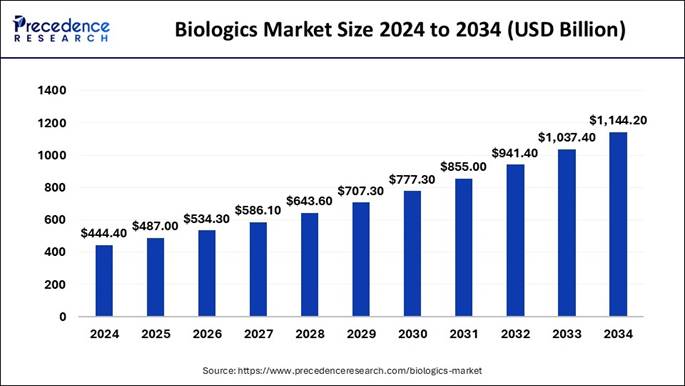

Precedence Research predicts the global biologics market size will grow from USD 487 billion in 2025 to approximately USD 1,144.20 billion by 2034, with a CAGR of 9.96% from 2025 to 2034. Growth is driven by the rising prevalence of chronic and autoimmune diseases, rapid adoption of biosimilars, and sustained R&D investments in advanced biologics such as monoclonal antibodies, vaccines, and cell-based therapies.

The global biologics market was valued at approximately USD 445.2 billion in 2024. The North American market was valued at USD 197.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 10.08% from 2025 to 2034. The biologics market has been growing in recent periods due to increasing demand for targeted therapies, personalized medicine, and innovative treatments for chronic and complex diseases.

Note: This

report is readily available for immediate delivery. We can review it with you

in a meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages for

Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/1638

Biologics Market Key Takeaways:

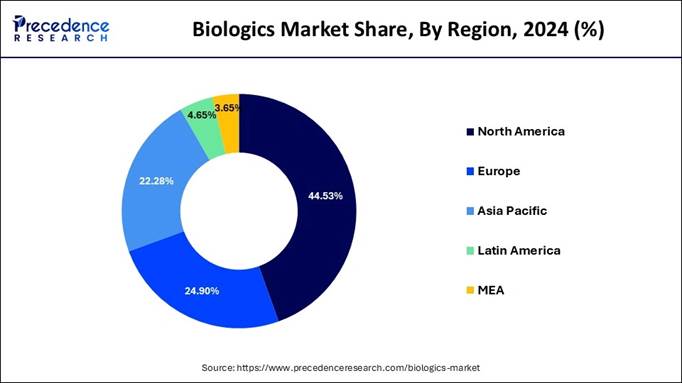

🔹 North America dominated the market, holding the largest market share of 44.53% in 2024.

🔹 Asia Pacific is expected to grow at a notable CAGR of 11.05% from 2025 to 2034.

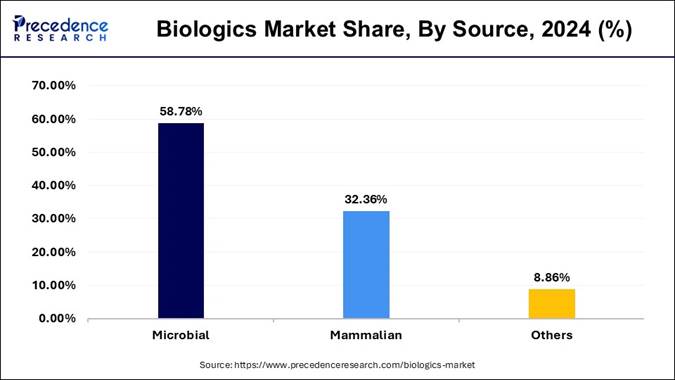

🔹 By source, the microbial segment held the major market share of 58.78% in 2024.

🔹 By source, the mammalian segment is expected to grow at the fastest rate from 2025 to 2034.

🔹 By product, the monoclonal antibodies segment accounted for the biggest market share of 56.48% in 2024.

🔹 By product, the vaccines segment is expected to grow at the fastest rate from 2025 to 2034.

🔹 By indication, the oncology indications segment is expected to grow at the fastest rate from 2025 to 2034.

🔹 By indication, the cardiovascular disorders segment held the largest share in the market in 2024.

🔹 By manufacturing, the in-house manufacturing segment contributed the highest market share of 83.96% in 2024.

🔹 By manufacturing, the outsourced manufacturing segment is expected to grow at the fastest rate from 2025 to 2034.

🔹 By distribution channel, the hospital segment held the largest market share in 2024.

🔹By distribution channel, the online segment is expected to grow at the fastest rate from 2025 to 2034.

