GLP-1

More patients are having to pay out-of-pocket for Eli Lilly’s weight-loss medication Zepbound than they did for type 2 diabetes drug Mounjaro, according to Lilly USA President Patrik Jonsson.

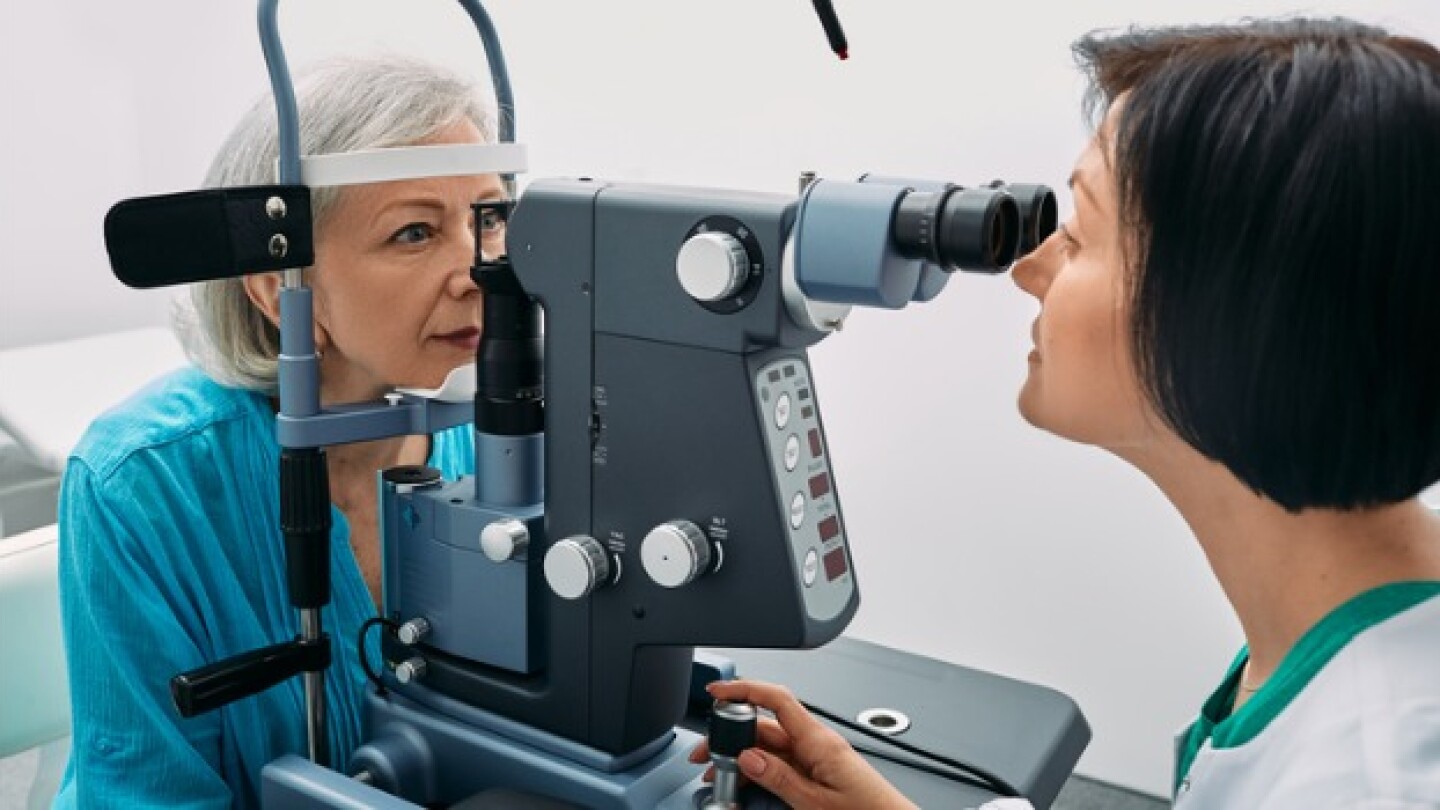

Skye Bioscience is putting the kibosh on its SBI-100 candidate for glaucoma, and the company’s entire ophthalmology program, after a mid-stage study did not reach its primary endpoint.

Lilly’s tirzepatide achieved an absence of metabolic dysfunction-associated steatohepatitis without the worsening of fibrosis in more than 50% of patients in a mid-stage study, the company reported Saturday.

The companies announced Friday that their candidate survodutide, which is licensed to Boehringer Ingelheim from Zealand Pharma, improved fibrosis in more than 50% of treated patients with metabolic dysfunction-associated steatohepatitis.

Both Eli Lilly and the partnered companies Boehringer Ingelheim and Zealand Pharma have mid-stage data readouts this week, fueling the race in metabolic dysfunction-associated steatohepatitis.

Zealand Pharma said on Thursday that partner Boehringer Ingelheim will present the results from the study on Friday at the European Association of the Study of Liver Congress.

Structure Therapeutics is offering over nine million shares on the heels of mid-stage data for its oral GLP-1 receptor agonist, which showed weight loss of 6.2% in overweight or obese patients.

Novo Nordisk will face strong generic competition from at least 15 companies in China for its blockbuster GLP-1 receptor agonist products Wegovy and Ozempic, according to Reuters.

More than 50% of nonalcoholic steatohepatitis patients treated with Eli Lilly’s tirzepatide saw at least a one-stage improvement in fibrosis, according to the pharma’s latest mid-stage readout.

The U.K.’s National Institute for Health and Care Excellence has endorsed the use of Eli Lilly’s Zepboundfor weight management in patients with BMI of 35 kg/m2 and above and at least one weight-related comorbidity.

PRESS RELEASES