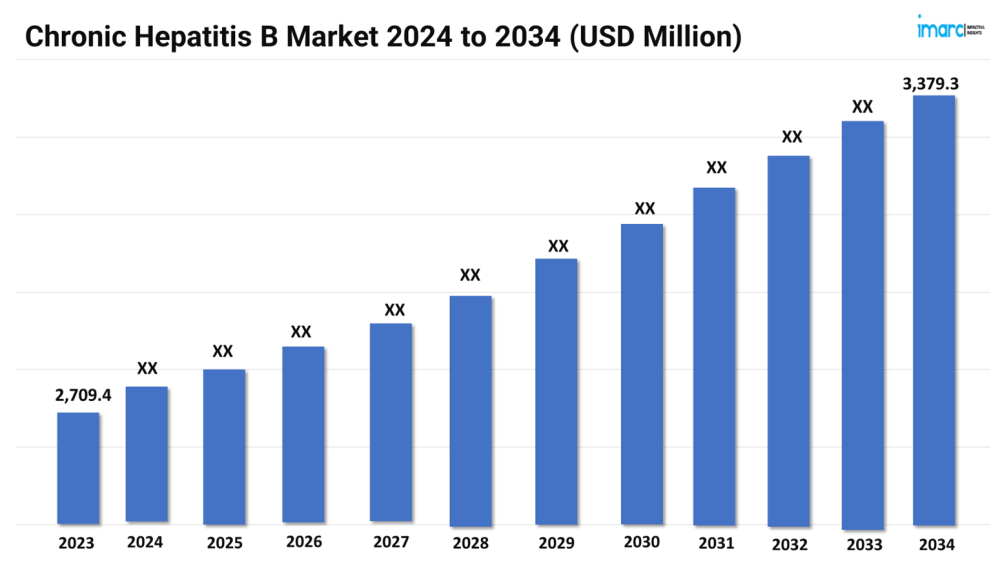

The chronic hepatitis B market size reached a value of USD 2,709.4 Million in 2023. Looking forward, the market is expected to reach USD 3,379.3 Million by 2034, exhibiting a growth rate (CAGR) of 2.03% during 2024-2034.

The market is driven by the development of novel antiviral therapies, a focus on combination treatments, and efforts toward a functional cure. Additionally, enhanced diagnostics and increased public health initiatives are improving early detection and treatment, leading to better patient outcomes worldwide.

Advancements in Therapeutics: Driving the Chronic Hepatitis B Market

Recent advancements in therapeutics for chronic hepatitis B (CHB) have focused on developing treatments that can achieve sustained viral suppression and potentially lead to functional cure. The primary goals of these advancements include reducing viral load, minimizing liver inflammation, and preventing disease progression to cirrhosis or hepatocellular carcinoma (HCC). One significant development is the introduction of novel antiviral agents such as tenofovir alafenamide (TAF) and besifovir dipivoxil maleate (BSV-M). These drugs offer improved safety profiles and a high barrier to resistance compared to older therapies like entecavir and tenofovir disoproxil fumarate (TDF). TAF, in particular, has shown promise in reducing systemic exposure to tenofovir, thereby potentially minimizing renal and bone toxicity commonly associated with TDF. In addition to direct antiviral agents, immunomodulatory therapies are being explored to enhance immune control over hepatitis B virus (HBV). Therapeutic vaccines, such as GS-4774 and Tarmogen, aim to stimulate specific immune responses against HBV-infected cells, potentially leading to sustained viral suppression or functional cure. These vaccines work by boosting the patient's immune response against viral antigens, which may help in achieving long-term control of the infection.

Request a PDF Sample Report: https://www.imarcgroup.com/chronic-hepatitis-b-market/requestsample

Furthermore, RNA interference (RNAi) therapies have emerged as a promising approach to silence viral gene expression. Drugs like ARB-1467 and JNJ-3989 utilize RNAi technology to inhibit HBV replication at the RNA level, offering a novel mechanism to achieve sustained viral suppression and potentially cure CHB. Clinical trials and research are ongoing to further optimize these therapeutic approaches and explore combination therapies that target multiple steps in the HBV life cycle. The landscape of CHB treatment is rapidly evolving, driven by the need for more effective and durable therapies that can improve patient outcomes and potentially eliminate the virus in chronically infected individuals.

