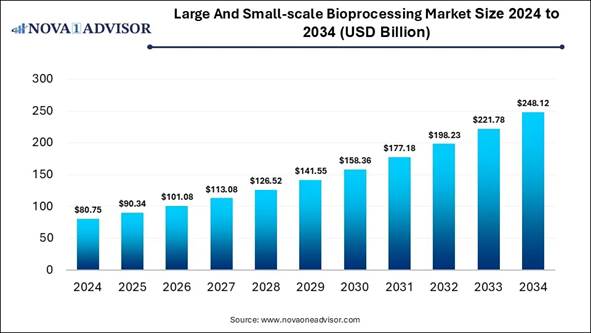

According to Nova One Advisor, the global large and small-scale bioprocessing market size is calculated at USD 80.75 billion in 2024, grows to USD 90.34 billion in 2025, and is projected to reach around USD 248.12 billion by 2034, growing at a CAGR of 11.88% from 2025 to 2034.

The large and small-scale bioprocessing market is expanding because this bioprocessing is significant to manufacturing progressive biotherapies and products for public use. Bioprocess provides many advantages, from vaccines, cell therapies, and biofuels to food. Due to its consequences and potential outcomes, bioprocessing has become one of the main fields of biotechnology in the world.

Small-scale bioprocessing use in food production, waste management, research and development, and other applications includes biofuel production, biosensors, and single-use systems, while large-scale bioprocessing use is in vaccine production, biopharmaceutical manufacturing, industrial fermentation, Stem Cell therapies, renewable energy sources, and other applications.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/9189

Large and Small-scale Bioprocessing Market Highlights:

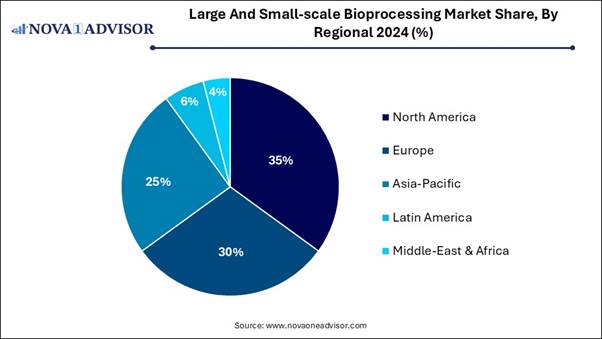

• North America dominated the global large and small-scale bioprocessing market, accounting for the largest share in 2024.

• Asia Pacific is expected to show the fastest growth in the market over the forecast period.

• By scale, the industrial scale segment dominated the market with the largest revenue share in 2024.

• By scale, the small-scale segment is expected to show the fastest growth during the forecast period.

• By workflow, the downstream processing segment accounted for the highest market share in 2024.

• By workflow, the fermentation segment is expected to register strong growth in the market during the predicted timeframe.

• By product, the bioreactors/ fermenters segment held the biggest market share in 2024.

• By product, the cell culture products segment is expected to register the fastest growth over the forecast period.

• By application, the biopharmaceuticals segment dominated the market, generating the highest revenue share in 2024.

• By application, the specialty industrial chemicals segment is expected to register significant growth in the market during the predicted timeframe.

• By use type, the multi-use segment generated the highest market revenue share in 2024.

• By use type, the single-use segment is expected to register significant growth during the forecast period.

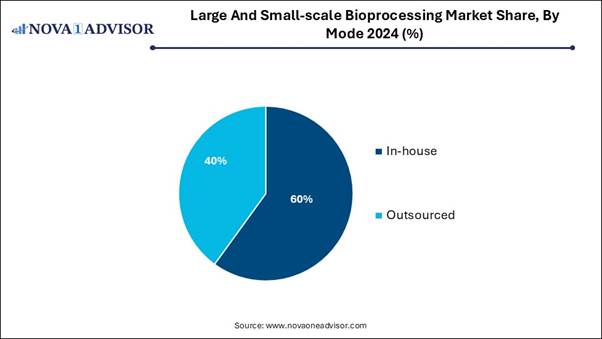

• By mode, the in-house segment captured the highest market share in 2024.

• By mode, the outsourced segment is expected to grow at a significant CAGR over the forecast period.

Market Overview and Industry Potential

The large and small-scale bioprocessing market is expanding due to bioprocessing is the creation of valuable products through the use of a living thing, frequently cells or cell components, viruses, or an entire organism. Finish products, anything from biofuels produced from algae, or antibiotics formed from mold, like penicillin. Bioprocessing hardware integrates an extensive range of gear for specific capacities and applications. The stages of bioprocessing comprise media preparation, selection of biocatalyst and its optimisation, volume production, downstream processing, and purification.

How are Recent Advancements in Bioprocessing Promoting the Growth of the Market?

