Type 2 Diabetes Market Outlook 2024-2034:

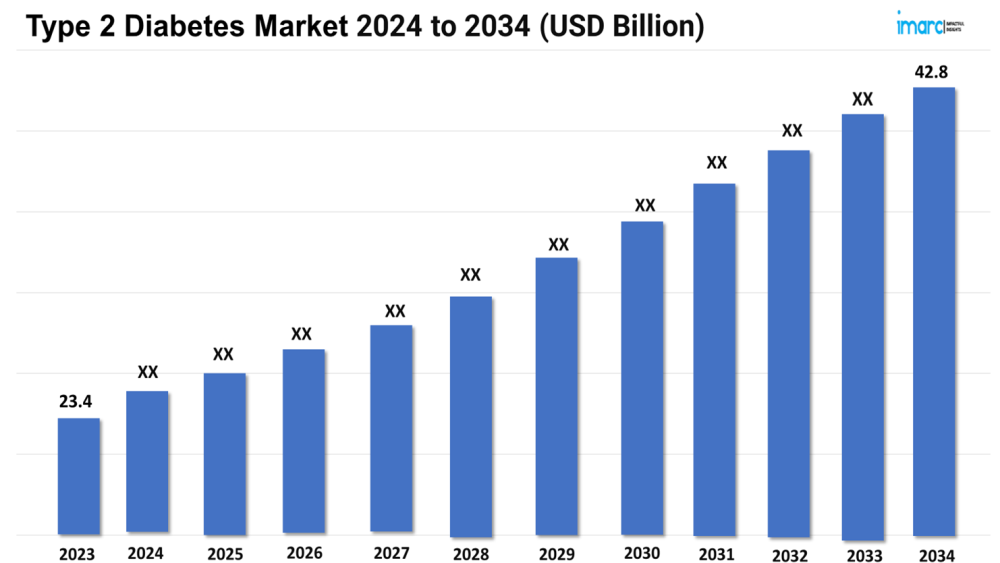

The type 2 diabetes market size reached a value of USD 23.4 Billion in 2023. Looking forward, the market is expected to reach USD 42.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.64% during 2024-2034. The market is driven by advancements in glucose monitoring technologies, personalized medicine, and increasing awareness about diabetes management. Additionally, emerging treatments such as GLP-1 receptor agonists and SGLT-2 inhibitors are gaining prominence, alongside a rise in digital health solutions for better patient outcomes.

Advancements in Treatment: Driving the Type 2 Diabetes Market

Advancements in treatment for the type 2 diabetes market have marked a transformative era in managing this chronic condition. The landscape has evolved significantly with the introduction of innovative medications and therapies designed to enhance glycemic control and improve patient outcomes. Key among these advancements are GLP-1 receptor agonists and SGLT-2 inhibitors. GLP-1 receptor agonists, such as semaglutide and liraglutide, mimic the effects of the glucagon-like peptide-1 hormone, which promotes insulin secretion, reduces glucagon release, and slows gastric emptying. These medications not only help in controlling blood sugar levels but also contribute to weight loss, which is beneficial given the association between obesity and type 2 diabetes. SGLT-2 inhibitors, including empagliflozin and dapagliflozin, work by preventing the reabsorption of glucose in the kidneys, thereby increasing glucose excretion through urine. This class of drugs has shown efficacy in lowering blood glucose levels and reducing the risk of cardiovascular events, which are prevalent among diabetic patients.

Request a PDF Sample Report: https://www.imarcgroup.com/type-2-diabetes-market/requestsample

Additionally, the development of combination therapies has enhanced treatment regimens by integrating different mechanisms of action to provide more comprehensive control of blood glucose levels. The growing focus on personalized medicine has also led to the tailoring of treatment plans based on individual patient profiles, including genetic, lifestyle, and metabolic factors, ensuring more effective and targeted management. Moreover, advancements in drug delivery systems, such as insulin pumps and continuous glucose monitors, have improved patient convenience and adherence to treatment. The integration of these technologies with digital health tools offers real-time data and insights, further optimizing diabetes management. These innovations collectively represent a significant leap forward in the type 2 diabetes market, offering patients more effective, personalized, and convenient treatment options.

