According to Nova One Advisor, the global Genomics Market size is expected to be worth around 176.28 billion by 2034, increasing from USD 37.95 billion in 2024, representing a healthy CAGR of 16.6% from 2025 to 2034.

Genomics emerged as a ground-breaking approach in the medical care system by providing personalized strategies that encourage longevity and wellness services. Genomics involves using data from an individual’s genes and their interaction with environmental factors to guide medical care decisions. By analysing the genetic makeup of a person, healthcare providers gain a deeper understanding related to the tendency towards some health conditions, enabling more accurate and proactive care of individual.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/6825

Genomics Market Key Takeaways

· North America led the global market in 2024.

· Europe is projected to expand at a notable CAGR during the forecast period.

· The hormone replacement therapy (HRT) segment contributed the highest market share in 2024.

· The specialty drugs segment is estimated to be the fastest-growing segment during the forecast period.

· The adult cohort segment captured the biggest market share in 2024.

· The pediatric cohort segment is expected to grow at a significant CAGR from 2025 to 2034.

· The Non-sterile compounding segment contributed the highest market share in 2024.

· The sterile compounding segment is estimated to be the fastest-growing segment during the forecast period from 2025 to 2034.

· The pharmaceutical ingredient alteration (PIA) segment contributed the highest market share in 2024.

· The currently unavailable pharmaceutical manufacturing (CUPM) segment is estimated to be the fastest-growing segment during the forecast period from 2025 to 2034.

Market Overview and Industry Potential

The recent revolution of genomics, emphasized by the sequencing of the human genome, promises to transform how diseases are identified, prevented, and treated. It has huge potential to enhance global health.

Advancements in genomic technologies drive the market growth, it is allowing scientists to understand the essentials of biology and discover innovative ways to recover health of human. Through supporting scientists in their pursuit of novel and innovative ways to address scientific issues, it gives hope these revolutions will continue to involve in new genomic solutions and discoveries.

· For Instance, In April 2025, the Swedish government announced that it would fund Genomic Medicine Sweden (GMS) with SEK 80 million in 2025. This fund helps to continue efforts to develop and sustainably implement precision medicine in healthcare in the areas of cancer, rare diseases, and microbiology.

Transformation of Prenatal Health Through Genomics: Market’s Largest Potential

Recent advances in genomics and genetics testing have transformed prenatal diagnosis, allowing safer, earlier, and more specific detection of fetal abnormalities. These advanced technologies have intensely changed the present practice of prenatal testing and screening for genetic abnormalities in the fetus. Novel technologies improve the accuracy and scope of genetic testing, providing more comprehensive data about genetic health, which contributes to the growth of the market.

· For Instance, In May 2025, a groundbreaking move, Gene Solutions, a leader in prenatal and oncology genetic testing, and NEWCL Biomedical Laboratory, Taiwan's pioneering clinical laboratory with LDTs certification, have joined forces to establish an advanced Next-Generation Sequencing (NGS) laboratory in Taiwan.

U.S. genomics market Size and Growth 2025 to 2034

The U.S genomics market size is evaluated at USD 12.2 billion in 2024 and is projected to be worth around USD 57.2 billion by 2034, growing at a CAGR of 15.0% from 2025 to 2034.

North America dominated the global genomics market due to the development of recent technology, growing healthcare expenditure, and increasing awareness related to genetic disorders. The increasing prevalence of chronic diseases such as rare genetic conditions, cardiovascular diseases, and cancer is driving the demand for genetic testing. Strong presence of key players such as Illumina, Quest Diagnostics, Thermo Fisher Scientific, and many others, which are majorly investing in the research and development of genomics studies, all factors contribute to the growth of the genomics market.

· For Instance, In March 2025, Genome Canada announced the launch of the Canadian Precision Health Initiative (CPHI) with $81 million in Government of Canada investment. A total investment of $200 million is expected, including co-funding from industry, academia, and public sector partners.

The USA hosts several worldwide renowned research centres, various notable genomics projects, this is major drivers of the market. Growing healthcare investment by the U.S. government in addressing the intricate challenges of integrating genomics into public health, drives the market growth.

· For Instance, In February 2025, Foundation Medicine, Inc., a genomics company committed to transforming cancer care, announced plans to launch two new germline tests, Foundation One Germline and Foundation One Germline More, in the United States to identify genetic variants associated with hereditary cancers and can be used by healthcare providers to understand underlying challenges for patients and their families.

Asia-Pacific is expected to exhibit the fastest growth during the forecast period.

Increasing demand for prenatal and neonatal screening programs by applications of next-generation sequencing (NGS) technologies, rising adoption of genetic testing, which is causing the growth of the market. This growth is driven by the development of novel sequencing technologies, government support, and increasing partnerships between biotech companies and research institutions, drives the growth of the market.

· For Instance, In January 2025, the Indian Biological Data Centre (IBDC) will facilitate seamless access to valuable genetic information, enabling researchers to explore genetic variations and design more accurate genomic tools. The 10,000 whole-genome sequencing (WGS) samples come from diverse Indian populations and provide a rich catalog of genetic variations. This initiative is set to position India as a leader in genomics, allowing the development of genomic chips tailored to the Indian demographic, therefore improving the precision of genetic studies.

