same batch. Since they are relatively cheap, these APIs easily reach the whole world markets, especially in the developing countries where healthcare budgets are low.

A numerous of cancer drugs are still made of complex small molecules, which are thus categorized as synthetics. The production facilities for synthetic APIs are already available in most places, thereby making the journey from production to the market quite short. Consequently, synthetic oncology APIs remain the cornerstone on which most of the present cancer treatment strategies are constructed.

Biologic oncology APIs constitute the fastest-growing area as cancer treatment progresses from general cytotoxic drugs to specific, immune, based therapies. These APIs are the main characters in such techniques as monoclonal antibodies, antibody, drug conjugates, and cellular immunotherapies, all of which require sophisticated biological engineering. The fact that these drugs can kill cancer cells selectively while at the same time causing very little harm to the healthy ones is what makes them the most preferred in the field of oncology today. As the clinical pipelines become heavily loaded with biologics, the manufacturers are henceforth speeding up their efforts to build bioprocessing facilities under high containment. Moreover, these APIs require the most advanced purification and cold, chain arrangements as well, which in turn are resulting in massive investments and technological upgrades in those fields. With an improvement in clinical success rates, biologic oncology APIs are reshuffling the roadmap of cancer therapeutics at a very high speed.

Drug Class

Why is Chemotherapy APIs is Oncology API Market?

Chemotherapy APIs are still in a dominating position because they are generally kept as frontline, combination, or supportive therapies in the global cancer care of various patients. A wide range of health systems mainly depend on the use of classic chemotherapeutics due to their already proven results and affordable cost structures. The manufacturers have certainty of quality and stability because the production processes for those APIs have already reached full maturity.

Targeted therapy APIs are the fastest, growing group because cancer is a disease that requires precision-based interventions. They are engineered to intervene in the specific molecular pathways which result in less harmful side, effects and at the same time more efficacious treatment. The utilization of these drugs is gaining ground very fast as a result of patient selection through genomics and biomarker. Some leading pharma companies have decided to put their money mainly in the development of targeted agents thereby creating a higher demand for advanced API skills.

On the other hand, these APIs need complicated synthesis and high purity levels, so they catalyze great innovation in API manufacturing technologies. Now that personalized medicine is on its way to becoming a norm, targeted therapy APIs are witnessing staggering growth.

Manufacturing Type

Why is captive/in-house Manufacturing is Oncology API Market?

Captive/in-house manufacturing is dominating the oncology API market, due to have absolute control over the production of highly toxic oncology APIs. Internal handling of synthesis makes it possible for the company to have closer supervision of not only the purity but also safety and compliance, which, are very important aspects in cancer drugs. Moreover, it is a way for the company to protect its proprietary chemistry and keep the secrets safe. By having the in, house capacity run with a big oncology portfolio, the company is lowering the risk of external providers and making the supply more stable. Usually, these facilities grow in parallel with a company's R&D requirements, thus highly integrated internal ecosystems are formed. Due to this operational and strategic control, captive manufacturing is still the main approach outsourced manufacturing is growing change fastest as a segment will be affected by the pressures from the side of companies related to cost, complexity, and speed.

The requirements that several organizations decide not to invest in them on their own. CDMOs provide an already established expertise, easy regulatory compliance, and a quick increase in production scale. Besides that, outsourcing leads to shorter development timelines since companies get access to worldwide manufacturing networks. A particularly advantageous situation is for smaller biotech firms that can take this route to easily and quickly get access to top, level facilities without investing a lot of capital. In brief, the external manufacturing option is turning into the most used way for the provision of oncology APIs in a rapidly and flexible manner.

Formulation Use

Why are oral drugs is Oncology API Market?

The oral drugs are dominating the oncology API Market, due great comfort they provide and hence they are very suitable for cancer patients who are able to self, manage therapy at home and thus are not obliged to go to hospital for infusion treatment. Also, they can easily be incorporated into modern treatment regimens whose main goal is to improve patients' quality of life and therapy adherence. Most of the small molecules used in cancer treatment are also ideal for oral administration.

Producers in the pharma industry are also more willing to adopt oral dosage forms because they are less complicated in terms of logistics and require less sterilization procedures. The flourishing business of oral targeted therapies is one of the main factors behind the rapid growth of this segment. All points together are still enough to justify why oral oncology APIs are leading in the field of formulation.