Recent advancements in automated bioprocessing offer many advantages to the biopharmaceutical sector, including better process control, improved product quality, lower variability, augmented throughput and effectiveness, and cost savings. The application of automation in bioprocessing has revolutionized the industry, enabled real-time control of the manufacturing process and improved product quality.

This results in enhanced process control and optimization, lowering the challenges of deviations and enhancing product quality. Automation platforms offer a comprehensive solution for electronic reports and audit trails, offering upstream (USP) or downstream bioprocessing (DSP) process engineers increasing access to process automation and data analysis, which drives the growth of the market.

What are Latest Trends of the Market

⬥︎ In February 2025, Union Budget 2025 catalyses next-generation startups with novel funds. BIRAC welcomes the government’s visionary move to expand the Fund of Funds (FFS) to Rs 20,000 crore. This initiative significantly improves access to capital for startups, driving revolution and entrepreneurship across different sectors, including biotechnology.

⬥︎ In August 2024, the Department of Biotechnology (DBT) launched the BioE3 Policy aimed at advancing high-performance biomanufacturing. This initiative focuses on innovation through integrated research and scale-up support, bridging the gap between discovery and commercialization. Key components of the program include Bio-Foundry, Bio-Enabler Hubs such as Bio-Artificial Intelligence Hubs for innovation and Biomanufacturing Hubs for scaling operations.

Growing Trends of Outsourcing: Market’s Largest Potential

The increasing trend of outsourcing biomanufacturing processes is gaining traction. Biopharmaceutical companies are advancing the expertise of contract development and manufacturing organizations (CDMOs) to modernize production, lowering expenses, and increasing quality. This shift is reforming the inexpensive landscape of the large and small-scale bioprocessing market.

Outsourcing enables a business enterprise to focus on the actions that are more significant to it. Worldwide outsourcing allows for to location of freelancers or contractors from a global pool with more dedicated skills and abilities than can be found domestically.

⬥︎ For Instance, In May 2025, BioMarin Pharmaceutical Inc. and Inozyme Pharma, Inc. announced that BioMarin has entered into a definitive agreement to acquire Inozyme for $4.00 per share in an all-cash transaction for a total consideration of approximately $270 million. The transaction has been unanimously approved by the Boards of Directors of both companies and is expected to close in the third quarter of 2025, subject to regulatory approval, successful completion of a tender offer, and other customary closing conditions.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/9189

Report Scope of Large And Small-scale Bioprocessing Market

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 90.34 Billion |

|

Market Size by 2034 |

USD 248.12 Billion |

|

Growth Rate From 2025 to 2034 |

CAGR of 11.88% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2034 |

|

Segments Covered |

Scale, Workflow, Product, Application, Use Type, Mode, Region |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Key Companies Profiled |

Avantor, Inc, Bio-Process Group, Bio-Synthesis, Inc., BPC Instruments AB, CESCO BIOENGINEERING CO., LTD, CerCell A/S, Corning Inc., Danaher (Cytiva), Distek, Inc., Entegris, Eppendorf AG,ExcellGene SA, F. Hoffmann-La Roche Ltd, Getinge AB, KUHNER AG, Lonza, Meissner Filtration Products, Inc., Merck KGaA, PBS Biotech, Inc., Repligen Corporation, Saint-Gobain, Sartorius AG, Thermo Fisher Scientific, Inc., Univercells Technologies |

Large and Small-scale Bioprocessing

Market Segmentation Analysis: By Scale Analysis: The industrial scale segment dominates in

the cell

and gene therapy contract research organization market, as

bioprocessing lowers the carbon footprint of production and helps reduce

pollution. This allows for high-yield production. The applications of

microorganisms in bioprocessing mean that large quantities of products can be

produced in a limited period. This is due to microorganisms reproducing

quickly, permitting the production of large quantities of product in a short

period. On the other hand, the small-scale segment is

expected to grow significantly during the forecast period, as it lowers the

expenses is another key advantage attracting bioprocessing industries to

single-use solutions. Compared to outdated equipment, single-use solutions are

cheaper and simpler to install, lowering initial capital investment. This

bioprocessing system surges the productivity of manufacturing processes as a

result of reducing expenses and complexity of automation and removal of the

requirement for changeover cleaning/validation between consecutive operations. By Workflow Analysis: The downstream

processing segment dominated the market in 2024, as this processing

comprises the separation and purification by means of centrifugation,

chromatography, and filtration of the cells generated throughout the downstream

bioprocessing step. Downstream processing often regulates the economic

probability of the procedure. The first operation is cell separation, which is

done through cross-flow microfiltration. On the other hand, the fermentation segment

is expected to grow at the fastest CAGR in the market during the forecast

period, as it provides an accurate and controlled environment for the growth of

microorganisms that are used to manufacture food ingredients such as vinegar,

casein, yeast, and other fermented dairy and protein products, or ice cream.