Biologics Market Size, Growth and Forecast 2025 to 2034

🔸 Market Size in 2025: USD 487 Billion

🔸 Market Size in 2026: USD 534.30 Billion

🔸 Forecasted Market Size by 2034: USD 1,144.20 Billion

🔸 CAGR (2025-2034): 9.96%

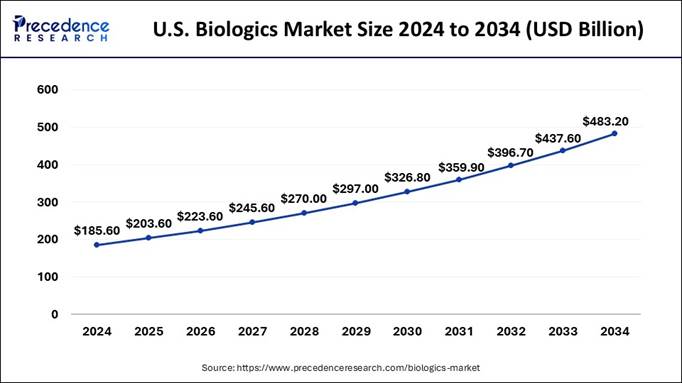

🔸 U.S. Market Size in 2025: USD 203.60 Billion

🔸 U.S. Market Size by 2034: USD 483.20 Billion

🔸 Largest Market in 2024: North America

🔸 Fastest Growing Market: Asia Pacific

Biologics Market Size by Source 2022 to 2024 (USD Billion)

|

Source |

2022 |

2023 |

2024 |

|

Microbial |

221.10 |

239.40 |

261.20 |

|

Mammalian |

119.30 |

130.50 |

143.80 |

|

Others |

33.80 |

36.30 |

39.40 |

Biologics Market Size by Product 2022 to 2024 (USD Billion)

|

Product |

2022 |

2023 |

2024 |

|

Monoclonal Antibody |

211.1 |

229.4 |

251.2 |

|

Immune Checkpoint Inhibitors |

116.5 |

126.5 |

138.4 |

|

Biosimilar |

71.9 |

78.7 |

86.8 |

|

Antibody-Drug Conjugates (ADC) |

22.6 |

24.2 |

26.1 |

|

Recombinant Insulin |

41.4 |

44.9 |

49.0 |

|

Vaccine |

76.0 |

81.3 |

87.6 |

|

Human Growth Hormone |

6.4 |

7.0 |

7.7 |

|

Cell & Gene Therapy |

23.0 |

26.0 |

29.5 |

|

Recombinant Enzyme |

3.6 |

4.0 |

4.4 |

|

Interferon |

9.3 |

10.0 |

10.9 |

|

Others |

3.5 |

3.7 |

4.0 |

Biologics Market Size by Disease 2022 to 2024 (USD Billion)

|

Disease |

2022 |

2023 |

2024 |

|

Oncology |

111.2 |

122.0 |

134.9 |

|

Infectious Diseases |

63.1 |

68.3 |

74.5 |

|

Immunological Disorders |

49.0 |

52.8 |

57.4 |

|

Cardiovascular Disorders |

88.8 |

96.7 |

106.1 |

|

Hematological Disorders |

35.3 |

37.9 |

41.0 |

|

Others |

26.8 |

28.5 |

30.4 |

Note: This report is readily available for immediate delivery.

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1638

Biologics Market Overview: Insights, Potential and Outlook

The biologics market is expanding rapidly due to targeted and personalized treatments, an increase in the prevalence of chronic illnesses, and ongoing advancements in biologic medications like monoclonal antibodies, vaccines, and cell and gene therapies. Market expansion is being further accelerated by rising R&D expenditures and encouraging regulatory environments.

With the expansion of biosimilar approvals and regulatory support across key markets like the U.S., Europe, and Asia-Pacific, biologics are becoming more accessible and cost-effective. The market outlook remains highly positive, with strong R&D pipelines, expanding therapeutic applications, and increasing investment from pharmaceutical giants and emerging biotech firms. As personalized medicine and immunotherapies continue to gain traction, the biologics sector is poised to be a cornerstone of the future healthcare landscape.

Biologics Market Outlook

🔹 Industry Growth Overview: Advancements in biotechnology and personalized medicine are accelerating the development of biology. The growing prevalence of chronic diseases and rising biologic drug adoption fuel steady industry growth.

🔹 Sustainability Trends: Green bioprocessing and waste reduction are two examples of eco-friendly manufacturing techniques that businesses are implementing. Sustainable bioproduction is becoming more popular in an effort to reduce its negative effects on the environment and boost productivity.