Top of Form

Bottom of Form

Improved Diagnostics: Contributing to Market Expansion

Improved diagnostics for chronic hepatitis B have significantly advanced the management and treatment of this persistent viral infection. Key developments in diagnostic tools have focused on enhancing the accuracy of HBV detection, monitoring disease progression, and guiding therapeutic decisions to improve patient outcomes. Quantitative PCR assays have revolutionized the measurement of HBV DNA levels in the blood, providing precise quantification of viral load. This capability is crucial for determining the stage of infection, assessing the need for antiviral therapy, and monitoring treatment response. High sensitivity and specificity of PCR assays ensure reliable detection even at low viral concentrations, facilitating early intervention to prevent liver damage and progression to severe complications such as cirrhosis or HCC. Moreover, serological markers like hepatitis B surface antigen (HBsAg), hepatitis B e antigen (HBeAg), and corresponding antibodies (anti-HBs and anti-HBe) remain fundamental in diagnosing CHB and assessing viral replication activity. Advanced immunoassays and automated platforms ensure accurate and rapid detection of these markers, aiding clinicians in evaluating disease status and prognosis.

Besides this, non-invasive methods for assessing liver fibrosis, such as transient elastography (FibroScan) and serum biomarkers (e.g., FibroTest, APRI score), have reduced the reliance on liver biopsy. These techniques provide reliable alternatives for evaluating liver health and guiding treatment decisions without the invasiveness and risks associated with biopsy procedures. Furthermore, molecular diagnostics, including next-generation sequencing (NGS), allow for comprehensive analysis of HBV genetic variability and mutations associated with antiviral resistance. This information is crucial for personalized treatment strategies, ensuring effective management of CHB by targeting specific viral strains and optimizing therapeutic outcomes. Overall, improved diagnostics in the CHB market have transformed clinical practice by enabling earlier diagnosis, precise monitoring of disease progression, and personalized treatment approaches tailored to individual patient needs. These advancements not only enhance patient care but also contribute to the global effort to reduce the burden of chronic hepatitis B worldwide.

Increased Awareness Campaigns and Vaccination Programs:

Increased awareness campaigns and vaccination programs play a pivotal role in combating chronic hepatitis B by promoting prevention, early detection, and timely intervention. These initiatives aim to educate the public, healthcare professionals, and policymakers about the risks associated with HBV infection and the importance of vaccination to reduce transmission and disease burden. Moreover, public awareness campaigns raise awareness about CHB transmission routes, which primarily include exposure to infected blood or bodily fluids, and emphasize the importance of vaccination, especially during infancy and early childhood. These campaigns often utilize various media channels, community outreach programs, and educational materials to reach diverse populations and encourage preventive behaviors. Vaccination programs are a cornerstone of CHB prevention efforts, focusing on widespread immunization with the hepatitis B vaccine. Universal vaccination of infants, starting within 24 hours of birth followed by additional doses, has been highly effective in reducing the incidence of new infections globally. In addition to routine childhood vaccination, targeted vaccination programs are implemented for high-risk groups, including healthcare workers, individuals with multiple sexual partners, and people who inject drugs.

Besides this, healthcare providers play a crucial role in vaccination efforts by advocating for and administering the hepatitis B vaccine, as well as screening high-risk individuals for HBV infection. Enhanced training and educational programs for healthcare professionals ensure that they are equipped with the knowledge and skills to effectively manage CHB, including the interpretation of serological markers and the initiation of appropriate interventions. Moreover, government support and policy initiatives are instrumental in sustaining awareness campaigns and vaccination programs. Policies mandating universal hepatitis B vaccination, subsidizing vaccine costs, and integrating vaccination into national immunization programs contribute to achieving high vaccination coverage rates and reducing the prevalence of CHB in populations worldwide.

Buy Full Report: https://www.imarcgroup.com/checkout?id=8289&method=587

Leading Companies in the Chronic Hepatitis B Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global chronic hepatitis B market, several notable companies are focusing on developing novel antiviral agents with improved efficacy and safety profiles. Drugs like TAF and BSV-M offer reduced systemic toxicity compared to older therapies, enhancing patient compliance and treatment outcomes. Arbutus Biopharma and Glaxosmithkline have been investing heavily in their manufacturing capacities in recent months.

Arbutus Biopharma Corporation announced that preliminary data from its ongoing Phase 2a clinical trial assessing the safety, tolerability, and antiviral activity of the combination of AB-729, the organization's lead RNAi therapeutic, and pegylated interferon alfa-2a (IFN) in patients with chronic hepatitis B virus, were presented at the European Association for the Study of the Liver (EASL) Congress. The preliminary data indicate that adding IFN to AB-729 medication was usually well tolerated and appears to result in ongoing HBsAg decreases in certain patients.

Glaxosmithkline, on the other hand, stated that the US Food and Drug Administration (FDA) has granted Fast Track designation to bepirovirsen, an experimental antisense oligonucleotide (ASO) for the treatment of chronic hepatitis B.

Apart from this, Altimmune had completed enrollment in its Phase II clinical trial of HepTcell for the treatment of chronic hepatitis B (CHB). The multicenter experiment included roughly 80 participants who were randomly assigned to either HepTcell or placebo in a 1:1 ratio. The study included subjects who had inactive CHB and low levels of hepatitis B surface antigen (HBsAg).

Request for customization: https://www.imarcgroup.com/request?type=report&id=8289&flag=E

Regional Analysis:

The major markets for chronic hepatitis B include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for chronic hepatitis B while also representing the biggest market for its treatment. This can be attributed to the widespread adoption of telemedicine and remote monitoring technologies in CHB management, which facilitate access to specialist care, improve treatment adherence, and enable ongoing monitoring of disease progression and treatment response.

Moreover, the growing emphasis on screening high-risk populations, including immigrants from endemic regions, individuals with a history of intravenous drug use, and healthcare workers is bolstering the market in the United States. Additionally, pharmaceutical companies, policymakers, and advocacy groups are working to address affordability barriers through pricing strategies, patient assistance programs, and policy advocacy for insurance coverage of diagnostic tests and therapies across the country.

Apart from this, ongoing research efforts in the United States focus on developing innovative therapies, including new antiviral agents, immunomodulators, and therapeutic vaccines aimed at achieving functional cure or sustained virological response (SVR) in CHB patients.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

This report offers a comprehensive analysis of current chronic hepatitis B marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

B-Cell Non-Hodgkin Lymphoma Market: The 7 major B-cell non-hodgkin lymphoma market is expected to exhibit a CAGR of 5.83%during the forecast period from 2024 to 2034.

Listeriosis Market: The 7 major listeriosis market is expected to exhibit a CAGR of 4.08% during the forecast period from 2024 to 2034.

Uterine Fibroids Market: The 7 major uterine fibroids market is expected to exhibit a CAGR of 2.99% during the forecast period from 2024 to 2034.

Acoustic Neuroma Market: The 7 major acoustic neuroma market is expected to exhibit a CAGR of 5.61% during the forecast period from 2024 to 2034.

Biliary Tract Neoplasms Market: The 7 major biliary tract neoplasms market is expected to exhibit a CAGR of 7.21%during the forecast period from 2024 to 2034.

Neuropathic Pain Market: The 7 major neuropathic pain market reached a value of US$ 5.5 Billion in 2023 and projected the 7MM to reach US$ 8.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.7% during the forecast period from 2024 to 2034.

Clostridium Difficile Infection Market: The 7 major clostridium difficile infection market reached a value of US$ 9.0 Billion in 2023 and projected the 7MM to reach US$ 14.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.7% during the forecast period from 2024 to 2034.

Cardiac Arrhythmias Market: The 7 major cardiac arrhythmias market reached a value of US$ 4.9 Billion in 2023 and projected the 7MM to reach US$ 8.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.57%during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The market is driven by the development of novel antiviral therapies, a focus on combination treatments, and efforts toward a functional cure. Additionally, enhanced diagnostics and increased public health initiatives are improving early detection and treatment, leading to better patient outcomes worldwide.

Advancements in Therapeutics: Driving the Chronic Hepatitis B Market

Recent advancements in therapeutics for chronic hepatitis B (CHB) have focused on developing treatments that can achieve sustained viral suppression and potentially lead to functional cure. The primary goals of these advancements include reducing viral load, minimizing liver inflammation, and preventing disease progression to cirrhosis or hepatocellular carcinoma (HCC). One significant development is the introduction of novel antiviral agents such as tenofovir alafenamide (TAF) and besifovir dipivoxil maleate (BSV-M). These drugs offer improved safety profiles and a high barrier to resistance compared to older therapies like entecavir and tenofovir disoproxil fumarate (TDF). TAF, in particular, has shown promise in reducing systemic exposure to tenofovir, thereby potentially minimizing renal and bone toxicity commonly associated with TDF. In addition to direct antiviral agents, immunomodulatory therapies are being explored to enhance immune control over hepatitis B virus (HBV). Therapeutic vaccines, such as GS-4774 and Tarmogen, aim to stimulate specific immune responses against HBV-infected cells, potentially leading to sustained viral suppression or functional cure. These vaccines work by boosting the patient's immune response against viral antigens, which may help in achieving long-term control of the infection.