Growth of Digital Health Solutions: Contributing to Market Expansion

The growth of digital health solutions in the type 2 diabetes market is reshaping how patients manage their condition and enhancing overall care. Digital health technologies, including continuous glucose monitors (CGMs), mobile health apps, and telemedicine platforms, are at the forefront of this transformation. CGMs, such as those developed by Dexcom and Abbott, provide real-time glucose readings, enabling patients to track their blood sugar levels continuously without the need for frequent fingerstick tests. This continuous data flow helps individuals make more informed decisions about their diet, exercise, and medication adjustments, leading to improved glycemic control and reduced risk of complications. Mobile health apps play a crucial role by offering personalized diabetes management tools. These apps, like MySugr and BlueLoop, allow users to log their glucose levels, track their dietary intake, and monitor physical activity. They often feature educational resources and reminders, which help patients adhere to their treatment plans and make lifestyle adjustments based on their real-time data. Integration with other digital devices, such as fitness trackers and smartwatches, further enhances the ability to monitor health metrics comprehensively.

Telemedicine has also gained significant traction, especially in providing access to healthcare professionals for consultations, follow-ups, and remote management. This approach is particularly beneficial for patients in remote areas or those with mobility challenges, offering a convenient alternative to in-person visits. The synergy of these digital health solutions fosters a more proactive and engaged approach to diabetes management, reducing hospital visits and improving quality of life. As technology continues to advance, the integration of artificial intelligence and machine learning into these tools promises even greater precision and personalized care. The ongoing growth and innovation in digital health solutions are poised to revolutionize the type 2 diabetes market, making diabetes management more accessible, efficient, and patient-centered.

Focus on Prevention and Early Intervention:

The focus on prevention and early intervention in the type 2 diabetes market has become a critical strategy for reducing the prevalence and impact of the disease. Recognizing that type 2 diabetes often develops silently over the years, there is a growing emphasis on proactive measures to identify and manage risk factors before the disease manifests fully. This shift towards prevention is driven by a combination of public health initiatives, advances in screening technologies and increasing awareness about lifestyle factors. Early detection is a key component of this approach, with initiatives aimed at identifying individuals at high risk of developing type 2 diabetes through comprehensive screening programs. These programs often include assessments of body mass index (BMI), blood glucose levels, and other biomarkers. The use of predictive algorithms and risk assessment tools helps in identifying individuals who may benefit from early interventions, thus enabling timely and targeted management strategies.

Lifestyle modifications play a central role in prevention efforts. Public health campaigns and educational programs are increasingly focusing on promoting healthy eating, regular physical activity, and weight management as primary strategies to reduce the risk of type 2 diabetes. Programs like the Diabetes Prevention Program (DPP) have demonstrated that lifestyle interventions can significantly lower the incidence of type 2 diabetes among high-risk populations. Moreover, healthcare providers are integrating early intervention strategies into routine care, emphasizing the importance of regular check-ups and personalized risk assessments. This approach includes counseling on dietary changes, physical activity, and behavioral modifications to prevent the progression from prediabetes to type 2 diabetes. The combination of these strategies fosters a more proactive and preventive approach to diabetes care, aiming to reduce the overall burden of the disease and improve long-term health outcomes. As research continues to uncover new insights into diabetes risk factors and effective interventions, the focus on prevention and early intervention is set to play an increasingly pivotal role in the type 2 diabetes market.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7604&method=587

Leading Companies in the Type 2 Diabetes Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global type 2 diabetes market, several notable companies are customizing treatment plans based on individual genetic profiles, metabolic characteristics, and lifestyle factors to optimize diabetes management and outcomes. Novo Nordisk and Eli Lilly & Company have been investing heavily in their manufacturing capacities in recent months.

In October 2023, Novo Nordisk's research established the long-term effectiveness of injectable semaglutide (Ozempic and Wegovy) in maintaining blood sugar control and weight loss in persons with type 2 diabetes.

In September 2023, the National Institute for Health and Care Excellence (NICE) approved Mounjaro (tirzepatide) injection for the treatment of type 2 diabetes in adults to lower blood sugar and A1C readings. It acts by activating the GIP and GLP-1 receptors, which are endogenous incretin hormones that regulate blood sugar levels.

Additionally, Eli Lilly & Company disclosed in June 2023 that orforglipron, an oral, non-peptide glucagon-like peptide-1 receptor agonist, reduced A1C levels in patients with type 2 diabetes by up to 2.1% on average.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7604&flag=E

Regional Analysis:

The major markets for type 2 diabetes include the United States, Germany, France, the United Kingdom, Italy, Spain and Japan. According to projections by IMARC, the United States has the largest patient pool for type 2 diabetes while also representing the biggest market for its treatment. This can be attributed to the use of digital health solutions, including CGMs, mobile health apps, and telemedicine.

Moreover, there is a growing adoption of newer classes of diabetes medications, such as GLP-1 receptor agonists and SGLT-2 inhibitors, across the country. These drugs are gaining popularity due to their effectiveness in controlling blood sugar levels and their additional benefits, such as weight loss and cardiovascular risk reduction.

Apart from this, there is also a strong focus on prevention and early intervention to reduce the incidence of type 2 diabetes. This includes increasing awareness about risk factors, implementing screening programs, and promoting lifestyle modifications such as diet and exercise to prevent progression from prediabetes to diabetes.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

This report offers a comprehensive analysis of current type 2 diabetes marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

Diabetic Retinopathy Market: The global diabetic retinopathy market size reached US$ 8.1 Billion in 2023, and projected to reach US$ 13.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2032.

Respiratory Syncytial Virus (RSV) Diagnostics Market: The global respiratory syncytial virus (RSV) diagnostics market size reached US$ 1,005.2 Million in 2023, and projected to reach US$ 2,072.3 Million by 2032 exhibiting a growth rate (CAGR) of 8.1% during the forecast period from 2024 to 2032.

Viral Inactivation Market: The global viral inactivation market size reached US$ 635.6 Million in 2023, and projected to reach US$ 1,390.8 Million by 2032, exhibiting a growth rate (CAGR) of 8.8% during the forecast period from 2024 to 2032.

Endoscopy Devices Market: The global endoscopy devices market size reached US$ 47.1 Billion in 2023, and projected to reach US$ 82.2 Billion by 2032, exhibiting a growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032.

Transdermal Drug Delivery Systems Market: The global transdermal drug delivery systems market size reached US$ 6.7 Billion in 2023, and projected to reach US$ 11.1 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2032.

Hearing Aid Market: The global hearing aid market size reached US$ 6.8 Billion in 2023, and projected to reach US$ 11.3 Billion by 2032, exhibiting a growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2032.

Stroke Management Market: The global stroke management market size reached US$ 35.7 Billion in 2023, and projected to reach US$ 61.7 Billion by 2032, exhibiting a growth rate (CAGR) of 6.1% during the forecast period from 2024 to 2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The type 2 diabetes market size reached a value of USD 23.4 Billion in 2023. Looking forward, the market is expected to reach USD 42.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.64% during 2024-2034. The market is driven by advancements in glucose monitoring technologies, personalized medicine, and increasing awareness about diabetes management. Additionally, emerging treatments such as GLP-1 receptor agonists and SGLT-2 inhibitors are gaining prominence, alongside a rise in digital health solutions for better patient outcomes.

Advancements in Treatment: Driving the Type 2 Diabetes Market

Advancements in treatment for the type 2 diabetes market have marked a transformative era in managing this chronic condition. The landscape has evolved significantly with the introduction of innovative medications and therapies designed to enhance glycemic control and improve patient outcomes. Key among these advancements are GLP-1 receptor agonists and SGLT-2 inhibitors. GLP-1 receptor agonists, such as semaglutide and liraglutide, mimic the effects of the glucagon-like peptide-1 hormone, which promotes insulin secretion, reduces glucagon release, and slows gastric emptying. These medications not only help in controlling blood sugar levels but also contribute to weight loss, which is beneficial given the association between obesity and type 2 diabetes. SGLT-2 inhibitors, including empagliflozin and dapagliflozin, work by preventing the reabsorption of glucose in the kidneys, thereby increasing glucose excretion through urine. This class of drugs has shown efficacy in lowering blood glucose levels and reducing the risk of cardiovascular events, which are prevalent among diabetic patients.