Injectable oncology APIs are increasing in popularity at a high rate as the biologics, immunotherapies, and sophisticated targeted agents take the lead in the new pipelines. A good number of the novel cancer treatments, best of monoclonal antibodies and cell, based therapies, are not orally deliverable. These treatments demand sterile, high, containment facilities which leads the production of specialized injectable API facilities to an extension. The handling of these drugs is becoming easier and more accessible in hospitals and infusion centers which in turn leads to their accelerated use.

Moreover, injectables can provide the most accurate dosing and highest bioavailability which are very important for the treatment of life, threatening conditions. For all these reasons, injectable oncology APIs have become a dominant force among different formulation categories and their growth rate has been the highest.

By Distribution Channel

Why is Direct Supply is Oncology API Market?

Direct supplies are dominating the oncology API Market, because companies wish to use safe and traceable channels for the deliverance of their high, potency APIs. To pharmaceutical manufacturers, direct relationships facilitate the closest supervision of quality, proper documentation, and adherence to regulations. This system also allows for a quicker reaction when production changes or emergency batches are needed. Long, term supply contracts which facilitate direct procurement are usually negotiated by big pharma companies. The reason why the direct supply is still very trusted is the sensitivity of oncology APIs, where even small deviations can have a great impact on the effectiveness. Consequently, it is the dominant distribution mode which has been used up till now.

Contract Development and Manufacturing Organizations (CDMOs) are becoming an essential part of the supply chain in the pharmaceutical industry. Their rapid growth can be attributed to the increasing reliance of companies on CDMOs for both manufacturing and supply needs. This shift allows businesses to focus on core activities while leveraging the expertise of CDMOs. As the demand for customized and efficient production rises, CDMOs are stepping up to meet these challenges. They provide flexibility and scalability, making it easier for companies to adapt to changing market conditions. Consequently, CDMOs are transforming the way products are developed and brought to market, fueling innovation and efficiency in the industry.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments in the Oncology API Market:

➤ In May 2025, Lonza announced the launch of its new model-based platform for small-molecule API process development. The Design2Optimize platform uses a statistical / model-based “design of experiments (DoE)” approach to optimize reaction conditions reducing trial-and-error in synthesis and accelerating timelines from molecule design to manufacturing.

➤ In April 2024, the API Innovation Center announced a milestone in establishing a U.S.-based manufacturing route for the active pharmaceutical ingredient for lomustine a key chemotherapy drug used in brain cancer (glioblastoma) treatment. This was done via continuous-flow manufacturing technology and a partnership with Apertus Pharmaceuticals.

Top Companies in the Oncology API Market

Pfizer Inc.

Novartis AG

Bristol-Myers Squibb

Roche Holding AG

Merck & Co., Inc.

AstraZeneca PLC

Johnson & Johnson (Janssen Pharmaceuticals)

Eli Lilly and Company

Amgen Inc.

Sanofi S.A.

Teva Pharmaceutical Industries Ltd.

Dr. Reddy’s Laboratories

Cipla Ltd.

Sun Pharmaceutical Industries Ltd.

Aurobindo Pharma

Lupin Pharmaceuticals

Biocon Ltd.

WuXi AppTec

Lonza Group AG

Samsung Biologics

Segments Covered in the Report

By Product Type

● Synthetic Oncology APIs

○ Small molecules for chemotherapy and targeted therapies

● Biologic Oncology APIs

○ Monoclonal antibodies, fusion proteins, and immunotherapy-based APIs

By Drug Class

● Chemotherapy APIs

○ Platinum compounds, alkylating agents, antimetabolites

● Targeted Therapy APIs

○ Tyrosine kinase inhibitors (TKIs), PARP inhibitors

● Immunotherapy APIs

○ Checkpoint inhibitors (PD-1/PD-L1, CTLA-4)

● Hormonal Therapy APIs

○ Aromatase inhibitors, anti-estrogens

● Others

○ Vaccines, emerging oncology classes

By Manufacturing Type

● Captive/In-house Manufacturing

● Contract/Outsourced Manufacturing

By Formulation Use

● Oral Drugs

○ Capsules, tablets (TKIs, chemotherapy)

● Injectable Drugs

○ IV infusions, biologics, monoclonal antibodies

● Others

By Distribution Channel

● Direct Supply to Pharma Companies

● Contract Development & Manufacturing Organizations (CDMOs/CMOs)

● API Traders & Distributors

By Region

● North America

● Asia Pacific

● Europe

● Latin America

● Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6105

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest