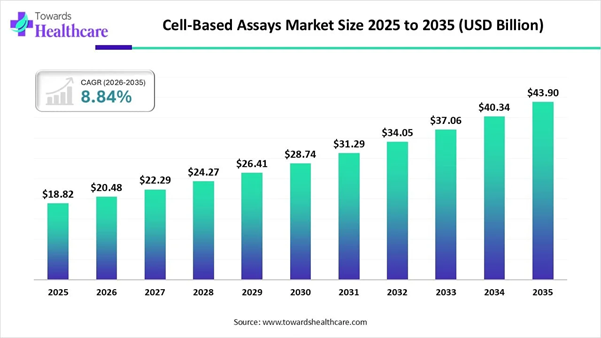

According to Towards Healthcare insight, the cell-based assays market is expected to grow from USD 18.8 billion in 2025 to USD 43.9 billion by 2035, driven by a CAGR of 8.84%. The cell-based assays market is growing because it is mainly applied in drug discovery and development, basic research, clinical trials, biomarker monitoring, and immunogenicity assessment. North America is dominated due to significant research funding and a robust healthcare infrastructure.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5965

Key Takeaways

➤ Cell-based assays market crossed USD 20.4 billion by 2026.

➤ Market projected at USD 43.9 billion by 2035.

➤ CAGR of 8.84% expected between 2026 to 2035.

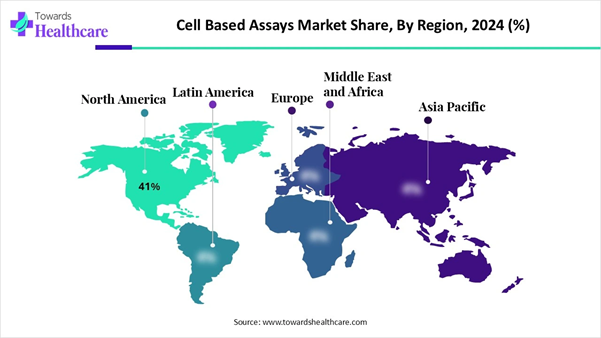

➤ North America is dominant in the cell-based assays market in 2024, with a revenue of 41%.

➤ Asia Pacific is estimated to grow at the fastest CAGR from 2025 to 2034.

➤ By product & service, the consumables segment for the largest market revenue in 2024, with a revenue of 34%.

➤ By product & service, the services segment is estimated to fastest-growing over the forecast period, 2025 to 2034.

➤ By application, the drug discovery segment is dominant in the market in 2024, with a revenue of 26%.

➤ By application, the predictive toxicology segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

➤ By technology, the high-throughput screening (HTS) segment is dominant in the cell-based assays market in 2024, with a revenue of 30%.

➤ By technology, the high content screening (HCS) segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

➤ By cell type, the immortalized cell lines segment is dominant in the market in 2024, with a revenue of 42%.

➤ By cell type, the induced pluripotent stem cells (iPSCs) segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

➤ By end user, the pharmaceutical & biotechnology companies’ segment is dominant in the cell-based assays market in 2024, with a revenue of 48%.

➤ By end user, the contract research organizations (CROs) segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

Why Are Cell-Based Assays Becoming the New Gold Standard in Modern Research?

The market for cell-based assay is on the rise as scientists are fast abandoning the use of simple biochemical tests in favor of models that replicate real biological responses more closely. Such assays provide a more accurate picture of the drugs behavior in living organisms, thereby making them indispensable for modern drug discovery and toxicity testing. Pharma companies use such assays increasingly to speed up their products' time-to-market and reduce the risk of clinical trial failures, which are quite expensive.

Meanwhile, progress in imaging, automation, and 3D cell culture is turning these assays into more potent and scalable ones. Academic institutions and biotech startups are also increasingly implementing cell-based systems in their quest for a deeper understanding of disease pathways. Together, the market is becoming a key component of pioneering biomedical research.