Request a PDF Sample Report: https://www.imarcgroup.com/type-2-diabetes-market/requestsample

Additionally, the development of combination therapies has enhanced treatment regimens by integrating different mechanisms of action to provide more comprehensive control of blood glucose levels. The growing focus on personalized medicine has also led to the tailoring of treatment plans based on individual patient profiles, including genetic, lifestyle, and metabolic factors, ensuring more effective and targeted management. Moreover, advancements in drug delivery systems, such as insulin pumps and continuous glucose monitors, have improved patient convenience and adherence to treatment. The integration of these technologies with digital health tools offers real-time data and insights, further optimizing diabetes management. These innovations collectively represent a significant leap forward in the type 2 diabetes market, offering patients more effective, personalized, and convenient treatment options.

Growth of Digital Health Solutions: Contributing to Market Expansion

The growth of digital health solutions in the type 2 diabetes market is reshaping how patients manage their condition and enhancing overall care. Digital health technologies, including continuous glucose monitors (CGMs), mobile health apps, and telemedicine platforms, are at the forefront of this transformation. CGMs, such as those developed by Dexcom and Abbott, provide real-time glucose readings, enabling patients to track their blood sugar levels continuously without the need for frequent fingerstick tests. This continuous data flow helps individuals make more informed decisions about their diet, exercise, and medication adjustments, leading to improved glycemic control and reduced risk of complications. Mobile health apps play a crucial role by offering personalized diabetes management tools. These apps, like MySugr and BlueLoop, allow users to log their glucose levels, track their dietary intake, and monitor physical activity. They often feature educational resources and reminders, which help patients adhere to their treatment plans and make lifestyle adjustments based on their real-time data. Integration with other digital devices, such as fitness trackers and smartwatches, further enhances the ability to monitor health metrics comprehensively.

Telemedicine has also gained significant traction, especially in providing access to healthcare professionals for consultations, follow-ups, and remote management. This approach is particularly beneficial for patients in remote areas or those with mobility challenges, offering a convenient alternative to in-person visits. The synergy of these digital health solutions fosters a more proactive and engaged approach to diabetes management, reducing hospital visits and improving quality of life. As technology continues to advance, the integration of artificial intelligence and machine learning into these tools promises even greater precision and personalized care. The ongoing growth and innovation in digital health solutions are poised to revolutionize the type 2 diabetes market, making diabetes management more accessible, efficient, and patient-centered.

Focus on Prevention and Early Intervention:

The focus on prevention and early intervention in the type 2 diabetes market has become a critical strategy for reducing the prevalence and impact of the disease. Recognizing that type 2 diabetes often develops silently over the years, there is a growing emphasis on proactive measures to identify and manage risk factors before the disease manifests fully. This shift towards prevention is driven by a combination of public health initiatives, advances in screening technologies and increasing awareness about lifestyle factors. Early detection is a key component of this approach, with initiatives aimed at identifying individuals at high risk of developing type 2 diabetes through comprehensive screening programs. These programs often include assessments of body mass index (BMI), blood glucose levels, and other biomarkers. The use of predictive algorithms and risk assessment tools helps in identifying individuals who may benefit from early interventions, thus enabling timely and targeted management strategies.