Request a PDF Sample Report: https://www.imarcgroup.com/chronic-hepatitis-b-market/requestsample

Furthermore, RNA interference (RNAi) therapies have emerged as a promising approach to silence viral gene expression. Drugs like ARB-1467 and JNJ-3989 utilize RNAi technology to inhibit HBV replication at the RNA level, offering a novel mechanism to achieve sustained viral suppression and potentially cure CHB. Clinical trials and research are ongoing to further optimize these therapeutic approaches and explore combination therapies that target multiple steps in the HBV life cycle. The landscape of CHB treatment is rapidly evolving, driven by the need for more effective and durable therapies that can improve patient outcomes and potentially eliminate the virus in chronically infected individuals.

Top of Form

Bottom of Form

Improved Diagnostics: Contributing to Market Expansion

Improved diagnostics for chronic hepatitis B have significantly advanced the management and treatment of this persistent viral infection. Key developments in diagnostic tools have focused on enhancing the accuracy of HBV detection, monitoring disease progression, and guiding therapeutic decisions to improve patient outcomes. Quantitative PCR assays have revolutionized the measurement of HBV DNA levels in the blood, providing precise quantification of viral load. This capability is crucial for determining the stage of infection, assessing the need for antiviral therapy, and monitoring treatment response. High sensitivity and specificity of PCR assays ensure reliable detection even at low viral concentrations, facilitating early intervention to prevent liver damage and progression to severe complications such as cirrhosis or HCC. Moreover, serological markers like hepatitis B surface antigen (HBsAg), hepatitis B e antigen (HBeAg), and corresponding antibodies (anti-HBs and anti-HBe) remain fundamental in diagnosing CHB and assessing viral replication activity. Advanced immunoassays and automated platforms ensure accurate and rapid detection of these markers, aiding clinicians in evaluating disease status and prognosis.

Besides this, non-invasive methods for assessing liver fibrosis, such as transient elastography (FibroScan) and serum biomarkers (e.g., FibroTest, APRI score), have reduced the reliance on liver biopsy. These techniques provide reliable alternatives for evaluating liver health and guiding treatment decisions without the invasiveness and risks associated with biopsy procedures. Furthermore, molecular diagnostics, including next-generation sequencing (NGS), allow for comprehensive analysis of HBV genetic variability and mutations associated with antiviral resistance. This information is crucial for personalized treatment strategies, ensuring effective management of CHB by targeting specific viral strains and optimizing therapeutic outcomes. Overall, improved diagnostics in the CHB market have transformed clinical practice by enabling earlier diagnosis, precise monitoring of disease progression, and personalized treatment approaches tailored to individual patient needs. These advancements not only enhance patient care but also contribute to the global effort to reduce the burden of chronic hepatitis B worldwide.

Increased Awareness Campaigns and Vaccination Programs:

Increased awareness campaigns and vaccination programs play a pivotal role in combating chronic hepatitis B by promoting prevention, early detection, and timely intervention. These initiatives aim to educate the public, healthcare professionals, and policymakers about the risks associated with HBV infection and the importance of vaccination to reduce transmission and disease burden. Moreover, public awareness campaigns raise awareness about CHB transmission routes, which primarily include exposure to infected blood or bodily fluids, and emphasize the importance of vaccination, especially during infancy and early childhood. These campaigns often utilize various media channels, community outreach programs, and educational materials to reach diverse populations and encourage preventive behaviors. Vaccination programs are a cornerstone of CHB prevention efforts, focusing on widespread immunization with the hepatitis B vaccine. Universal vaccination of infants, starting within 24 hours of birth followed by additional doses, has been highly effective in reducing the incidence of new infections globally. In addition to routine childhood vaccination, targeted vaccination programs are implemented for high-risk groups, including healthcare workers, individuals with multiple sexual partners, and people who inject drugs.

Besides this, healthcare providers play a crucial role in vaccination efforts by advocating for and administering the hepatitis B vaccine, as well as screening high-risk individuals for HBV infection. Enhanced training and educational programs for healthcare professionals ensure that they are equipped with the knowledge and skills to effectively manage CHB, including the interpretation of serological markers and the initiation of appropriate interventions. Moreover, government support and policy initiatives are instrumental in sustaining awareness campaigns and vaccination programs. Policies mandating universal hepatitis B vaccination, subsidizing vaccine costs, and integrating vaccination into national immunization programs contribute to achieving high vaccination coverage rates and reducing the prevalence of CHB in populations worldwide.

