According to Statifacts, the global pharmaceutical excipients market size is predicted to increase from USD 9.32 billion in 2025 and is anticipated to be worth USD 15.60 billion by 2034, The market is expanding at a CAGR of 5.85% from 2025 to 2034.

In terms of revenue, the worldwide pharmaceutical excipients market size accounted for USD 8.83 billion in 2024 and is anticipated to reach around USD 13.35 billion by 2031. Rising collaboration and partnership of pharmaceutical companies, increased demand for excipients due to the expiration of patents, and innovation in the development of excipients are driving the growth of the market.

This Report is Readily Available for Immediate Delivery, Visit Here to Explore the Report Sample and In-depth Databook Now@ https://www.statifacts.com/stats/databook-download/7564

Highlights of the Pharmaceutical Excipients Market

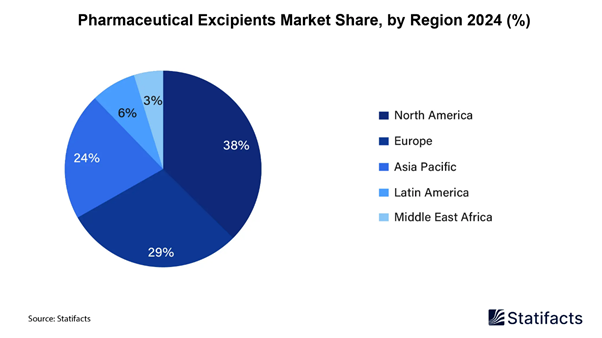

• North America dominated the global market

share of 38% in 2024.

• Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

• By functionality, the

fillers and diluents segment held a dominant presence in the market share of

50% in 2024.

• By functionality, the coating agents

segment is expected to grow at the fastest rate in the pharmaceutical

excipients market during the forecast period of 2025 to 2034.

• By excipients type, the lactose-based

excipients segment accounted for a considerable share of the market share of

42% in 2024.

• By excipients type, the cellulose-based

excipients segment is projected to experience the highest growth rate in the

pharmaceutical excipients market between 2025 and 2034.

Pharmaceutical Excipients Market Size by Functionality, 2024 to 2034 (USD Million)

|

Segments |

2024 |

2025 |

2026 |

2034 |

|

Binders & Fillers |

4,414.50 |

4,689.10 |

4,994.30 |

8,242.45 |

|

Coating Agents |

1,560.80 |

1,756.10 |

1,867.70 |

2,884.98 |

|

Disintegrants |

969.20 |

1,022.10 |

1,078.70 |

1,673.28 |

|

Flavoring Agents & Colorants |

596.00 |

625.30 |

657.40 |

985.17 |

|

Lubricants & Glidants |

312.70 |

326.10 |

340.80 |

487.48 |

|

Sweeteners |

296.70 |

306.70 |

317.80 |

420.48 |

|

Preservatives & Antioxidants |

253.00 |

262.70 |

273.20 |

377.08 |

|

Others |

422.70 |

434.40 |

446.80 |

570.27 |

Pharmaceutical Excipients Market Size by Excipient Type, 2024 to 2034 (USD Million)

|

Segments |

2024 |

2025 |

2026 |

2034 |

|

Lactose-based Excipients |

3,676.10 |

3,919.40 |

4,191.10 |

7,147.08 |

|

Cellulose-based Excipients |

1,352.90 |

1,431.20 |

1,517.90 |

2,435.15 |

|

Starches |

910.70 |

960.10 |

1,014.50 |

1,571.28 |

|

Carboxymethyl cellulose (CCS) |

528.40 |

571.40 |

594.70 |

747.03 |

|

Sodium Starch Glycolate (SSG) |

184.90 |

191.60 |

1,990.00 |

2,698.50 |

|

Fine Chemicals Mannitol |

748.40 |

816.50 |

854.10 |

1,248.73 |

|

Mannitol |

246.60 |

254.50 |

263.10 |

348.52 |

|

Biopharma Excipients |

696.40 |

734.00 |

767.00 |

1,055.63 |

|

Others (Biopharma) |

481.50 |

502.50 |

524.70 |

733.52 |

What is the Remarkable Potential of the Pharmaceutical

Excipients Market?