The manufacturing of sources of substitute plant-based, protein animal protein

alternatives for plant-based foods, additions, and alternative egg white and

meat products is also possible using this process. By Product Analysis: The bioreactors/ fermenters segment dominated

the market in 2024, as it allows large-scale cultivation with close-fitting

environmental control, enhancing yields and consistency. They bridge the gap

from lab bench to manufacturing production by making conditions that are

problematic to attain in basic shake flasks or petri dishes. Bioreactors offer

a closed, sterile system, lowering contamination challenges and enabling cells

to be grown for longer periods or to advanced densities than in open cultures. On the other hand, the cell culture

products segment is expected to grow at the fastest CAGR in the market during

the forecast period, as cell culture is one of the significant tools used in

cellular and molecular biology, offering excellent model systems for reviewing

the usual physiology and biochemistry of cells, the effects of medicines and

poisonous compounds on the cells, and mutagenesis and carcinogenesis. It is

also used in drug screening and development, and large-scale manufacturing of

biological compounds. By Application Analysis: The biopharmaceuticals

segment dominated the market in 2024, as this process is a quickly developing

landscape that is reforming the way biopharmaceuticals are produced, promising

enhanced efficiency, reduced expenses, and faster approval for life-saving

medicines. Bioprocessing plays a significant role in the advancement and

production of advanced pharmaceuticals, with vaccines, monoclonal antibodies,

and gene therapies providing safer and more efficient treatments for a broad

range of diseases. On the other hand, the specialty industrial

chemicals segment is expected to grow at the fastest CAGR in the market during

the forecast period, as bioprocesses need mild reaction conditions, are more

specific and efficient, and produce renewable by-products. The advancement of

recombinant DNA

technology has prolonged and extended the potential of bioprocesses. By Use-Type Analysis: The multi-use segment generated the highest

market revenue share in 2024, as the use of recyclable equipment in

biopharmaceutical engineering. These procedures include equipment such as

stainless-steel bioreactors and media preparation systems that are cleaned and

sterilized between batches to produce different products, providing advantages

in scalability and cost-effectiveness. On the other hand, the single-use segment

is expected to grow at the fastest CAGR in the market during the forecast

period, extensive adoption of single-use bioprocessing technologies. The

advantages include reduced challenges of cross-contamination, improved

flexibility in scaling production, and faster setup times. The rise in demand

for single-use systems (SUS) and devices is transforming the production of

vaccines and biologics. By Mode Analysis: The in-house segment generated the highest

market revenue share in 2024, as this manufacturing allows to do product

development to be done as rapidly and as economically as possible because

consumers have control over it. Thus, in-house strategies can be serious for

CGT entrants and drug developers that intend to become an entirely integrated

organization. On the other hand, the outsourced segment

is expected to grow at the fastest CAGR in the market during the forecast

period, as outsourcing processes are emerging as an opportunity for businesses

to optimize their operations, lower costs, and improve overall efficiency. By Regional Insights Which Region Dominated the Large and

Small-scale Bioprocessing Market in 2024? North America dominated the large and

small-scale bioprocessing market in 2024, due to the growing application of AI

and machine learning in bioprocessing is enhancing process optimization,

prognostic maintenance, and quality control. These technologies are allowing

more intelligent and adaptive manufacturing processes, hypothetically leading

to noteworthy improvements in efficacy and product quality. The US strategies for regulating

biotechnology vary from those characteristically embraced in the region. North

America with an estimated 2,840 to 6,653 active firms, which is increasing

demand for the bioprocessing market. ⬥︎ For Instance, In April 2025,

BioProcess360 Partners announced the formation of ChromaGenix, a new

biotechnology company focused on advancing downstream purification technologies

for emerging biotherapeutics. The company has been formed through the transfer

of intellectual property, core assets, and scientific personnel from LigaTrap

Technologies, LLC, a platform technology company originally spun out of North

Carolina State University (NC State). In the United States, there were 2,435

biotechnologies in the US businesses as of 2024, a rise of 3.0% from 2023.