Lifestyle modifications play a central role in prevention efforts. Public health campaigns and educational programs are increasingly focusing on promoting healthy eating, regular physical activity, and weight management as primary strategies to reduce the risk of type 2 diabetes. Programs like the Diabetes Prevention Program (DPP) have demonstrated that lifestyle interventions can significantly lower the incidence of type 2 diabetes among high-risk populations. Moreover, healthcare providers are integrating early intervention strategies into routine care, emphasizing the importance of regular check-ups and personalized risk assessments. This approach includes counseling on dietary changes, physical activity, and behavioral modifications to prevent the progression from prediabetes to type 2 diabetes. The combination of these strategies fosters a more proactive and preventive approach to diabetes care, aiming to reduce the overall burden of the disease and improve long-term health outcomes. As research continues to uncover new insights into diabetes risk factors and effective interventions, the focus on prevention and early intervention is set to play an increasingly pivotal role in the type 2 diabetes market.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7604&method=587

Leading Companies in the Type 2 Diabetes Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global type 2 diabetes market, several notable companies are customizing treatment plans based on individual genetic profiles, metabolic characteristics, and lifestyle factors to optimize diabetes management and outcomes. Novo Nordisk and Eli Lilly & Company have been investing heavily in their manufacturing capacities in recent months.

In October 2023, Novo Nordisk's research established the long-term effectiveness of injectable semaglutide (Ozempic and Wegovy) in maintaining blood sugar control and weight loss in persons with type 2 diabetes.

In September 2023, the National Institute for Health and Care Excellence (NICE) approved Mounjaro (tirzepatide) injection for the treatment of type 2 diabetes in adults to lower blood sugar and A1C readings. It acts by activating the GIP and GLP-1 receptors, which are endogenous incretin hormones that regulate blood sugar levels.

Additionally, Eli Lilly & Company disclosed in June 2023 that orforglipron, an oral, non-peptide glucagon-like peptide-1 receptor agonist, reduced A1C levels in patients with type 2 diabetes by up to 2.1% on average.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7604&flag=E

Regional Analysis:

The major markets for type 2 diabetes include the United States, Germany, France, the United Kingdom, Italy, Spain and Japan. According to projections by IMARC, the United States has the largest patient pool for type 2 diabetes while also representing the biggest market for its treatment. This can be attributed to the use of digital health solutions, including CGMs, mobile health apps, and telemedicine.

Moreover, there is a growing adoption of newer classes of diabetes medications, such as GLP-1 receptor agonists and SGLT-2 inhibitors, across the country. These drugs are gaining popularity due to their effectiveness in controlling blood sugar levels and their additional benefits, such as weight loss and cardiovascular risk reduction.

Apart from this, there is also a strong focus on prevention and early intervention to reduce the incidence of type 2 diabetes. This includes increasing awareness about risk factors, implementing screening programs, and promoting lifestyle modifications such as diet and exercise to prevent progression from prediabetes to diabetes.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the type 2 diabetes market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the type 2 diabetes market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current type 2 diabetes marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

Diabetic Retinopathy Market: The global diabetic retinopathy market size reached US$ 8.1 Billion in 2023, and projected to reach US$ 13.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2032.

Respiratory Syncytial Virus (RSV) Diagnostics Market: The global respiratory syncytial virus (RSV) diagnostics market size reached US$ 1,005.2 Million in 2023, and projected to reach US$ 2,072.3 Million by 2032 exhibiting a growth rate (CAGR) of 8.1% during the forecast period from 2024 to 2032.

Viral Inactivation Market: The global viral inactivation market size reached US$ 635.6 Million in 2023, and projected to reach US$ 1,390.8 Million by 2032, exhibiting a growth rate (CAGR) of 8.8% during the forecast period from 2024 to 2032.

Endoscopy Devices Market: The global endoscopy devices market size reached US$ 47.1 Billion in 2023, and projected to reach US$ 82.2 Billion by 2032, exhibiting a growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032.

Transdermal Drug Delivery Systems Market: The global transdermal drug delivery systems market size reached US$ 6.7 Billion in 2023, and projected to reach US$ 11.1 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2032.

Hearing Aid Market: The global hearing aid market size reached US$ 6.8 Billion in 2023, and projected to reach US$ 11.3 Billion by 2032, exhibiting a growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2032.

Stroke Management Market: The global stroke management market size reached US$ 35.7 Billion in 2023, and projected to reach US$ 61.7 Billion by 2032, exhibiting a growth rate (CAGR) of 6.1% during the forecast period from 2024 to 2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800