The pharmaceutical excipients market refers to the production, distribution, and application of pharmaceutical excipients, which are substances other than the active pharmaceutical ingredient (API) that have been appropriately evaluated for safety. The excipients provide protection to the active ingredient from degradation by external factors like oxygen, humidity, and light. This ensures that the medication maintains its efficacy over time.

Rising partnership and collaboration of pharmaceutical companies, rising demand

for excipients because of the expiration of patents, innovation in the

development of excipients, and growing demand for generic drugs and

pharmaceutical drugs contribute to the growth of the pharmaceutical excipients

market.

Pharmaceutical excipients help improve the flowability and compressibility of

powders, improve dissolution and bioavailability of APIs, modify release

profiles, improve stability and shelf life, and enhance patient accessibility

and compliance. They have specific purposes, like improving the taste and

texture of the medicine.

• According to Eximpedia Analysis, Active Pharmaceutical Ingredients export, import records including data from 351 buyers, 4607 export shipments, 46 suppliers, and 131 import shipments.

Source:- Eximpedia

Pharmaceutical Excipients Launched by Prominent Players

|

Sr. No. |

Name of the Product |

Name of the Brand |

Product Specification |

|

1. |

VitiPure LEX 3350 S, VitiPure LEX 4000 S, and Polyglykol 1450 S |

Clariant |

These new high-performance excipients were launched to support the evolution of safe and effective medicines. |

|

2. |

Orally derived biologic therapies. |

Lonza |

These new orally derived biologic therapies support the unique development and manufacturing needs of smart capsule companies. |

|

3. |

Labrafac MC60, Gelucire 59/14, and Emulfree |

Gattefosse |

These three new pharmaceutical excipients are used for the oral administration route and the topical administration route. |

|

4. |

A series of digital initiatives |

Central Drugs Standard Control Organization (CDSCO) |

The new series of digital initiatives is aimed at revolutionizing the pharmaceutical regulatory framework in India. |

Source: - Indian Pharma Post, Pharmaceutical Manufacturer, Express Pharma, and Pharma Biz

Major Trends in the Pharmaceutical Excipients Market

How do technological advancements drive the global Pharmaceutical Excipients

Market?

Rising collaboration of pharmaceutical companies and innovation in the development of excipients are driving the growth of the global pharmaceutical excipients market.

• Rising collaboration of pharmaceutical companies:

Collaboration in the pharmaceutical sector includes partnerships between

stakeholders, researchers, organizations, and governments to advance drug

development, enhance patient outcomes, and address global health challenges.

Collaborative efforts by pharmaceutical companies include public-private

partnerships (PPPs), manufacturing & supply agreements, co-marketing &

co-promotion agreements, licensing agreements, co-development agreements, and

research & development collaborations that focus on discovering and

developing new drugs or technologies. Collaboration allows individuals to work

together to achieve a defined and common business purpose.

• Innovation in development of excipients: Innovation in the development of new excipients, which are substances that are added to pharmaceutical products for many purposes, including enhancing the appearance or taste, aiding in the manufacturing process, aiding bioavailability, improving stability, and facilitating administration or delivery of the active ingredient. The influence of excipients plays an important role in improving the dissolution of poorly aqueous soluble compounds. The drug substance needs to be dissolved in gastric fluids to achieve better absorption and bioavailability of an orally administered drug.

Which Potential Factors Impose Significant Concerns Related Market’s Growth?

Lack of proper approval process and adverse effects of excipients are the

potential factors that impose significant concerns related to the

pharmaceutical excipients market’s growth.

• Lack of proper approval process: An approval process is

a critical workflow mechanism organizations use to systematically review and

approve many items, including operational tasks, documents, and projects.

Without a proper approval process management, it leads to compliance issues,

inefficiencies, businesses risk delays, and even reputational harm. The biggest

challenge in the approval process includes time wasted in waiting for

approvals, chasing down stakeholders, and reconciling feedback can add up

quickly, therefore leading to delays and missed deadlines. Addressing this

challenge requires businesses to get a proper approval workflow with clear

deadlines and escalation procedures together.

• Adverse effects of excipients: Common adverse effects caused by excipients include skin eruptions, bronchoconstriction, hyperactivity, angio-oedema, and gastrointestinal symptoms. Excipients can participate in physical and chemical interactions with the drug molecule, which can reduce the effectiveness of the drug. The physical interaction of excipients may affect the rate of dissolution of a solid dosage form. Adverse effects of excipients can vary depending on many factors, like acute or chronic exposure, route of administration, which may include irritation, genotoxicity, reproductive toxicity, and carcinogenicity.