🔹 Global Expansion: Large producers of biologics are entering emerging markets in order to satisfy the growing demand for healthcare products. The expansion of facilities and strategic partnerships throughout the Asia Pacific is propelling global reach.

✚ Read the Full Market Overview 👉 https://www.precedenceresearch.com/biologics-market

Analyst View:

According to Precedence Research lead analyst, “The biologics sector is entering a scale-up phase characterized by the convergence of AI-driven discovery, single-use manufacturing, and biosimilar penetration. Between 2025 and 2034, oncology and immunology pipelines will remain the primary growth engines for global biologics revenues.”

Market Opportunity: Growth in CDMO/Biomanufacturing Capacity

As more biotech companies outsource production, the need for contract development and manufacturing services is increasing. Investing in single-use bioreactors in single use bioreactors high-yield cell lines, and more adaptable facilities gives businesses a competitive advantage.

🔸 In June 2025, Aragen announced that its biologics facilities in Bangalore, India, will begin GMP manufacturing in late July 2025, boosting its capacity to serve multi-client biologics programs. (Source: https://www.biopharminternational.com)

Biologics Market Major Limitation and Challenge:

High Manufacturing and Development Costs

To produce biologics, complicated procedures like cell culture fermentation and purification are required, which call for specialized facilities, highly qualified staff, and a significant investment in R&D. Biologics are more costly to develop and manufacture than small molecule medications due to their high upfront and operating costs, which affect affordability and pricing globally.

🔸 In May 2024, Biocon Ltd reported a sharp decline in Q4 profit despite 16% revenue growth, attributing it to increased raw materials and manufacturing costs in its biosimilars division. (Source: https://www.reuters.com/)

Biologics Market Report Coverage:

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 487.00 Billion |

|

Market Size in 2026 |

USD 534.30 Billion |

|

Market Size by 2034 |

USD 1,144.20 Billion |

|

CAGR from 2025 to 2034 |

9.96% |

|

Leading Region in 2025 |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Source, Product, Indication, Manufacturing, Distribution Channel, and Regions |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Key Case Study: Biocon Biologics' U.S.

FDA Approval of Denosumab Biosimilars

Biocon Biologics, a subsidiary of India's Biocon Limited, has been a

significant player in the global biosimilars market. In September 2025, the

company achieved a major milestone with the U.S. FDA approval of two

biosimilars to denosumab, branded as Prolia and Xgeva. These biologics are used

to treat osteoporosis and prevent bone fractures in cancer patients.

Key Developments:

🔹 Regulatory Approval: The FDA granted approval for Biocon's denosumab biosimilars, marking a significant achievement in the company's biosimilars portfolio.

🔹 Interchangeability Designation: One of the biosimilars received a provisional interchangeability designation. This allows pharmacists to substitute the biosimilar for the reference product without consulting the prescriber, potentially increasing adoption and market penetration.

🔹 Market Impact: Following the approval, Biocon's stock price rose by 2%, reflecting positive investor sentiment. The approval positions Biocon to compete in the U.S. market, offering a more affordable alternative to the reference biologics.

Strategic Implications:

The approval opens doors for Biocon to expand its presence in the U.S. market, a significant step for a company based in India. Biosimilars offer cost-effective alternatives to expensive reference biologics, potentially reducing healthcare costs and increasing patient access to essential treatments. The interchangeability designation provides Biocon with a competitive edge, as it simplifies the substitution process for pharmacists and may lead to broader adoption.

Biologics Market Regional Landscape:

1. North America

North America dominated the global biologics market in 2024, accounting for 44.53% of total revenue, valued at approximately USD 197.9 billion. The region’s leadership is driven by advanced healthcare infrastructure, robust R&D investment, and strong presence of key biopharma companies such as Amgen, AbbVie, and Pfizer. The North American market is projected to expand at a CAGR of 10.08% during 2025–2034, supported by growing adoption of personalized therapies, rapid biosimilar approvals, and expansion of CDMO capacity in the U.S. and Canada.

2. Europe

Europe held the second-largest market share of 24.90% in 2024, reaching an estimated value of USD 110.7 billion. The region benefits from strong regulatory support for biosimilars, extensive biomanufacturing capabilities, and government-backed R&D initiatives. Increasing focus on immunotherapies, gene therapy trials, and strategic partnerships between biotech firms and research institutions continue to drive growth across major countries such as Germany, France, and the U.K. Europe is expected to maintain steady expansion throughout the forecast period.

3. Asia Pacific

Asia Pacific accounted for 22.28% of the global biologics market in 2024, valued at roughly USD 99.1 billion. The region is forecasted to be the fastest-growing, with an impressive CAGR of 11.05% from 2025 to 2034. Growth is fueled by rapid expansion of biopharmaceutical manufacturing in countries like China, India, and South Korea, along with favorable government initiatives, clinical research investments, and growing healthcare access. The region is emerging as a global hub for cost-effective biologics and biosimilars production.

4. Latin America

Latin America captured 4.65% of the biologics market in 2024, valued at approximately USD 20.7 billion. Rising prevalence of chronic diseases, expanding access to biologic drugs, and government initiatives aimed at strengthening healthcare infrastructure are driving growth. Countries such as Brazil and Mexico are witnessing increased participation from global biotech firms and local partnerships focused on improving biologic drug accessibility and affordability.

5. Middle East & Africa (MEA)

The Middle East and Africa region represented 3.65% of the global biologics market in 2024, valued at around USD 16.2 billion. Market growth is primarily supported by increasing healthcare expenditure, expansion of hospital infrastructure, and government-driven efforts to localize pharmaceutical manufacturing. Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are investing in biologics manufacturing capabilities to reduce import dependence and enhance regional availability.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1638

Regional Insights:

North America dominated the biologics market because of its sophisticated medical system, robust regulatory environment, and widespread use of biologics. The region's dominant position is strengthened by the presence of large biopharmaceutical companies and substantial R&D investments. North America's dominance is also being reinforced by also being reinforced by continuous advancements in personalized medical and biologics manufacturing.

North America Biologics Market: Key Players and Strategies

North America, led predominantly by the United States, continues to dominate the global biologics market, holding a significant share due to the presence of major pharmaceutical and biotech companies. These key players focus heavily on expanding their biologics portfolios, including monoclonal antibodies, biosimilars, and advanced gene therapies, to meet the rising demand for innovative treatments.

Many companies are also investing in strategic partnerships and collaborations to accelerate research, optimize manufacturing processes, and improve patient access to biologic medicines. Additionally, efforts to enhance operational efficiency and sustainability in production further strengthen their competitive position in this dynamic market.

What is the Biologics Market Size?

According to Precedence Research, the U.S. biologics market size is predicted to reach USD 483.20 billion by 2034, increasing from USD 203.60 billion in 2025. The industry is expanding at a solid CAGR of 10.08% between 2025 and 2034.

This Report is Readily Available for Immediate Delivery | Download the Sample

Pages of this Report@ https://www.precedenceresearch.com/sample/1638

Key Drivers of the U.S. Biologics Market:

The U.S. biologics market growth is primarily fueled by several critical factors. A high prevalence of chronic and complex diseases, such as cancer, autoimmune disorders, and diabetes, drives demand for effective biologic therapies. Technological advancements in biotechnology have accelerated the development of novel treatments, including personalized and gene-based therapies, broadening therapeutic options.

Asia Pacific is the fastest-growing region in the biologics market, driven by rising healthcare costs, growing capacity to manufacture biopharmaceuticals, and growing demand for cutting-edge treatments. Biologics are being rapidly adopted in the regions' emerging economies thanks to supportive government initiatives. Strategic partnerships between domestic and international businesses are also speeding up the market.

Asia-Pacific Biologics Market: Key Players and Strategies

The Asia-Pacific region is rapidly emerging as a vital hub in the global biologics market, driven by growing healthcare demands and increasing investments from local and multinational pharmaceutical companies. Key players in countries like India, China, and South Korea are expanding their biologics portfolios, including biosimilars, vaccines, and innovative therapies. \

Many companies are forging strategic partnerships to enhance R&D capabilities and scale up manufacturing to meet regional and global needs. Emphasis on cost-effective production and improving access to biologics is a strong focus, helping to address healthcare challenges across diverse and densely populated markets.

Biologics Market Segmentation Insights

By Source Insights

The microbial segment dominates the biologics market because of its high scalability, economical production methods, and widespread application in vaccines, enzymes, and antibiotics. Given its well-established manufacturing infrastructure and familiarity with regulations, many biologic developers choose it.

Mammalian segment is growing rapidly in the biologics market, motivated by the growing need for monoclonal antibodies and complex protein treatments. For sophisticated treatments, mammalian cells facilitate appropriate protein folding and post-translational modifications.

By Product Insights

Monoclonal antibodies are the dominant product segment in the biologics market because of their effectiveness in the treatment of autoimmune diseases, cancer, and other chronic illnesses. Their global adoption is a result of their specificity and demonstrated therapeutic efficacy. Their dominance in the market is further strengthened by ongoing research and pipeline expansion.

Vaccines segment is the fastest growing product category, driven by expanding vaccination campaigns, increased readiness for pandemics, and developments in mRNA and recombinant vaccine technology. With expanding healthcare initiatives, demand is particularly high in emerging economies. The development and distribution of vaccines are also being accelerated by growing government support.

By indication Insights

Oncology indications dominate the biologics market because cancer is becoming more commonplace globally and because biologics are effective in targeted cancer therapy. New approvals and ongoing clinical research support the leadership of the market. The market is growing steadily due to the emphasis on personalized oncology treatments and precision medicine.

Cardiovascular disorders are the fastest growing indication segment, as the use of biologics and innovative treatments to treat heart disease is growing. Global increases in cardiovascular cases and creative drug development are fueling market growth. Rising demand is also a result of initiatives for preventive healthcare and increased awareness.

By Manufacturing Insights

In-house manufacturing dominates the biologics market due to the fact that many businesses would rather maintain control over intellectual property, production quality, and regulatory compliance. This strategy guarantees a steady supply and dependability of vital treatments. Businesses also gain from improved integration with R&D initiatives and process optimization.

Outsourced manufacturing is the fastest growing trend as scale production effectively biotech companies are depending more on contract manufacturing organizations. Time to market is accelerated; capital investment is decreased, and specialized knowledge is utilized through outsourcing. This growth is being fueled in part by the increasing number of CMOs with advanced capabilities worldwide.

By Distribution Channel Insights

The hospital segment dominated the market in 2024, driven by its well-established supply chains, sophisticated infrastructure, and capacity to offer specialized treatments. When administering complex biologics such as monoclonal antibodies and other expensive treatments, they are favored because they guarantee patient safety and adherence to legal requirements.

Online segment is growing rapidly in the market due to telemedicine services and growing digital adoption to facilitate convenience, increased patient engagement, and wider reach. Patients and healthcare providers are using online pharmacies and e-commerce platforms to obtain biologics more quickly.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Competitive Landscape of Biologics Market:

|

Company |

Headquarters |

Core Biologics / Biopharma Offerings & Capabilities |

Strategic / Competitive Highlights / Focus Areas |

|

Eli Lilly & Company |

Indianapolis, Indiana, USA |

Monoclonal antibodies, fusion proteins, peptide biologics, next‑generation biologic platforms |

Investing heavily in integrated R&D + manufacturing (e.g. “Lilly Medicine Foundry”) to accelerate biologics and gene therapy scale‑up (Lilly) |

|

Samsung Biologics |

Songdo, Incheon, South Korea |

Contract development & manufacturing (CDMO) for monoclonal antibodies, bispecifics, antibody‑drug conjugates (ADCs), mRNA services (Wikipedia) |

Strong contract manufacturing partner for global pharma, with advanced platforms (e.g. S‑CHOice, S‑DUAL) (Wikipedia) |

|

F. Hoffmann‑La Roche (Roche) |

Basel, Switzerland |

Therapeutic antibodies (oncology, immunology), diagnostics + biologic drugs |

Integrated pharma + diagnostics model, with strong pipeline in oncology and precision medicine (Wikipedia) |

|

Celltrion |

Incheon / South Korea |

Biosimilars (mAbs, biologics), novel biologics |

One of the major biosimilar players globally, targeting affordable biologics production |

|

Addgene |

Cambridge, Massachusetts, USA |

Plasmid vectors, molecular biology reagents (not a full biologics manufacturer) |

Addgene is more of a repository/distributor of plasmids, widely used in research, enabling biologics development rather than commercial biologics sales |

|

Amgen |

Thousand Oaks, California, USA |

Monoclonal antibodies, fusion proteins, biologic therapeutics (e.g. oncology, immunology) |

Strong biologics R&D and manufacturing, with deep experience in scaling complex biologic medicines |

|

AbbVie Inc. |

North Chicago, Illinois, USA |

Monoclonal antibodies (e.g. Humira, new biologics), immunology / oncology biologics |

Focused on immunology, oncology, and expanding biologics pipeline to offset patent expirations (Wikipedia) |

|

Sanofi |

Paris, France (global) / multiple research hubs |

Biologics including monoclonal antibodies, vaccines, recombinant proteins |

Broad presence in biologics + vaccines, investing in next‑gen biologic technologies |

|

Pfizer Inc. |

New York, NY, USA |

Biologics (antibodies, fusion proteins, vaccine biologics) |

Integrated portfolio of small molecules + biologics, strong global reach and R&D capabilities |

|

Merck & Co., Inc. |

Kenilworth, New Jersey, USA |

Biologic therapeutics (e.g. checkpoint inhibitors, immuno‑oncology biologics) |

Deep pipeline in immuno‑oncology and strategic biologics R&D |

|

Novo Nordisk A/S |

Bagsværd, Denmark |

Biologics (especially in diabetes, endocrinology: insulins, GLP‑1 biologics), peptide biologics |