California and Massachusetts are hubs for the most biotech firms in the US,

which drives the growth of the market. Why Asia Pacific is the Fastest Growing

in the Large and Small-scale Bioprocessing Market? In Asia Pacific, increasing government

support for biotechnology R&D, rising demand for biologics, and rising

applications of biotech in personalized medicine, particularly in the

healthcare sector. Growing private funding and increasing government grants in

the region support biotech companies in adapting to technological advancements,

which contributes to the growth of the market. ⬥︎ For Instance, In July 2025, Asahi

Kasei Life Science, a division of diversified global manufacturer Asahi Kasei,

announced plans to construct a new spinning plant for its Planova virus removal

filters in Nobeoka City, Miyazaki, Japan. The new facility will be the

company’s fourth spinning plant for hollow-fiber cellulose membrane filters. Large and Small-scale Bioprocessing

Market Companies: • Bio-Synthesis, Inc. • CESCO BIOENGINEERING CO., LTD • CerCell A/S • Corning Inc. • Danaher (Cytiva) • Entegris • Eppendorf AG • ExcellGene SA • F. Hoffmann-La Roche Ltd • Getinge AB • KUHNER AG • Lonza • Meissner Filtration Products, Inc. • Merck KGaA • PBS Biotech, Inc. • Repligen Corporation • Saint-Gobain • Sartorius AG • Thermo Fisher Scientific, Inc. • Univercells Technologies What is Going Around the Globe? ⬥︎ In May 2025, DuPont expanded its

bioprocessing portfolio with the launch of DuPont AmberChrom TQ1 chromatography

resin for the purification of oligonucleotides and peptides in support of a

wide range of biopharma applications. ⬥︎ In June 2025, Ecolab Life Sciences

launched its novel Purolite AP+50 affinity chromatography resin at the

Biotechnology Innovation Organization (BIO) International Convention. The new

resin can optimize operations during the antibody manufacturing process. ⬥︎ In January 2025, Repligen Corporation, a life

sciences company focused on bioprocessing technology leadership, announced the

commercial launch of its CTech SoloVPE PLUS System, the most advanced UV-based

Variable Pathlength Technology system now available to biopharmaceutical

manufacturers. The SoloVPE PLUS System is engineered to offer unparalleled

accuracy, speed, and ease-of-use for at-line ultraviolet-visible (UV-Vis)

concentration measurement in complex biological production workflows, from

process development scale through cGMP manufacturing. ⬥︎ In April 2025, Culture

Biosciences, headquartered in South San Francisco, Calif., announced

the launch of Stratyx 250, which the company said in a press release is the

first mobile, cloud-integrated bioreactor that is designed to provide biotech

companies with simultaneous flexibility, automation, and remote process

control. You can place an order or ask any

questions, please feel free to contact at sales@novaoneadvisor.com |

+1 804 441 9344 Related Report ⬥︎ U.S. Large And Small-scale Bioprocessing Market - https://www.novaoneadvisor.com/report/us-large-and-small-scale-bioprocessing-market

⬥︎ U.S. Single-use Bioprocessing Market - https://www.novaoneadvisor.com/report/us-single-use-bioprocessing-market

⬥︎ Single-use Bioprocessing Market - https://www.novaoneadvisor.com/report/single-use-bioprocessing-market

⬥︎ India Single-use Bioprocessing Probes And Sensors Market - https://www.novaoneadvisor.com/report/india-single-use-bioprocessing-probes-and-sensors-market

⬥︎ Single-use Bioprocessing Probes & Sensors Market - https://www.novaoneadvisor.com/report/single-use-bioprocessing-probes-sensors-market

⬥︎ Single-use Bioprocessing Probes And Sensors Market - https://www.novaoneadvisor.com/report/single-use-bioprocessing-probes-and-sensors-market

Segments Covered in the Report This report forecasts revenue growth at

country levels and provides an analysis of the latest industry trends in each

of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc.

has segmented the large and small-scale bioprocessing market. By Scale • Industrial Scale (Over 50,000 Litres) • Small Scale (Less Than 50,000 Litres) By Workflow • Downstream Processing • Fermentation • Upstream Processing By Product • Bioreactors/Fermenters • Cell Culture Products • Filtration Assemblies • Bioreactors Accessories • Bags & Containers • Others By Application • Biopharmaceuticals • Speciality Industrial Chemicals • Environmental Aids By Use Type • Multi-Use • Single-Use By Mode • In-house • Outsourced By Regional • North America • Europe • Asia Pacific • Latin America • Middle East and Africa (MEA) Immediate Delivery Available | Buy This

Premium Research https://www.novaoneadvisor.com/report/checkout/9189

About-Us Nova One Advisor is a global leader

in market intelligence and strategic consulting, committed to delivering deep,

data-driven insights that power innovation and transformation across

industries. With a sharp focus on the evolving landscape of life sciences, we

specialize in navigating the complexities of cell and gene therapy, drug

development, and the oncology market, enabling our clients to lead in some of

the most revolutionary and high-impact areas of healthcare. Our expertise spans the entire

biotech and pharmaceutical value chain, empowering startups, global

enterprises, investors, and research institutions that are pioneering the next

generation of therapies in regenerative medicine, oncology, and precision

medicine. Web: https://www.novaoneadvisor.com/ Contact Us USA: +1 804 420 9370 Email: sales@novaoneadvisor.com For Latest Update

Follow Us: LinkedIn