How big is the Development of the Pharmaceutical Excipients Platforms?

Pharmaceutical excipients platform technology is a foundational technology or

system that acts as a base for the development of many products, solutions, or

applications, mainly in the biotech, pharmaceutical, and life sciences

industries. The pharmaceutical excipient platform provides a standardized

approach that allows new applications to be developed faster, more efficiently,

and more cost-effectively. PharmaExcipients.com is the all-in-one platform for

users, manufacturers, and people sharing an interest in excipients.

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/7564

Pharmaceutical Excipient Market Report Coverage:

|

Report Attributes |

Statistics |

|

Market Size in 2024 |

USD 8.83 Billion |

|

Market Size in 2025 |

USD 9.32 Billion |

|

Market Size in 2030 |

USD 12.61 Billion |

|

Market Size in 2032 |

USD 14.1 Billion |

|

Market Size by 2034 |

USD 15.6 Billion |

|

CAGR 2025-2034 |

5.85% |

|

Leading Region in 2024 |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Years |

2025-2034 |

|

Segments Covered |

Functionality, Excipient Type, and Region |

|

Region Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

|

Competitive Landscape: |

Ashland Global Holdings, BASF SE, DuPont, Roquette Feres, Evonik Industries AG, Associated British Foods, Archer Daniels Midland Company, Croda International, Kerry Group, and Others. |

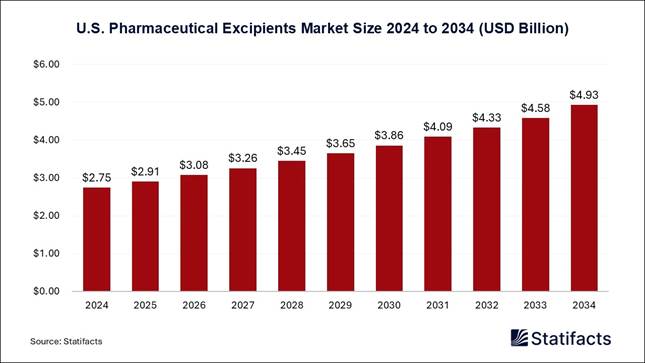

U.S. Pharmaceutical Excipients Market Size 2025 to 2034 (USD Billion)

The U.S. pharmaceutical excipients market size surpassed at USD 2.75 billion in 2024 and is projected to reach around USD 4.93 billion by 2034, growing at a CAGR of 6.01% from 2025 to 2034.

How Big is the Success of the North American Pharmaceutical Excipients Market?

North America dominated the global pharmaceutical excipients market in 2024.

The regulatory changes, consumer preferences, and technological advancements,

companies invest significantly in research and development to create advanced

excipient solutions, and focus on innovation, contributing to the growth of the

market in the North American region.

• In May 2025, the successful completion of commercial manufacturing scale-up for PrimeC in preparation for potential Canadian market launch was announced by NeuroSense Therapeutics. NeuroSense announces global CDMO selection and manufacturing scale-up, allowing rapid pathway to commercialization for what is projected to be a $100-150M Canadian Market Opportunity.

Source: - Finance Yahoo

How is the Opportunistic rise of Asia Pacific in the Pharmaceutical Excipients

Market?

The Asia Pacific region is anticipated to grow at the fastest rate in the

market during the forecast period. Increased adoption of advanced technologies,

rising demand for efficient and eco-friendly solutions, rising consumer

inclination towards preventive health, and increasing healthcare expenditure

contribute to the growth of the pharmaceutical excipients market in the Asia

Pacific region.

How is the Prestigious move of China, India, and Japan?

• In September 2025, Chinese authorities pointed out a new roadmap on the quality of pharmaceutical excipients. The representatives of the Chinese Pharmacopeia have talk about, during a workshop organized by Edqm.

Source: - Pharma Excipients

• In December 2021, a Virtual Booth for the Chinese market to interact, connect, and share experiences with its partners and customers was launched by DFE Pharma, a global leader in pharmaceutical excipient solutions.

Source: - DFE Pharma

• In November 2024, new high-performing excipients at CPHI India 2024 will be introduced by Clariant Health Care. India is now a global leader in pharmaceutical manufacturing, supplying over 50% of global vaccines and 40% of generic drugs.