Focused on metabolic / endocrinology biologics; leading in diabetes / obesity biologic therapies |

Biologics Market Competitive Concentration and Company Landscape:

The global biologics market demonstrates moderate-to-high concentration, dominated by a small group of multinational pharmaceutical and biotechnology corporations that collectively hold over 55% of total market revenue as of 2024. These leaders maintain strong control across the biologics value chain—from discovery to commercialization—through extensive R&D pipelines, proprietary platforms, and global-scale manufacturing capabilities. Below is an in-depth overview of the market concentration and positioning of each major player.

Market Concentration Overview

- Top 10 companies account for ~55–60% of the global biologics market revenue (2024).

- Top 3 players (Roche, Pfizer, and AbbVie) alone capture over 25% of total global sales, primarily due to their dominance in monoclonal antibodies and oncology biologics.

- The mid-tier layer (Lilly, Sanofi, Amgen, Merck, and Novo Nordisk) contributes another 25–30%, driven by specialized portfolios in immunology, endocrinology, and chronic disease therapeutics.

- Emerging biologics specialists and CDMOs (Samsung Biologics, Celltrion, Syngene, Lonza, Boehringer Ingelheim) are gaining traction as outsourcing partners, collectively capturing 10–15% of the value chain through manufacturing contracts and biosimilar production.

- The biologics market remains oligopolistic at the top but increasingly competitive in biosimilars and CDMO-driven manufacturing segments, where Asian and European entrants are expanding capacity rapidly.

Company-Specific Market Concentration and Strategic Positioning

1. Eli Lilly & Company (U.S.)

- Estimated Market Share: ~6–7% of global biologics revenue (2024).

- Focus Areas: Immunology, oncology, diabetes, and Alzheimer’s biologics.

- Strategic Concentration: Lilly’s strong presence in peptide and antibody biologics, combined with its billion-dollar investment in India (2025), reflects vertical integration—from R&D to large-scale manufacturing. The company’s emerging biologics foundry model enhances R&D throughput and manufacturing autonomy, positioning it as a key innovator in next-generation biologic platforms.

2. Samsung Biologics (South Korea)

- Estimated Market Share: ~3–4% globally, but commands >35% of global biologics CDMO capacity.

- Focus Areas: Contract manufacturing of monoclonal antibodies, bispecifics, ADCs, and mRNA biologics.

- Strategic Concentration: Samsung Biologics operates one of the world’s largest single-site biologics production hubs in Songdo, with total bioreactor capacity exceeding 600,000 liters (as of 2025). Its proprietary S-CHOice™ cell line and S-DUAL™ bispecific platform strengthen its contract development advantage, consolidating its lead in biologics outsourcing.

3. F. Hoffmann-La Roche Ltd (Switzerland)

- Estimated Market Share: ~10–12% of global biologics revenue.

- Focus Areas: Oncology, immunology, and diagnostics-linked biologics.

- Strategic Concentration: Roche maintains the world’s deepest monoclonal antibody pipeline and leads in oncology biologics through products like Avastin®, Herceptin®, and Tecentriq®. Its integrated pharma-diagnostics model gives it unique biomarker-driven market strength, enabling personalized biologics development.

4. Celltrion Inc. (South Korea)

- Estimated Market Share: ~2–3% globally, among top five biosimilar producers.

- Focus Areas: Biosimilars, monoclonal antibodies, and novel biologics.

- Strategic Concentration: Celltrion’s strong biosimilar portfolio (Remsima®, Truxima®, Herzuma®) underpins its expansion into North America and Europe. The firm’s cost-efficient biologics production and vertically integrated model strengthen its global biosimilar leadership, contributing significantly to Asia’s export-oriented biologics growth.

5. Addgene (U.S.)

- Estimated Market Share: <1%, operates primarily as a biological materials repository rather than a therapeutic biologics manufacturer.

- Focus Areas: Plasmid distribution, molecular biology reagents, CRISPR tools.

- Strategic Concentration: While not a direct revenue player in therapeutics, Addgene enables the global biologics R&D ecosystem by facilitating open access to plasmid and vector resources—an essential backbone for early-stage biologics research.

6. Amgen Inc. (U.S.)

- Estimated Market Share: ~8–9% of global biologics revenue.

- Focus Areas: Oncology, inflammation, and bone health biologics.