Genomics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 44.25 billion |

|

Revenue forecast in 2034 |

USD 176.28 billion |

|

Growth rate |

CAGR of 16.6% from 2025 to 2034 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, deliverables, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Agilent Technologies; Bio-Rad Laboratories, Inc.; BGI Genomics; Color Genomics, Inc.; Danaher Corporation; Eppendorf AG; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; GE Healthcare; Illumina Inc.; Myriad Genetics, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Quest Diagnostics Incorporated; Thermo Fisher Scientific, Inc.; 23andMe, Inc. |

Genomics Market Segmentation Analysis:

By Application Analysis:

The Functional genomics dominated the genomics market, as functional genomics can speed up the elucidation of the genetic etiology of pharmacologic sensitivity patterns. It has huge advantages, including enhancing understanding of disease, drug discovery, biomarker discovery, personalized medicine, and environmental applications.

On the other hand, the biomarker discovery segment is expected to grow significantly during the forecast period, as genomics biomarker allows scientists to create adequate data that spans the human genome and concurrently addresses a wide range of genetic challenges. Genomics biomarker contains numerous methods, including DNA-, RNA-, and methylation-based profiling on a global scale or at specific regions.

By Deliverables Analysis:

The products (instruments, systems, consumables, and reagents) segment held the largest share of the packaging testing market in 2024, as this product helps lessen the trials and failures in scientific research to some extent, which could advance the quantity and quality of genomics testing.

On the other hand, the services segment is expected to grow at a notable rate as services include NGS-based and computational genomics. This offers a view of multiple genetic variations at the same time, which is specifically helps in managing diseases. It requires lower sample input, provides huge accuracy, and capacity to detect variants at lower allele frequencies than with Sanger sequencing.

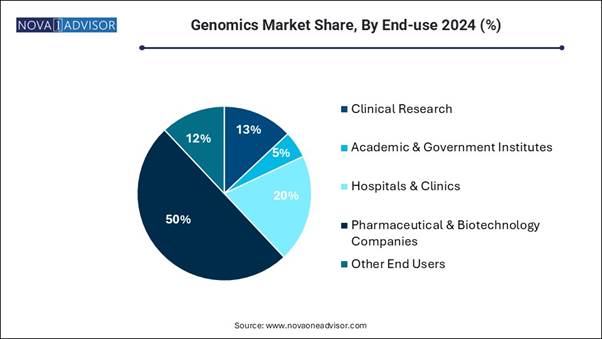

By End-user Analysis:

Academic and government institutes led the genomics market as genomics provides many advantages for academic and government institutions, such as advancements in disease understanding and management, improved healthcare practices, and a better understanding related human ancestry and evolution.

Hospitals and clinics are the fastest-growing segment as recent genome-wide or high-throughput multiple gene tests are emerging as a new hope for genetically affected patients; they provide rapid, affordable, and comprehensive analysis of genetic variation in hospitals and clinics. This is specifically interesting in disorders with huge genetic heterogeneity.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/6825

CGT Landscape:

|

Rank |

Organization Name |

Headquarters |

Description |

FDA-Approved CGT Products |

|

1 |

Bluebird Bio |

Somerville, MA, USA |

Gene therapies for genetic diseases |

Zynteglo, Skysona, Lyfgenia |

|

2 |

Novartis |

Basel, Switzerland |

Pioneer: CAR-T (Kymriah), Zolgensma (SMA) |

Kymriah, Zolgensma |

|

3 |

Gilead Sciences/Kite Pharma |

Foster City, CA, USA |

CAR-T therapies for oncology |

Yescarta, Tecartus |

|

4 |

Bristol Myers Squibb |

New York, NY, USA |

Multiple CAR-T approvals |

Abecma, Breyanzi |

|

5 |

Roche |

Basel, Switzerland |

Inherited retinal disease gene therapy |

Luxturna |

|

6 |

Pfizer |

New York, NY, USA |

Gene therapy in hemophilia B, others |

Beqvez |

|

7 |

BioMarin Pharmaceutical |

San Rafael, CA, USA |

Rare disease gene therapy (hem A) |

Roctavian |

Related Report

· AI In Genomics Market - https://www.novaoneadvisor.com/report/artificial-intelligence-in-genomics-market

· Forensic Genomics Market- https://www.novaoneadvisor.com/report/forensic-genomics-market

· U.S. Metagenomics Market- https://www.novaoneadvisor.com/report/us-metagenomics-market

· U.S. Consumer Genomics Market- https://www.novaoneadvisor.com/report/us-consumer-genomics-market

· U.S. Genomics Market- https://www.novaoneadvisor.com/report/us-genomics-market

· Europe Genomics Market - https://www.novaoneadvisor.com/report/europe-genomics-market

· U.S. Spatial Genomics & Transcriptomics Market- https://www.novaoneadvisor.com/report/us-spatial-genomics-transcriptomics-market

· Genomics In Cancer Care Market - https://www.novaoneadvisor.com/report/genomics-cancer-care-market

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the genomics market

By Application & Technology

- Functional Genomics

- Transfection

- Real-Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High-Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

By Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarrays

- Other technologies

By Deliverables

- Products

- Instruments/Systems/Software

- Consumables & Reagents

- Services

- NGS-based Services

- Core Genomics Services

- Biomarker Translation Services

- Computational Services

- Others

By End-use

- Clinical Research

- Academic & Government Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other End Users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/6825

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

You can place an order or ask any questions, please feel free to contact at sales@novaoneadvisor.com | +1 804 441 9344