Source: - Indian Chemical News

Pharmaceutical Excipients Market Segmentation

Functionality Insights

The fillers and diluents segment underwent notable growth in the

pharmaceutical excipients market during 2024. Fillers and diluents

are excipient substances used in the pharmaceutical industry to improve the

manufacturing and performance of medications. Fillers are inactive substances

used to make a product bigger or easier to handle. Fillers may be used to make

pills or capsules due to the amount of active drug is too small to be handled

conveniently. Most of all, specialty medical practitioners use diluents in the

preparation and administration of specific medications.

The coating agents segment will gain a significant share of the market over the period from 2025 to 2034. Coating provides stability to the tablet in handling and prevents them from sticking together. The coating also improves the mechanical strength of the dosage form, causing the dosage form to be smoother and more suitable for swallowing purposes. A coating agent is a chemical ingredient that is added to coatings to improve properties like appearance, surface quality, film formation, dispersion, and wetting.

Excipients Type Insights

The lactose-based excipients segment enjoyed a prominent

position in the market during 2024. Lactose as an excipient

plays a key role in medicines, acting as a diluent, binder, disintegrant,

filler, flow agent, and retaining or releasing the active ingredient. Lactose

is one of the most widespread excipients used in the pharmaceutical industry.

Due to its water solubility and acceptable flowability. Lactose is generally

added to tablet formulation to enhance wettability and undesirable flowability.

The cellulose-based excipients segment is predicted to witness significant growth in the market over the forecast period. Cellulose and its derivatives have many benefits in used as fillers in solid pharmaceuticals, like their compatibility with most other excipients, pharmacologically inert nature, and indigestibility by human gastrointestinal enzymes. Microcrystalline cellulose is a commonly used excipient in the pharmaceutical industry. It has excellent compressibility properties and is used in solid dose forms, like tablets.

See More Related Reports:

• The Europe pharmaceutical excipients market size was calculated at USD 2.41 billion in 2024 and is predicted to attain around USD 4.31 billion by 2034, expanding at a CAGR of 5.98% from 2025 to 2034.

• The Germany pharmaceutical excipients market grows with innovations in drug delivery, 3D printing, and sustainable production amid rising R&D costs.

• The China's pharmaceutical excipients market trends, key players, growth drivers like rising drug demand, and advanced tech opportunities in pharma.

• The Asia Pacific pharmaceutical excipients market size was evaluated at USD 1.99 billion in 2024 and is expected to grow around USD 3.58 billion by 2034, registering a CAGR of 6.04% from 2025 to 2034.

• The North America pharmaceutical excipients market size surpassed USD 3.24 billion in 2024 and is predicted to reach around USD 5.77 billion by 2034, registering a CAGR of 5.94% from 2025 to 2034.

• The global carboxymethyl cellulose for pharmaceutical excipient market size is projected to be worth around USD 249.85 million by 2034, growing at a CAGR of 4.3%.

• The microcrystalline cellulose as pharmaceutical excipient market expected to grow from USD 693 Mn in 2023 to USD 1,520 Mn by 2034, at a CAGR of 7.4%.

Competitive Landscape in the Pharmaceutical Excipients Market

• Ashland Global Holdings: Ashland Global Holdings

Company focuses on providing solutions in architectural coatings, construction,

energy, food and beverage, personal care, and pharmaceutical markets.

• BASF SE: BASF SE is a chemical company. It carries out

the production, marketing, and sales of chemicals, plastics, crop protection

products, and performance products.

• DuPont: DuPont offers a wide array of materials,

equipment, and systems for the printing and package printing industries.

• Roquette Feres: Roquette is a leading provider of

plant-based ingredients, excipients, and pharmaceutical solutions dedicated to

improving the quality and convenience of essential products for consumers and

patients worldwide.

• Evonik Industries AG: They provide specialty additives

to the agricultural industry used as spreaders, penetrants, antifoams,

emulsifiers, and dispersants in tank mix applications and in crop protection

formulations.

• Associated British Foods: They provide safe,

nutritious, affordable food, ingredients, and clothing that is great value for

money.

• Archer Daniels Midland Company: ADM is a global leader

in both human and animal nutrition. They use the power and provisions of nature

to create ingredients and solutions.

• Lubrizol Corporation: Lubrizol Corporation delivers

sustainable solutions to advance mobility, improve well-being, and improve

modern life.