Buy Full Report: https://www.imarcgroup.com/checkout?id=8289&method=587

Leading Companies in the Chronic Hepatitis B Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global chronic hepatitis B market, several notable companies are focusing on developing novel antiviral agents with improved efficacy and safety profiles. Drugs like TAF and BSV-M offer reduced systemic toxicity compared to older therapies, enhancing patient compliance and treatment outcomes. Arbutus Biopharma and Glaxosmithkline have been investing heavily in their manufacturing capacities in recent months.

Arbutus Biopharma Corporation announced that preliminary data from its ongoing Phase 2a clinical trial assessing the safety, tolerability, and antiviral activity of the combination of AB-729, the organization's lead RNAi therapeutic, and pegylated interferon alfa-2a (IFN) in patients with chronic hepatitis B virus, were presented at the European Association for the Study of the Liver (EASL) Congress. The preliminary data indicate that adding IFN to AB-729 medication was usually well tolerated and appears to result in ongoing HBsAg decreases in certain patients.

Glaxosmithkline, on the other hand, stated that the US Food and Drug Administration (FDA) has granted Fast Track designation to bepirovirsen, an experimental antisense oligonucleotide (ASO) for the treatment of chronic hepatitis B.

Apart from this, Altimmune had completed enrollment in its Phase II clinical trial of HepTcell for the treatment of chronic hepatitis B (CHB). The multicenter experiment included roughly 80 participants who were randomly assigned to either HepTcell or placebo in a 1:1 ratio. The study included subjects who had inactive CHB and low levels of hepatitis B surface antigen (HBsAg).

Request for customization: https://www.imarcgroup.com/request?type=report&id=8289&flag=E

Regional Analysis:

The major markets for chronic hepatitis B include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for chronic hepatitis B while also representing the biggest market for its treatment. This can be attributed to the widespread adoption of telemedicine and remote monitoring technologies in CHB management, which facilitate access to specialist care, improve treatment adherence, and enable ongoing monitoring of disease progression and treatment response.

Moreover, the growing emphasis on screening high-risk populations, including immigrants from endemic regions, individuals with a history of intravenous drug use, and healthcare workers is bolstering the market in the United States. Additionally, pharmaceutical companies, policymakers, and advocacy groups are working to address affordability barriers through pricing strategies, patient assistance programs, and policy advocacy for insurance coverage of diagnostic tests and therapies across the country.

Apart from this, ongoing research efforts in the United States focus on developing innovative therapies, including new antiviral agents, immunomodulators, and therapeutic vaccines aimed at achieving functional cure or sustained virological response (SVR) in CHB patients.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the chronic hepatitis B market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the chronic hepatitis B market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current chronic hepatitis B marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

B-Cell Non-Hodgkin Lymphoma Market: The 7 major B-cell non-hodgkin lymphoma market is expected to exhibit a CAGR of 5.83%during the forecast period from 2024 to 2034.

Listeriosis Market: The 7 major listeriosis market is expected to exhibit a CAGR of 4.08% during the forecast period from 2024 to 2034.

Uterine Fibroids Market: The 7 major uterine fibroids market is expected to exhibit a CAGR of 2.99% during the forecast period from 2024 to 2034.

Acoustic Neuroma Market: The 7 major acoustic neuroma market is expected to exhibit a CAGR of 5.61% during the forecast period from 2024 to 2034.

Biliary Tract Neoplasms Market: The 7 major biliary tract neoplasms market is expected to exhibit a CAGR of 7.21%during the forecast period from 2024 to 2034.

Neuropathic Pain Market: The 7 major neuropathic pain market reached a value of US$ 5.5 Billion in 2023 and projected the 7MM to reach US$ 8.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.7% during the forecast period from 2024 to 2034.

Clostridium Difficile Infection Market: The 7 major clostridium difficile infection market reached a value of US$ 9.0 Billion in 2023 and projected the 7MM to reach US$ 14.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.7% during the forecast period from 2024 to 2034.

Cardiac Arrhythmias Market: The 7 major cardiac arrhythmias market reached a value of US$ 4.9 Billion in 2023 and projected the 7MM to reach US$ 8.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.57%during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800