- Strategic Concentration: Amgen pioneered recombinant protein therapeutics and remains a leader in monoclonal antibodies (e.g., Enbrel®, Prolia®). Its extensive experience in cell line development and purification makes it one of the most vertically integrated biologics manufacturers worldwide. Amgen also invests heavily in biosimilars to maintain portfolio resilience post-patent expiration.

7. AbbVie Inc. (U.S.)

- Estimated Market Share: ~9–10%, one of the top three biologics producers globally.

- Focus Areas: Immunology, oncology, neuroscience.

- Strategic Concentration: AbbVie’s biologic blockbuster Humira® generated over USD 20 billion at its peak, defining its dominance in immunology. The company continues to expand its pipeline with Skyrizi® and Rinvoq®, aiming to offset post-Humira biosimilar erosion through diversified next-generation biologics.

8. Sanofi (France)

- Estimated Market Share: ~6–7% globally.

- Focus Areas: Vaccines, monoclonal antibodies, rare diseases.

- Strategic Concentration: Through Sanofi Pasteur and Genzyme divisions, Sanofi integrates vaccine innovation with biologics R&D. The company is scaling mRNA and recombinant protein platforms while pursuing sustainability in biologics production. Its expansion in cell and gene therapies positions it for steady mid-term growth.

9. Pfizer Inc. (U.S.)

- Estimated Market Share: ~9–10% globally.

- Focus Areas: Vaccines, oncology biologics, immunotherapies.

- Strategic Concentration: Pfizer’s biologics leadership surged following its mRNA vaccine success and oncology partnerships. The company maintains diversified capabilities in recombinant proteins, antibody engineering, and vaccine production, supported by a global manufacturing footprint spanning North America, Europe, and Asia.

10. Merck & Co., Inc. (U.S.)

- Estimated Market Share: ~7–8% globally.

- Focus Areas: Immuno-oncology, vaccines, and infectious diseases.

- Strategic Concentration: Keytruda® anchors Merck’s biologics portfolio, making it one of the highest-grossing biologics worldwide. Merck’s investments in checkpoint inhibitors, biosimilar manufacturing partnerships, and combination therapy research consolidate its premium-tier biologics dominance.

11. Novo Nordisk A/S (Denmark)

- Estimated Market Share: ~5–6% globally.

- Focus Areas: Endocrinology, diabetes, obesity biologics (GLP-1 analogs, insulins).

- Strategic Concentration: Novo Nordisk’s biologics leadership in metabolic diseases is unmatched. Its continuous pipeline of peptide and protein-based biologics such as Ozempic® and Wegovy® drives one of the fastest-growing therapeutic verticals globally.

Market Structure Summary

|

Tier |

Representative Companies |

Approx. Combined Share (2024) |

Strategic Role |

|

Tier I – Global Leaders |

Roche, Pfizer, AbbVie |

25–30% |

Deep pipelines, high-value biologics (oncology/immunology) |

|

Tier II – Integrated Innovators |

Lilly, Amgen, Merck, Sanofi, Novo Nordisk |

25–30% |

Diversified biologics, sustained R&D, expanding capacity |

|

Tier III – Specialized & CDMO Players |

Samsung Biologics, Celltrion, Syngene, Lonza |

10–15% |

Contract manufacturing, biosimilars, regional expansion |

|

Tier IV – Research Enablers |

Addgene, regional biotech firms |

<2% |

Supply chain and R&D infrastructure support |

Competitive

Outlook (2025–2034)

- Market concentration will gradually decline as biosimilars and CDMOs gain share from originator companies.

- Asia Pacific players (Samsung Biologics, Celltrion, WuXi Biologics) are expected to collectively capture an additional 5–7% global share by 2034 through capacity expansion and global partnerships.

- U.S. and European incumbents will maintain lead positions in innovation-driven biologics—particularly monoclonal antibodies, antibody-drug conjugates, and next-gen immunotherapies—but face pricing and biosimilar competition pressure.

- Overall structure: The biologics market remains innovation-concentrated at the top but is capacity-competitive at the mid-tier level, signaling a dual-axis competition model: innovation leadership vs manufacturing efficiency.