• Croda International: They are a global supplier of

high-performance ingredients and additives used in the manufacture of products

for a diverse range of applications.

• Kerry Group: Kerry Group is a global leader in providing taste and nutrition solutions for the food and beverage and pharmaceutical markets.

What is Going Around the Globe?

• In June 2025, a comprehensive open-access database cataloging all active pharmaceutical ingredients with documented evidence of clinical testing was introduced by Purdue University. The Clinical Drug Experience Knowledgebase (CDEK), housed within the university’s College of Pharmacy, aims to provide researchers and healthcare professionals with detailed information on clinically tested drugs. This initiative is a part of Purdue’s Center for Research Innovation in Biotechnology (CRIB), developed in collaboration with Stony Brook University.

Source: - Gene Online

• In September 2024, the launch of a new active pharmaceutical ingredients (API) product portfolio for FY 2024-25 was announced by Wanbury. The company outlined a range of products to be commercialized, which cover therapeutic areas including anaesthetics, antitussives, anti-inflammatory drugs, analgesics, antihistamines, anti-depressants, and anti-diabetics.

Source: - Express Pharma

Pharmaceutical Excipients Market Segments Covered in the Report

By Functionality

• Fillers and Diluents

• Suspending and Viscosity Agents

• Coating Agents

• Binders

• Disintegrants

• Colorants

• Lubricants and Glidants

• Preservatives

• Emulsifying Agents

• Flavoring Agents and Sweeteners

• Other Functionalities

By Excipient Type

• Lactose-based Excipients

o α-lactose monohydrate

o Anhydrous α-lactose

o Anhydrous β-lactose

o Amorphous Lactose

• Cellulose-based

o Microcrystalline Cellulose (MCC)

o Cellulose Ethers

o Others

• Starches

• Carboxymethylcellulose Sodium (CCS)

• Sodium Starch Glycolate (SSG)

• Fine Chemicals

• Mannitol

• Biopharma Excipients

• Others

By Geography

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

• Asia-Pacific

o China

o India

o Japan

o South Korea

o Malaysia

o Philippines

• Latin America

o Brazil

o Rest of Latin America

• Middle East & Africa (MEA)

o GCC

o North Africa

o South Africa

o Rest of the Middle East & Africa

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/7564

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a global market intelligence and consulting leader, committed to delivering deep strategic insights that fuel innovation and transformation. With a sharp focus on the fast-evolving landscape of life sciences, we excel at navigating the intricacies of cell and gene therapies, oncology, and drug development. We empower our clients, ranging from biotech pioneers to institutional investors with the intelligence needed to lead in high-impact areas like regenerative medicine, cancer therapeutics, and precision health. Our broad expertise across the pharma-biotech value chain is backed by robust, statistically driven data for every market we cover, ensuring decisions are informed, forward-looking, and built for impact.

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Connect with Us

Ballindamm 22, 20095 Hamburg, Germany

Europe: +44 7383092044

Web: https://www.statifacts.com/

For Latest Update Follow Us: https://www.linkedin.com/company/statifacts

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Nova One Advisor

FAQs

1. What is driving growth in the global pharmaceutical

excipients market?

Growth

is powered by rising chronic disease prevalence, increasing drug development,

especially generic formulations, and advances in drug delivery systems. The

shift toward personalized and biopharmaceutical therapies also elevates

excipient demand.

2. Which excipient types are most commonly used, and which are expanding?

Binders

remain dominant due to their essential role in tablet and capsule integrity,

while lubricants and glidants are among the fastest-growing functional classes,

improving manufacturing efficiency and dosage consistency.

3. Which dosage form relies most heavily on excipients?

Oral

solid dosage forms, such as tablets and capsules, dominate the market, thanks

to their ease of administration, stability, and patient compliance, leading to

widespread reliance on excipient formulations.

4. Where is demand growing the fastest by region?

While

North America leads the market due to a mature pharmaceutical infrastructure,

Asia-Pacific is growing fastest as drug manufacturing scales rapidly and

healthcare access expands across emerging markets.

5. What challenges does the pharmaceutical excipients industry face?

Strict

regulatory requirements for safety and quality, high development costs for

novel excipients, and pressure from commoditized pricing hinder innovation and

create barriers, especially for smaller manufacturers.

Reference: Pharmaceutical Excipients Market Size to Hit USD 15.43 Bn by 2034