Key Indicators and Highlights

|

Metric |

Details |

|

Market Size in 2026 |

USD 20.4 Billion |

|

Projected Market Size in 2035 |

USD 43.9 Billion |

|

CAGR (2026 - 2035) |

8.84% |

|

Leading Region |

North America Share 41% |

|

Market Segmentation |

By Product & Service, By Application, By Technology, By Cell Type, By End User, By Region |

|

Top Key Players |

Thermo Fisher Scientific, Danaher Corporation, Becton, Dickinson and Company (BD), PerkinElmer, Merck KGaA, Lonza Group, Charles River Laboratories, Promega Corporation, GE HealthCare, Bio-Rad Laboratories, Corning Incorporated, Agilent Technologies, Eurofins Scientific, Cell Signaling Technology, Miltenyi Biotec, Abcam plc, DiscoverX (Eurofins), Cytek Biosciences, Sartorius AG, Revvity, Inc. |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Factors Are Driving the Rise of the Cell-Based Assays Market?

The demand for physiologically relevant testing systems in drug development is the prime factor that has led to the emergence of the cell-based assay market. As medical treatment pipelines grow increasingly complicated oncology, neurology, and immunology, in particular--researchers need assays that record cellular behaviours in real-time. Automation technologies and high-content imaging have transformed such assays into very efficient ones; hence, they can now be performed on a large scale in a very short period.

The worldwide effort to phase out animal testing serves as another impetus for cell-based assays as they are considered to be ethical and accurate. The trend towards personalized medicine is a great contributor to demand as patient-derived cells allow for individualized drug response studies. All these drivers together contribute to a radical change in the drug discovery, validation, and marketing processes.

What Barriers Still Hold Back the Cell-Based Assays Market?

Even though the market is booming, it is still constrained by some obstacles related to the cost of assays, complexity, and standardization. Several advanced assays require imaging systems that are expensive, high-quality cell lines, and skilled technicians, thus making it tough for small labs to adopt. At the same time, variations between cell batches make reproducibility difficult, which is a big problem in the drug development environment that is under strict regulation.

Among those 3D and co-culture systems that are also sophisticated, some take longer to be prepared thus the high-throughput workflows are slowed down. On the other hand, it can be quite difficult to incorporate automation in a lab that is shifting from the older manual techniques to the newer ones without it. These operational and technical prompts act as a barrier to the spread of the market despite its enormous potential.

Regional Insights

Why Does North America Lead the Global Cell-Based Assays Landscape?

North America is at the forefront of the market by 41% due to its tightly knit ecosystem of pharmaceutical innovators, biotech startups, and leading-edge academic research centers. The region witnesses substantial investment in high-throughput screening platforms, stem-cell-based assays, and sophisticated imaging technologies. With new drugs being developed rapidly in the fields of oncology and immunology, major pharmaceutical companies are increasingly turning to cell-based methods to provide these drugs with the necessary supporting data.

Besides that, funding agencies and venture capital companies also play the role of enablers for productivity-enhancing drug discovery technologies as they show great interest in the latter. In addition, the regulatory agencies in the area are quite supportive of in vitro procedures that have been validated and call for less use of animals in testing. All these things together confirm the reason why North America is the leading player in this market–her scientific aspiration, monetary power, and technological maturity.

What Makes Asia Pacific the Fastest-Rising Growth Engine?

On the one hand, through a robust expansion of their biopharma research infrastructure and by acquiring the best assay technologies, the countries in Asia Pacific region are really charging ahead. With the growing global focus on precision medicine and the presence of large patient populations, there is a solid demand for cell-based testing models. Across the region, research institutions are purchasing automation, imaging, and 3D cell culture equipment to be on a par with the world scientific community.

Governments are opening their coffers increasingly for life sciences research; thus, labs can now update and increase their capacities. The local biotech companies are turning into major drug discovery players and, hence, the demand for cell-based assays is rising further and faster. With its ever-growing skilled workforce and investment-friendly atmosphere, Asia Pacific is swiftly transforming into a major global hub of cell-based assay innovation.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segment Insights

Product & Service Insights

The consumables segment is still the major factor in the cell-based assay market, as laboratories require them for every single experiment, thus creating a continuous and recurring demand cycle. These are the bare necessities reagents, media, plates, dyes which designate the backbone of assay workflows; hence, they are indispensable despite any technological change. The category that has a constant need for replenishment thus has a natural momentum which cannot be matched by capital expenditures.

In addition, consumables give researchers the possibility to standardize conditions and keep reproducibility, thus, increasing their preference. The fast change in biological testing also facilitates the introduction of improved consumables, thus, the replacement demand is increased. If research intensity is growing, consumables will be the life force of this market.

Assay kits represent the segment that grows the fastest. This is mainly because kits provide researchers with convenience, consistency, and ready-to-use protocols, thus saving them a lot of time. Scientists do not have to build assays from scratch as they can simply use the validated kits which result in less variability and thus faster decision-making. The increasing complexity of biological questions is one of the factors that leads researchers to use kits that are designed with specialized biomarkers and functional endpoints.

This segment benefits from the desire of pharmaceutical companies to shorten development cycles and minimize risks in the early phases. The more sophisticated kits become integrating multiplex formats and automation-friendly designs the faster they are adopted. The growth mirrors the bigger change towards efficiency and plug-and-play experimentation.

Application Insights

Drug discovery is still the major application for cell-based assays as they depict more accurately the physiological conditions than biochemical tests. Scientists use them for the screening of molecules at an early stage, elimination of compounds that are not suitable, and the prioritization of the most promising ones. The pharmaceutical industry is very much in favor of these assays as they contribute to failure reduction in the late stages of the drug development process by giving more biologically relevant insights.

What is more, the increasing number of therapeutic pipelines is keeping the demand steady as each new target needs to be evaluated rigorously. The segment is further deepening its hold on the market through investment in sophisticated drug discovery tools. In total, it still has a great success record because it is the very first step of modern medicine.

Lead identification is the most rapidly expanding use case as companies are intensifying their efforts to detail promising candidates with accuracy. With cell-based assays developers can determine mechanism of action, potency, and toxicity, thus, in a single system selection is accelerated. The targeting of therapies, gene modulators, and biologics are areas where most interest is, and this, in turn, requires very advanced screening instruments which this segment is capable of.

The use of automation and analytical software serves the process of lead triaging thus making it more efficient and encouraging the movement to a broader level. In the light of pharma pipeline competition becoming fierce, the pressure of quickly finding high-quality leads gets even stronger. That is why this segment is growing rapidly, as companies decide that smart decision-making is more important than brute-force screening.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Technology Insights

High-throughput screening (HTS) is a leading technology because it allows scientists to test a vast number of compounds very quickly, thus the early stages of development are finished in a much shorter time. The big pharma companies are the main users of HTS platforms to handle their enormous libraries and speed up their discovery programs. The capacity of HTS to add on robotic systems, miniaturized assays, and automated data processing is what gives it the highest level of efficiency. Besides, HTS has also transformed to manage more complicated biological assays, thus, it is still a powerful and mature technology. Labs find it great in terms of scalability and consistency when it comes to delivering big data sets fast. If being quick is a factor that can give you the upper hand, HTS is going to stay on top.

High-content technologies are the fastest growing because they combine imaging, multiparametric analysis, and AI-driven insights to reveal deep biological behaviour. They allow researchers to look beyond simply yes-or-no outcomes and explore cellular morphology, signaling pathways, and subtle phenotypic changes. As precision medicine grows, this granularity becomes increasingly valuable. The merging of advanced optics with machine learning further accelerates adoption. High-content assays empower scientists to uncover mechanisms and refine compounds with confidence. This segment rises swiftly because it transforms cells into rich, information-dense systems rather than simple readouts.

Cell Type

Immortalized cell lines dominate as they are stable, cheap, and easy to look after, thus, making them a universal starting point for most labs. Their reproducibility is what ensures the same results for long-term studies and large-scale screenings. Researchers commend their sturdiness, especially in high-throughput settings. These cell lines have well-characterised profiles, which reduces experimental uncertainty. The pharmaceutical industry uses them to efficiently model basic cellular behaviours. Being easily accessible and dependable as workhorses, immortalized lines are the natural focal point of most cell-based assays.

Induced pluripotent stem cells (iPSCs) are the fastest-growing segment attributable to their capacity to replicate patient-specific biology and thus allow more personalised science. Their adaptability supports differentiation into various cell types, thus, facilitating advanced disease modelling. Scientist broaden the use of iPSCs to reflect genetic variability and investigate diseases that were previously hard to replicate. The growth in regenerative medicine and precision diagnostics is the reason why the demand for iPSC-based assays is soaring. Although they are technically challenging, their scientific worth is not disputable. The expansion of this segment is indicative of the market's move towards human-relevant, next-generation testing systems.

End User Insights

Pharmaceutical and biotech companies are the main drivers of demand at the end-user level as they largely depend heavily on cell-based assays in R&D stages. The main utilities for these assays are the validation of targets, optimization of compounds, safety assessment, and clinical outcome prediction. The increasing pipelines and mounting complexity of therapeutics are the main reasons for their dependence to strengthen further.