Recent Developments:

🔸 In March 2025, Syngene International acquired its first biologics manufacturing facility in the United States, located in Baltimore-Bayview, for approximately US$36.5 million. The facility is expected to begin operations in the second half of 2025 and will expand Syngene’s global contract development and biologics manufacturing capabilities. (Source: https://www.reuters.com)

🔸 In October 2025, Eli Lilly announced a US$1 billion investment in India to expand its manufacturing capacity and strengthen its supply chain for drugs targeting obesity, diabetes, Alzheimer’s, cancer, and autoimmune diseases. This initiative underlines Lilly’s commitment to emerging markets and global biologics manufacturing. (Source: https://www.reuters.com

The biologics market report categorizes into the following segments and subsegments:

By Source

🔹 Microbial

🔹 Mammalian

🔹 Others

By Product

🔹 Monoclonal Antibodies

→ Human mABs

→ Humanized mABs

→ Chimeric mABs

→ Murine mABs

🔹 Vaccines

🔹 RecombinantProteins

🔹 Antisense, RNAi & molecular therapy

🔹 Cell-Based Therapies

→ Stem Cell Therapy

→ CAR-T Cell Therapy

→ Tissue Engineering

🔹 Others

By Indication

🔹 Oncology

🔹 Immunological Disorders

🔹 Cardiovascular Disorders

🔹 Hematological Disorders

🔹 Others

By Manufacturing

🔹 Outsourced

🔹 In-house

By Distribution Channel

🔹 Hospital Pharmacies

🔹 Retail Pharmacies

🔹 Online Pharmacies

By Region

🔹 North America

🔹 Latin America

🔹 Europe

🔹 Asia-pacific

🔹 Middle and East Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive

Report 👉 https://www.precedenceresearch.com/checkout/1638

Frequently Asked Questions

✚ What is the current size of the

biologics market?

➡️ The global biologics market was valued

at USD 444.40 billion in 2024 and is projected to surpass USD

1,144.20 billion by 2034.

✚ What is the CAGR of the global

biologics market?

➡️ The biologics market is expected to

grow at a CAGR of 9.96% from 2025 to 2034.

✚ Who are the key players in the

biologics market?

➡️ Leading companies include Eli Lilly

& Company, Samsung Biologics, F. Hoffmann-La Roche, Celltrion, Amgen,

AbbVie Inc., Sanofi, Pfizer Inc., Merck & Co., Inc., and Novo

Nordisk A/S.

✚ What are the main growth drivers of

the biologics market?

➡️ Market growth is driven by rising

demand for biopharmaceuticals, government support for biologics development,

and the growing shift toward targeted and personalized therapies.

✚

Which

region dominates the global biologics market?

➡️ North America leads the global biologics

market, supported by advanced healthcare infrastructure, strong R&D

investment, and high biologics adoption.

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us:

✚ Related Topics You May Find Useful

💡 Next Generation Biologics Market: Explore how breakthrough therapies and precision biologics are redefining modern medicine.

💡 Cancer Biologics Market: Examine how targeted biologic therapies are transforming global oncology treatment paradigms.

💡 Anti-inflammatory Biologics Market: See how biologics are reshaping treatment approaches for chronic inflammatory diseases.

💡 Biologics CDMO Market: Understand how outsourcing and single-use bioprocessing are accelerating biologics manufacturing.

💡 Next Generation Biologics Market : Review the latest market insights and growth outlook shaping next-gen biologics.

💡 Biologics Contract Development Market: Analyze how strategic partnerships and advanced facilities are fueling CDMO expansion.

💡 Wound Care Biologics Market: Discover how biologically active dressings and growth factors are advancing wound healing.

💡 Neurological Rare Disease Biologics Market: Uncover how biologics are addressing unmet needs in rare neurological disorders.

💡 Cancer Biological Therapy Market: Track innovations in immune-oncology and monoclonal antibody therapies.

💡 Biosimilars Market: Explore how affordability, accessibility, and regulatory momentum are driving biosimilar adoption.

💡 Biological Safety Testing Market: Learn how quality assurance and regulatory compliance are shaping biologics safety standards.

💡 Biobetters Market: See how enhanced efficacy and stability are positioning biobetters as the next frontier in biologics.

💡 Immunology Biosimilars Market: Understand how biosimilars are revolutionizing immunology treatment accessibility.

💡 Psoriasis Biosimilars Market: Examine how biosimilar adoption is transforming psoriasis care economics and outcomes.

💡 Drug Discovery Services Market: Analyze how AI, automation, and biologics innovation are reshaping drug discovery pipelines.

💡 Immunology Market: Discover emerging biologic therapies driving breakthroughs in autoimmune and infectious diseases.

💡 Lyophilized Injectable Drug Market: Explore how lyophilization technology enhances biologic drug stability and shelf life.

💡 Synthetic Biology Market: Track how engineered biology and DNA synthesis are revolutionizing biopharma innovation.

💡 Biopharmaceutical CMO and CRO Market: Learn how outsourcing models are boosting biologics R&D, scalability, and global reach.