Big firms are making an investment in advanced assay platforms as a means of maintaining their competitivity. They have the financial power to rapidly adopt top technologies. This segment is the biggest concern of the drug development engine and thus it stays on a perpetuator level.

Contract research organizations (CROs) are the most rapidly expanding group of end-users. This is a result of the trend where companies are outsourcing the early stages of research to CROs as a method of cost and risk reduction. The biotech firms, especially the smaller ones, are the main beneficiaries of CROs whom they rely on for specialized assays, expertise, and infrastructure that they cannot maintain in their own facilities. CROs provide the great advantages of being flexible, scalable, and having a shorter turnaround period, thus, making them very attractive partners. In addition, their capability to quickly embrace cutting-edge assay platforms is also a reason behind their growing market share. The rise of global R&D partnerships is leading to the expansion of CROs in the same proportion.

Top Players in Cell-based Assays Market & Their Offerings:

|

Company |

Cell-Based Assay Offerings |

Focus / Strength |

|

Thermo Fisher Scientific |

Reagents, kits, instruments, 3D cell culture, multiplex assays |

Broad portfolio, advanced immunotherapy support |

|

Danaher Corporation |

Instruments, reagents, integrated assay platforms |

High throughput, automated assay workflows |

|

Becton, Dickinson and Company |

Flow cytometry instruments, reagents, automation integration |

Flow cytometry expertise, automation focus |

|

PerkinElmer |

Instrumentation, multiplex screening, reagents, assay kits |

High-throughput screening, automated solutions |

|

Merck KGaA |

Reagents, 3D/organoid assays, software, contract services |

Advanced 3D models, disease modeling |

|

Lonza Group |

Assay development, optimization, validation, CRO services |

Flexible outsourced assay development |

|

Charles River Laboratories |

Preclinical services including cell-based assays, safety testing |

Comprehensive preclinical and assay services |

|

Promega Corporation |

Assay kits, luminescence-based detection, viability and cytotoxicity assays |

Sensitive reporter assays, high-throughput |

|

GE HealthCare |

Imaging systems, cell analysis instruments, high-content screening |

Imaging and diagnostic-grade instrumentation |

|

Bio-Rad Laboratories |

Assay kits, reagents for cell signaling, viability, proliferation, multiplex immunoassays |

Reliable, validated assays for research & clinical labs |

Segments Covered in the Report

By Product & Service

• Consumables

○ Reagents & Buffers

○ Assay Kits

■ Reporter Gene Assays

■ Cell Viability Assays

■ Apoptosis Assays

■ Calcium Flux Assays

■ Others

○ Microplates

○ Probes & Labels

○ Others

• Instruments

○ High Content Screening Systems

○ Flow Cytometers

○ Automated Liquid Handling Systems

○ Plate Readers

○ Cell Imaging Systems

○ Others

• Software

○ Data Analysis & Management Software

○ Image Analysis Software

○ Others

• Services

○ Assay Development Services

○ Screening Services

○ Custom Cell Line Development

○ Others

By Application

• Drug Discovery

○ Lead Identification

○ Lead Optimization

• ADME Studies

• Toxicity Testing

• Basic Research

• Predictive Toxicology

• Cancer Research

• Stem Cell Research

• Others

By Technology

• High Throughput Screening (HTS)

• Flow Cytometry

• Label-Free Detection

• Automated Liquid Handling

• High Content Screening (HCS)

• Others

By Cell Type

• Primary Cells

• Stem Cells

○ Induced Pluripotent Stem Cells (iPSCs)

○ Embryonic Stem Cells (ESCs)

• Immortalized Cell Lines

Others

By End User

• Pharmaceutical & Biotechnology Companies

• Academic & Research Institutes

• Contract Research Organizations (CROs)

• Hospitals & Diagnostic Laboratories

• Others

By Region

• North America

○ U.S.

○ Canada

• Asia Pacific

○ China

○ Japan

○ India

○ South Korea

○ Thailand

• Europe

○ Germany

○ UK

○ France

○ Italy

○ Spain

○ Sweden

○ Denmark

○ Norway

• Latin America

○ Brazil

○ Mexico

○ Argentina

• Middle East and Africa (MEA)

○ South Africa

○ UAE

○ Saudi Arabia

○ Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5965

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

North America Region: +1 8044 4193 44

Europe Region: +44 778 256 0738

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest